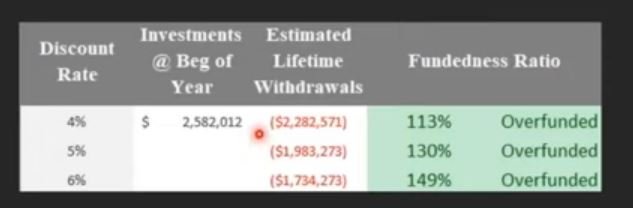

I have been watching this lady channel on YouTube lately. The video talks about creating a Retirement Income Plan and assessing your retirement readiness by using the Excel NPV formula against all your withdrawals from your retirement accounts during your retirement lifetime. In the video, they use 4%, 5%, and 6% rate of return. The result is then compared against the present value of your retirement nest egg to determine if your retirement goals are over or under funded. Very interesting methodology.

More detail can be found starting at 33:00 minutes in the video below.

Would love to hear feedback from other on this approach to assess retirement readiness.

More detail can be found starting at 33:00 minutes in the video below.

Would love to hear feedback from other on this approach to assess retirement readiness.

Attachments

Last edited: