pirsquared

Recycles dryer sheets

- Joined

- Jun 13, 2021

- Messages

- 129

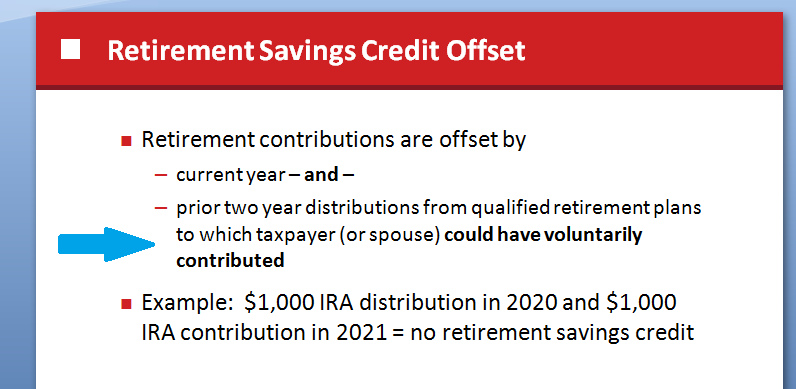

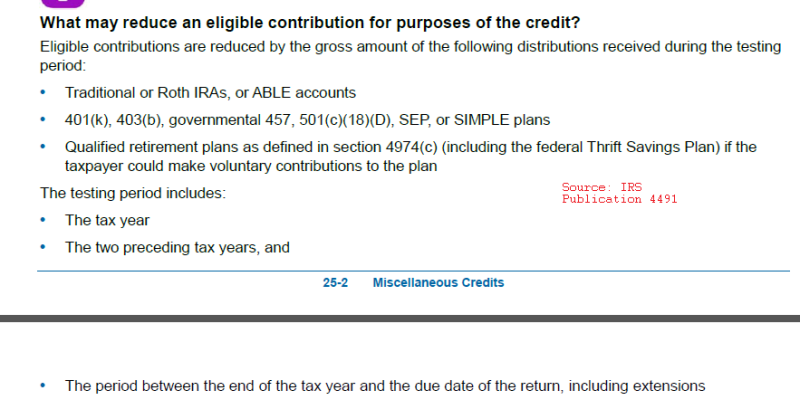

I am trying to determine whether we qualify for the Saver's Credit (form 8880). My question relates to the section where you subtract any distributions from a retirement plan over the last few years. We have never made any withdrawals from our IRAs or 401Ks. However, DH is drawing a pension (approx. $900/month). This is a traditional defined benefit pension to which he did not and could not contribute. His company did have a separate option to contribute extra to a pension, but that was a separate thing in which he did not participate. The one he is drawing now is not something he did or could contribute to.

I have done some research and it appears that we would not need to subtract the DB pension $, but I am still not completely sure. Here are two bogleheads threads that seem to confirm that DH's pension $ are not subtracted from our contributions:

https://www.bogleheads.org/forum/viewtopic.php?t=185689

https://www.bogleheads.org/forum/viewtopic.php?t=211326

This IRS statement also seems to confirm my thoughts:

https://itap1.for.irs.gov/owda/0/re...s_Redirect_ITA/en-US/help/retcrexcldplan.html

However, this link says differently:

https://www.taxtopics.net/Sec4974c....RA, 401(k) and certain other retirement plans.

None of these links is very recent and I am wondering if anyone here has more recent experience with this issue.

Thanks!

I have done some research and it appears that we would not need to subtract the DB pension $, but I am still not completely sure. Here are two bogleheads threads that seem to confirm that DH's pension $ are not subtracted from our contributions:

https://www.bogleheads.org/forum/viewtopic.php?t=185689

https://www.bogleheads.org/forum/viewtopic.php?t=211326

This IRS statement also seems to confirm my thoughts:

https://itap1.for.irs.gov/owda/0/re...s_Redirect_ITA/en-US/help/retcrexcldplan.html

However, this link says differently:

https://www.taxtopics.net/Sec4974c....RA, 401(k) and certain other retirement plans.

None of these links is very recent and I am wondering if anyone here has more recent experience with this issue.

Thanks!