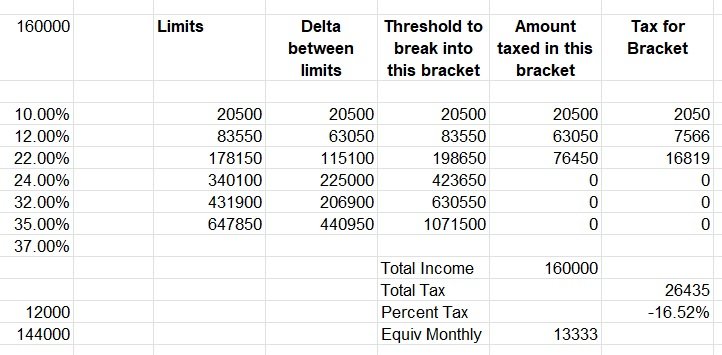

Haven't seen it mentioned yet, so I will -- when you input spending into FIRECalc, you must gross up for taxes. For example, if you anticipate actually spending $125k per year, and you are drawing it from a taxable IRA or 401k, you will actually need to draw $160k per year, because you'll be in the federal 22% tax bracket. So, Draw = 160; tax = (0.22 x 160) = ~35; Net to spend = 160 - 35 = 125. If you have state tax, you need to account for that too.

The formula for grossing up is this:

Desired actual spend/ (1 - marginal tax rate). So $125k/(1.00 - 0.22) = $160,256.00 draw from account.

You should use the $160k in FIRECalc, because it is tracking draws on your portfolio, whether that actually goes to taxes or vacation is irrelevant to FIRECalc.

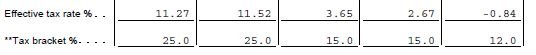

Not all of the $160k will be taxed at 22%. It is a graduated tax scale. Only the last $76k or so would be taxed at 22%. For federal only, with no deductions used, actual fed tax rate on $160K would be 16.52%. I wrote a tax calculator in Excel for this. Results for $160K would be:

Attachments

Last edited: