That point about distributions and taxes is good, and one people often overlook.I had decided early on that I could live with the annual income variability due to spending flexibility.

Turns out that in practice it’s hasn’t been a big deal and wasn’t in 2022 either. It turns out that taxes owed create quite a bit of smoothing. After a tough year like 2022 income taxes usually drop quite a bit. There are opportunities for tax loss harvesting plus the mutual fund distributions drop a lot. Since our actual spending is after taxes - we may have a lower $ withdraw but taxes lower the net doesn’t drop as much. So that helps.

But a bigger reason is that after several years of up markets, withdrawals outpace spending for a while so a drop isn’t as painful as you might think.

We’ve been lucky overall - long periods of up markets in spite of some nasty bear markets mixed in. Knock on wood!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Morningstar declares 4% safe once again

- Thread starter MichaelB

- Start date

- Joined

- Apr 14, 2006

- Messages

- 23,103

+1. But I do believe that we are headed for higher levels of taxation. My state just implemented a millionaires tax and after two years there's already rumblings about making it to include those making $750k. And in five years? "High net worth" is relative and is a sliding scale.

At a smaller level aren't we going to lose many tax cuts next year? Sixty years ago, we had a top marginal tax rate of 91%. Could we revert to something like that? Not likely, but it wouldn't surprise me.

So, do you spend it now and have less to be taxed or do you save it so that you can maintain your lifestyle after new, higher taxes?

I have tried never to let the tax tail wag the investing dog. Or, in this case, no I would not spend money now to avoid tax later. Unless the marginal tax rate exceeds 100%, it's always better to make more money, especially if it's passive income.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Running my models for % remaining portfolio I carefully reviewed max drawdowns worst case scenarios. Yes, it can be both very extended and severe. Clyatt method was about the same. Belt tightening, but the classic method simply runs out of money - much worse.down turns don’t have to be steep to be retirement hurters , they just have to be extended enough .

what is interesting is every failure for 40 to 60% equities has had normal returns over 30 year periods

but the first poor 15 years did them in so bad that even the best bull market in history couldn’t save them later .

a perfect example of sequence of returns going wrong

Having at least 50% discretionary spending helps with the belt tightening. Seriously!

Last edited:

mathjak107

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 27, 2005

- Messages

- 6,208

Running my models for % remaining portfolio I carefully reviewed max drawdowns worst case scenarios. Yes, it can be very extended and severe. Clyatt method was about the same. Belt tightening, but the classic method simply runs out of money - even worse.

Having at least 50% discretionary spending helps with the belt tightening. Seriously!

funny you said 50% because that was my goal too .

i don’t want to go off track here but one of the most useless mantras we hear is live below your means .

what the heck does that mean as far as action .

if i spend 10 bucks less a month then i take in i am certainly living below my means .

so it really doesn’t tell us how to spend , in fact there is little out there that guides you .

fidelity has a reasonable idea they came up with which has about 30% ear marked for discretionary spending .

when you eliminate the savings aspect they show in retirement , it actually comes up to about 50% allocated to discretionary spending , a number both of us just arrived at on our own coincidentally

Last edited:

mathjak107

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 27, 2005

- Messages

- 6,208

so let’s run thru a typical retirement scenario where the pay checks stopped and all you have is a pile of money with no idea what to do with it .

of course there are other ways to do it but this would be my way .

so i would add up all my non discretionary bills , including that which we would never want to not have or do unless forced to .

for us it’s our gyms , my studio time as a drummer , etc .

let’s total it all up and say it’s 50k ..

i would double that as an initial goal of comfort for non discretionary spending like audrey .

so we need 100k a year or rather would like 100k a year if possible

let’s say we have 30k in social security and 30k pension .

we have a shortfall of 40k we need to fill from our savings . let’s suppose we have 1 million dollars to make it easy .

so let’s see how we need to allocate that

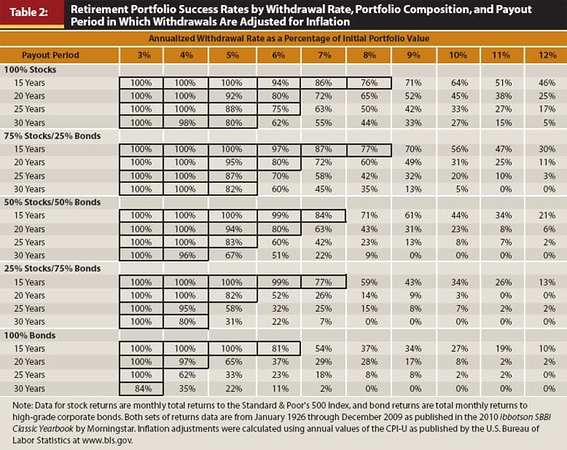

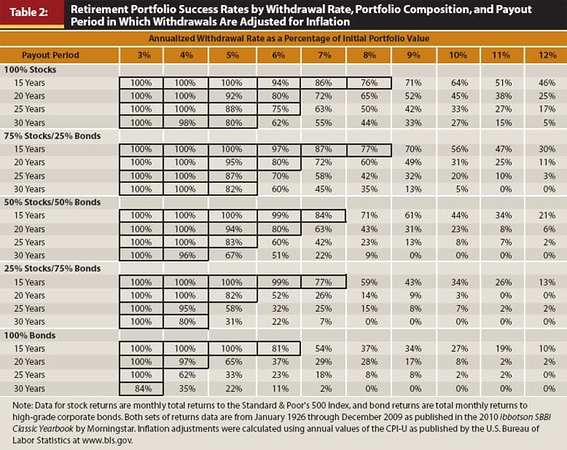

we want at least a 90% success rate so consulting a safe withdrawal chart we need at least 35-40% equities .

however if we want all fixed income we will need more than a million dollars or we have to go back and review our budget to see what has to go .

there are many ways to calculate this but the important thing is the more discretionary spending you can allow for , the better and less stressful the financial life as well as the more choices in things you have

of course there are other ways to do it but this would be my way .

so i would add up all my non discretionary bills , including that which we would never want to not have or do unless forced to .

for us it’s our gyms , my studio time as a drummer , etc .

let’s total it all up and say it’s 50k ..

i would double that as an initial goal of comfort for non discretionary spending like audrey .

so we need 100k a year or rather would like 100k a year if possible

let’s say we have 30k in social security and 30k pension .

we have a shortfall of 40k we need to fill from our savings . let’s suppose we have 1 million dollars to make it easy .

so let’s see how we need to allocate that

we want at least a 90% success rate so consulting a safe withdrawal chart we need at least 35-40% equities .

however if we want all fixed income we will need more than a million dollars or we have to go back and review our budget to see what has to go .

there are many ways to calculate this but the important thing is the more discretionary spending you can allow for , the better and less stressful the financial life as well as the more choices in things you have

Last edited:

- Joined

- Apr 14, 2006

- Messages

- 23,103

As long as, while you are working, you treat retirement savings as an "essential expense" and not "whatever is left over", then you don't need much more guidance on the ratio of essential to discretionary spending.

mathjak107

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 27, 2005

- Messages

- 6,208

As long as, while you are working, you treat retirement savings as an "essential expense" and not "whatever is left over", then you don't need much more guidance on the ratio of essential to discretionary spending.

absolutely , but how many americans do that ?

i have always looked at this forum right from my first day here back almost 20 years ago as the WISE ELDERS . i learned so much here early on .

i have changed views on things so many times based on what those a lot smarter then me have shown me .

The group here is either here because they are successful or they want to learn to be successful so what this group does is very different from the typical american .

if you don’t tell the typical american what to do and how to do it , odds are it won’t be done

so the thinking in forums like this is more the exception then what goes on i find

Last edited:

LateToFIRE

Thinks s/he gets paid by the post

- Joined

- Jun 4, 2023

- Messages

- 1,171

Running my models for % remaining portfolio I carefully reviewed max drawdowns worst case scenarios. Yes, it can be both very extended and severe. Clyatt method was about the same. Belt tightening, but the classic method simply runs out of money - even worse.

Having at least 50% discretionary spending helps with the belt tightening. Seriously!

funny you said 50% because that was my goal too .

i don’t want to go off track here but one of the most useless mantras we hear is live below your means .

what the heck does that mean as far as action .

if i spend 10 bucks less a month then i take in i am certainly living below my means .

so it really doesn’t tell us how to spend , in fact there is little out there that guides you .

fidelity has a reasonable idea they came up with which has about 30% ear marked for discretionary spending .

when you eliminate the savings aspect they show in retirement , it actually comes up to about 50% allocated to discretionary spending , a number both of us just arrived at on our own coincidentally

This is exactly where I come out on retirement budget: 50% discretionary.

Admitted purely coincidence, did not plan it this way. But, once I drilled into the numbers this is where it came out. Realizing we have this level of flexibility was a key part of conclusion we had enough to FIRE.

It's also part of what drives my thesis, that at least in my case, WD could be somewhat higher than 4% if willing to cur back in down years (because we have the cushion to cut way back if had to). FYI, our WD comes out to ~4%, but gives me comfort to know it could be higher for BTD or if I simply got the budget wrong. I like having a Plan B, C, D, etc.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I think it was CuteFuzzyBunny who used to always say that you needed 2X essential expenses to retire early. In other words at least 50% discretionary.

Last edited:

mathjak107

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 27, 2005

- Messages

- 6,208

i guess if one can do it , 50% is a nice comfortable number..

it’s funny how over the years many things we called discretionary originally , are so much a part of our life they have really become non discretionary

it’s funny how over the years many things we called discretionary originally , are so much a part of our life they have really become non discretionary

LateToFIRE

Thinks s/he gets paid by the post

- Joined

- Jun 4, 2023

- Messages

- 1,171

i guess if one can do it , 50% is a nice comfortable number..

it’s funny how over the years many things we called discretionary originally , are so much a part of our life they have really become non discretionary

Ain't that the truth! I had just never given it too much thought until I did some serious FIRE planning. Just figured, we need to absolutely maintain our current living standard and then some with 500% certainty. But, ego aside, in reality, we don't actually need most of the stuff we spend $$$ on (at least in my case). Reading this forum, have seen examples of people who manage to live on (and be happy on) a fraction of my budget. Been eye-opening to say the least. Made me rethink some priorities.

Reason I never gave it much thought is had expected to keep working a few more years. Significant OMY syndrome. Actually greatly enjoyed my career. But, ageism being what it is in the megacorp world, became clear I was not moving up, so moved out and here I am

mathjak107

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 27, 2005

- Messages

- 6,208

it’s like we had a subaru outback and i thought for our next car i wanted to go up in luxury .

so we just spent 80k on a lexus rx500h thinking once i got it out of system we would go back to what we typically drove .

NO WAY CAN WE GO BACK .

the difference in performance, comfort and handling is totally on another level .

so it is very easy to get used to the better things all to easy.

there is a saying , the poor man always pays twice …that is because the more economical something is , the more of a compromise it is usually .

upgrading is usually so different that once one tries it they don’t want to switch back.

there are just things that one would not think it made a big difference until they tried it .

it’s like we used to tell my buddy he was lucky he married a virgin ….she didn’t know if he was good or bad. lol

so we just spent 80k on a lexus rx500h thinking once i got it out of system we would go back to what we typically drove .

NO WAY CAN WE GO BACK .

the difference in performance, comfort and handling is totally on another level .

so it is very easy to get used to the better things all to easy.

there is a saying , the poor man always pays twice …that is because the more economical something is , the more of a compromise it is usually .

upgrading is usually so different that once one tries it they don’t want to switch back.

there are just things that one would not think it made a big difference until they tried it .

it’s like we used to tell my buddy he was lucky he married a virgin ….she didn’t know if he was good or bad. lol

Last edited:

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I think it was CuteFuzzyBunny who used to always say that you needed 2X essential expenses to retire early. In other words at least 50% discretionary.

"Need"? That seems like a gross over-generalization to me!

i guess if one can do it , 50% is a nice comfortable number..

it’s funny how over the years many things we called discretionary originally , are so much a part of our life they have really become non discretionary

One of the reasons I strive for a conservative WR is that I don't want to cut any spending, anywhere, anytime! I want to enjoy my retirement. If I have to scrimp, I should have worked longer (realizing that's not an option for everyone).

We don't travel a lot, my hobbies are not expensive (maybe even net positive) - we could cut out some entertainment and dining, choose cheaper food options (no Costco steaks!!

Anything above the most basic food, shelter, taxes, and health expenses are "discretionary". I don't want to get anywhere close to that!

-ERD50

LateToFIRE

Thinks s/he gets paid by the post

- Joined

- Jun 4, 2023

- Messages

- 1,171

^^^ mathjak107

Totally understand what you are saying. In my case it applies to things we use everyday (houses, cars, food, etc.) and/or things that increase our level comfort (flying front of plane) and convenience (housekeeper) and security (alarm system).

In some other cases though, I've found that once I've been there, done that, the allure fades pretty quickly. Luxury hotels/resorts/spas for me - we're usually about as happy at a Hampton Inn as we are at the Ritz - the utility just doesn't add up to the cost for us. Or cars - I can appreciate that you love your new ride, but I'm not sure I could bring myself to spend $80K on a car. I'm thinkin about it though. Or I'm looking at Florida condos right now - I already know the headaches of owning a vacation home - would it really be worth it.

We're all pretty funny about money - where we see value, where we don't, what we can or can't live without. But, most importantly with ret budgeting, I see that you gotta have a clear picture to work from.

Totally understand what you are saying. In my case it applies to things we use everyday (houses, cars, food, etc.) and/or things that increase our level comfort (flying front of plane) and convenience (housekeeper) and security (alarm system).

In some other cases though, I've found that once I've been there, done that, the allure fades pretty quickly. Luxury hotels/resorts/spas for me - we're usually about as happy at a Hampton Inn as we are at the Ritz - the utility just doesn't add up to the cost for us. Or cars - I can appreciate that you love your new ride, but I'm not sure I could bring myself to spend $80K on a car. I'm thinkin about it though. Or I'm looking at Florida condos right now - I already know the headaches of owning a vacation home - would it really be worth it.

We're all pretty funny about money - where we see value, where we don't, what we can or can't live without. But, most importantly with ret budgeting, I see that you gotta have a clear picture to work from.

LateToFIRE

Thinks s/he gets paid by the post

- Joined

- Jun 4, 2023

- Messages

- 1,171

"Need"? That seems like a gross over-generalization to me!

One of the reasons I strive for a conservative WR is that I don't want to cut any spending, anywhere, anytime! I want to enjoy my retirement. If I have to scrimp, I should have worked longer (realizing that's not an option for everyone).

We don't travel a lot, my hobbies are not expensive (maybe even net positive) - we could cut out some entertainment and dining, choose cheaper food options (no Costco steaks!!) and cut back on gifts to kids/g-kids, but that would suck.

Anything above the most basic food, shelter, taxes, and health expenses are "discretionary". I don't want to get anywhere close to that!

-ERD50

Neither do I - certainly not part of the plan - just good to know there is that safety valve, which makes me a bit more comfortable leaning in on some [highly discretionary] BTD early in the game.

Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

it’s like we had a subaru outback and i thought for our next car i wanted to go up in luxury .

so we just spent 80k on a lexus rx500h thinking once i got it out of system we would go back to what we typically drove .

NO WAY CAN WE GO BACK .

the difference in performance, comfort and handling is totally on another level .

so it is very easy to get used to the better things all to easy.

there is a saying , the poor man always pays twice …that is because the more economical something is , the more of a compromise it is usually .

upgrading is usually so different that once one tries it they don’t want to switch back.

there are just things that one would not think it made a big difference until they tried it .

it’s like we used to tell my buddy he was lucky he married a virgin ….she didn’t know if he was good or bad. lol

On the other side of that, the Lexus is likely more expensive to insure, maintain, etc. than a econmical car costing half the price, so the poor man really might come out ahead.

I feel the way you do on tools though. I hate buying a Harbor Freight tool, can't quite bring myself to buy Festool, and usually settle for something inbetween like Milwaukee. (That being said, we did just get our first Festool, a track saw)

mathjak107

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 27, 2005

- Messages

- 6,208

On the other side of that, the Lexus is likely more expensive to insure, maintain, etc. than a econmical car costing half the price, so the poor man really might come out ahead.

I feel the way you do on tools though. I hate buying a Harbor Freight tool, can't quite bring myself to buy Festool, and usually settle for something inbetween like Milwaukee. (That being said, we did just get our first Festool, a track saw)

maybe not . the lexus can be serviced by any toyota dealer for less ..it also has the best reliability track record and one of the lowest costs of maintenance then any other high end cars .

many lexus have a hundred thousand miles with few issues .

so even with cars one can’t say …my subaru had quite a few issues , so did my jeep

Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

maybe not . the lexus can be serviced by any toyota dealer for less ..it also has the best reliability track record and one of the lowest costs of maintenance then any other high end cars .

many lexus have a hundred thousand miles with few issues .

so even with cars one can’t say …my subaru had quite a few issues , so did my jeep

I'll concede that. We bought a new 2018 Ford Transit Van for $31,000 in 2019, drove it across country and used it for building our house, put 27,000 miles on it, then sold it in 2022 for $32,000 to CarMax.

One of the reasons I strive for a conservative WR is that I don't want to cut any spending, anywhere, anytime! I want to enjoy my retirement. If I have to scrimp, I should have worked longer (realizing that's not an option for everyone).

I agree. The assumption underpinning retirement calculations is the target budget is the desired amount needed for a specific lifestyle which we have chosen. If one wants to continuously increase one’s consumption or standard of living how can a target budget even be calculated. Likewise, if one cannot choose a standard of living and live with it how can they consider or plan for retirement.

Last edited:

Andre1969

Thinks s/he gets paid by the post

maybe not . the lexus can be serviced by any toyota dealer for less ..it also has the best reliability track record and one of the lowest costs of maintenance then any other high end cars .

many lexus have a hundred thousand miles with few issues .

so even with cars one can’t say …my subaru had quite a few issues , so did my jeep

It's also not a given that the Lexus is going to cost more to insure. Even if it's a more expensive car than the Subaru, one big factor with insurance is how much that car, on average, costs the insurance company. If it's a car that tends to get stolen alot, or bought by younger drivers who wreck them, or whatever, that's going to play a bigger factor than the book value of the car.

All other things being equal, big cars tend to be safer than smaller ones as well, so bodily injury claims are probably lower.

mathjak107

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 27, 2005

- Messages

- 6,208

it cost us an extra 500 a year to go from a 2018 subaru worth 25k to a 2023 rx500h worth 80k.

the bulk of insurance costs are for liability not the car we drive

the bulk of insurance costs are for liability not the car we drive

Andre1969

Thinks s/he gets paid by the post

it cost us an extra 500 a year to go from a 2018 subaru worth 25k to a 2023 rx500h worth 80k.

the bulk of insurance costs are for liability not the car we drive

Yeah, I was surprised last September, when I bought a $50K 2023 Charger R/T, which replaced a 2003 Regal. I actually had collision/comprehensive on the Regal, because it was so cheap I figured why not. I was worried the Charger would be expensive, being high-performance, and often bought by a demographic that chews them up and spits them out. But, my insurance only went up by something like $372/yr.

I also found out, after I bought it, on a per capita basis, the V8, non-Hellcat Charger is the 2nd most stolen car in the United States! Most stolen? The Hellcat version! At least, according to some lists I found online.

But, I guess I'm old enough, and live in a low-crime enough area, the insurance company figures I'm a low enough risk. I also told my insurance guy that I'm keeping it garaged, and have no intention of driving it to work, unless absolutely necessary, so it's listed as a secondary vehicle.

Sometimes I wonder, too, if a more expensive vehicle can be cheaper to insure, if it's harder to total out? For instance, if you get into a wreck and do $15K worth of damage to a $25K car, they're going to total out the car most likely, and have to cough up the whole $25K. But, $15K on an $80K car, they're just out $15K. But then, perhaps that gets offset, by the fact that a serious enough wreck could total the $80K car and they'd be out that whole amount, whereas with the cheaper car, they'd only be out the $25K?

Last edited:

Taco

Recycles dryer sheets

- Joined

- Feb 1, 2022

- Messages

- 127

The assumption underpinning retirement calculations is the target budget is the desired amount needed for a specific lifestyle which we have chosen.

I'm not sure "chosen" is quite right. The calculations are based on determining that we have "enough". And we decide that working longer to have "more than enough" isn't worth it.

But if I could choose to have an extra 100K per year without working longer, heck yeah, I would choose that.

If one wants to continuously increase one’s consumption or standard of living how can a target budget even be calculated. Likewise, if one cannot choose a standard of living and live with it how can they consider or plan for retirement.

These 2 questions miss what I took to be Mathjak's point.

Most of us are somewhat conservative when we determine that we have enough. The plan includes being okay in the worst case scenario (which most do not experience).

When the worst case scenario doesn't occur, when the early years with the biggest SORR come and go, there comes a point when people may end up with "more than enough".

So I think the point is not that "one *wants* to continuously increase one’s consumption", but they may reach a point where they *can*.

And if they do reach that point, why not increase withdrawals accordingly? Treat yourself, give more to your kids, help others in need, etc.

A famous quote by John Maynard Keynes is:

“When the facts change, I change my mind - what do you do, sir?”

I took Mathjak's point to be similar:

"When my portfolio value exceeds what I had planned for, I change my plan..."

Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I think it was CuteFuzzyBunny who used to always say that you needed 2X essential expenses to retire early. In other words at least 50% discretionary.

We have been averaging around 30% discretionary each year of retirement.

LateToFIRE

Thinks s/he gets paid by the post

- Joined

- Jun 4, 2023

- Messages

- 1,171

I'm not sure "chosen" is quite right. The calculations are based on determining that we have "enough". And we decide that working longer to have "more than enough" isn't worth it.

But if I could choose to have an extra 100K per year without working longer, heck yeah, I would choose that.

These 2 questions miss what I took to be Mathjak's point.

Most of us are somewhat conservative when we determine that we have enough. The plan includes being okay in the worst case scenario (which most do not experience).

When the worst case scenario doesn't occur, when the early years with the biggest SORR come and go, there comes a point when people may end up with "more than enough".

So I think the point is not that "one *wants* to continuously increase one’s consumption", but they may reach a point where they *can*.

And if they do reach that point, why not increase withdrawals accordingly? Treat yourself, give more to your kids, help others in need, etc.

A famous quote by John Maynard Keynes is:

“When the facts change, I change my mind - what do you do, sir?”

I took Mathjak's point to be similar:

"When my portfolio value exceeds what I had planned for, I change my plan..."

+1, spot on

Similar threads

- Replies

- 97

- Views

- 11K

- Replies

- 15

- Views

- 7K

- Replies

- 15

- Views

- 2K

- Replies

- 38

- Views

- 39K