Earl E Retyre

Full time employment: Posting here.

- Joined

- Jan 1, 2010

- Messages

- 541

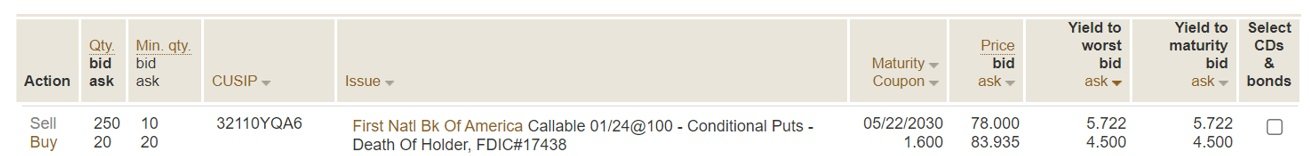

Looking at Vanguard secondary market brokered CDs and I see the attached one available. My understanding is that this would be a 5.5 year CD (maturing 5/2030) which is being offered at a worst-case-scenario to yield 4.5%. The current highest bidder is offering 5.7%.

So, it is possible I could offer 5% and it is possible my bid gets taken. If so, it would essentially give me a 5%, 5+ year CD.

While it is callable, since the face value is $1.60 it should never be called.

Am I understanding this all correctly?

Would this not be a good deal at 5%? Even at the asking price of 4.5%, that seems to be a decent deal based on new offers right now.

Or am I totally confused in understanding secondary CD markets?

So, it is possible I could offer 5% and it is possible my bid gets taken. If so, it would essentially give me a 5%, 5+ year CD.

While it is callable, since the face value is $1.60 it should never be called.

Am I understanding this all correctly?

Would this not be a good deal at 5%? Even at the asking price of 4.5%, that seems to be a decent deal based on new offers right now.

Or am I totally confused in understanding secondary CD markets?