pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

As you may recall, we recently had GS#1 who is now 18 months old and GBaby#2 "in the oven" and my DM recent died. Part of my inheritance will include an inherited Roth IRA of ~$50k.

This is money that I would never need. I'm thinking of investing the Roth for dramatic growth for the grandkids benefit and then taking the money out in the tenth year as required.

I'm thinking of Hedgefundie's Excellent Adventure Portfolio (HFEA). See attached link and you can also find it on bogleheads.

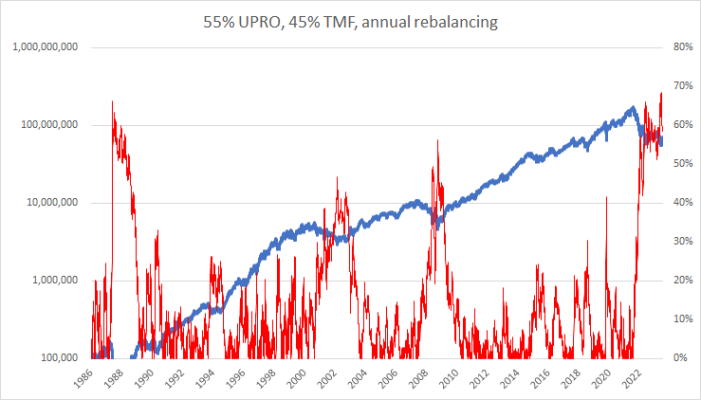

HFEA is 55% 3x leveraged S&P 500 bull ETF (UPRO) and 45% 3x leveraged 20-year Treasury bull ETF (TMF) that would be rebalanced quarterly... a risky and volatile combination that backtests very well.

This combination has an average rolling 10-year average return of 26.08% with a low of 11.52% and a high of 35.50%. So with a starting balance of $50k, at the end of 10 years it would total $149k (low) or $507k (average) or $1,043k (high) and would be a great jumpstart for them for their college education and lives.

Alternatively, if I just went 100% UPRO with no rebalancing then based on 10 year total return the account would total $286k (low), $651k (average) and $1,556k (high) at the end of 10 years.

The reason for using a Roth is because with the HFEA the quarterly rebalancing can result in signifcant taxes if done in a taxable account.

The way I figure it is even if the return is average then the grandkids will remember grandpa as a genius.

Thoughts? Am I crazy?

https://www.etfcentral.com/news/hedgefundies-excellent-adventure-3x-leveraged-etf-portfolio

This is money that I would never need. I'm thinking of investing the Roth for dramatic growth for the grandkids benefit and then taking the money out in the tenth year as required.

I'm thinking of Hedgefundie's Excellent Adventure Portfolio (HFEA). See attached link and you can also find it on bogleheads.

HFEA is 55% 3x leveraged S&P 500 bull ETF (UPRO) and 45% 3x leveraged 20-year Treasury bull ETF (TMF) that would be rebalanced quarterly... a risky and volatile combination that backtests very well.

This combination has an average rolling 10-year average return of 26.08% with a low of 11.52% and a high of 35.50%. So with a starting balance of $50k, at the end of 10 years it would total $149k (low) or $507k (average) or $1,043k (high) and would be a great jumpstart for them for their college education and lives.

Alternatively, if I just went 100% UPRO with no rebalancing then based on 10 year total return the account would total $286k (low), $651k (average) and $1,556k (high) at the end of 10 years.

The reason for using a Roth is because with the HFEA the quarterly rebalancing can result in signifcant taxes if done in a taxable account.

The way I figure it is even if the return is average then the grandkids will remember grandpa as a genius.

Thoughts? Am I crazy?

https://www.etfcentral.com/news/hedgefundies-excellent-adventure-3x-leveraged-etf-portfolio