Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

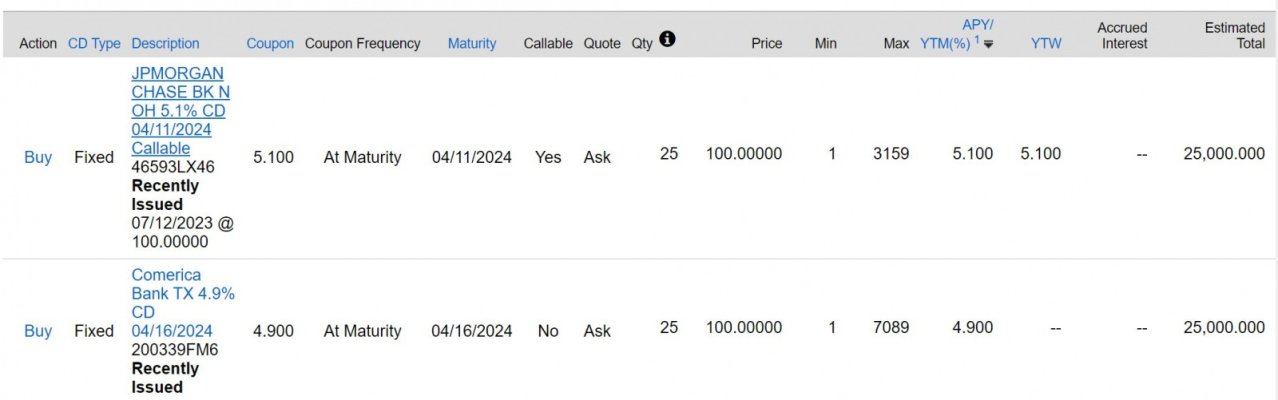

Yes, its nothing to be worried about. In fact your closer to “owning the CD”, than you are owning your stocks. As many may not even know that any stock in your brokerage account isnt even owned by yourself. Its in street name through brokerage and furthermore Cede and Co. is technically the owner of all common stocks outstanding.

Added…. Jim, I just saw your post, I’m too late, ha.

I learn something new every day. I first thought Cede and Co was a play on the name abbreviation CD we use for Certificate of Deposits. But, there really is a Cede and Co.!!!