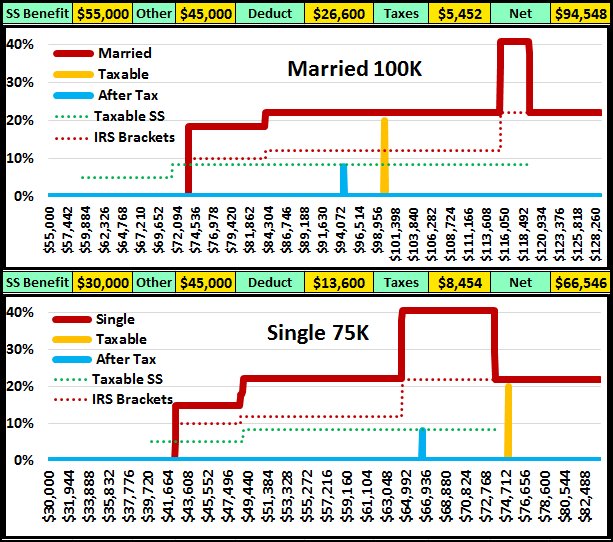

Line 5 on your 1040 tax return can be extremely costly during retirement. Box 5a asks how much did we get from Social Security and box 5b asks how much of your Social Security Benefits are taxable income. Once we reach a certain income level each additional dollar of income causes an additional 50 cents of our SSB to become taxable income, then at a second income level each dollar causes 85 cents to become taxable until 85% of our total benefit has been taxed.

When one dollar of extra income also cause 85 cent of our SSB to also become taxable, your AGI and taxable income increases by $1.85, not just $1.00. 12% of $1.85 is 22.2 cents and 22% of $1.85 is 40.7 cents. Your Marginal Tax Rates, the taxes you pay on the next dollar of income, are 22.2% then 40.7% then back to 22% once 85% of your SSB has been taxed.

One thing that I have learned during retirement is to start doing my tax returns in January. Not the January of the next year after I got my W2s when I was working, but the January of the current year. By the end of January I know how much Social Security I will get that year and how much my yearly pension income will be, plus other guaranteed income like annuities etc. Using this information I can then calculate how much other income I can create from IRA withdrawals, part time jobs, capital gains, etc. before I reach the top end of the 12% Federal Tax Bracket, the 22.2% Marginal Tax Rate.

I redo my tax return every time BEFORE I create extra income. My goal is to know when to switch from IRA withdrawals to Roth withdrawals so that none of my income will be taxed at the 40.7% Marginal Tax Bracket. I also redo my tax return right after Christmas each year to see if I can withdraw extra IRA funds at the 22.2% Marginal Tax Rate to reduce my taxable income needs for the next year.

The primary reason that I can do this is because I did a number of Roth Conversions prior to starting my Social Security benefits. I also used these conversions to do backdoor Roth Contributions. I told my broker to do the Roth Conversion and to withhold zero taxes, then I immediately went on line and filed state and federal estimated tax returns using non-IRA money. 100% of my IRA funds went into my Roth account, not just 70% after tax, a 30% backdoor contribution!

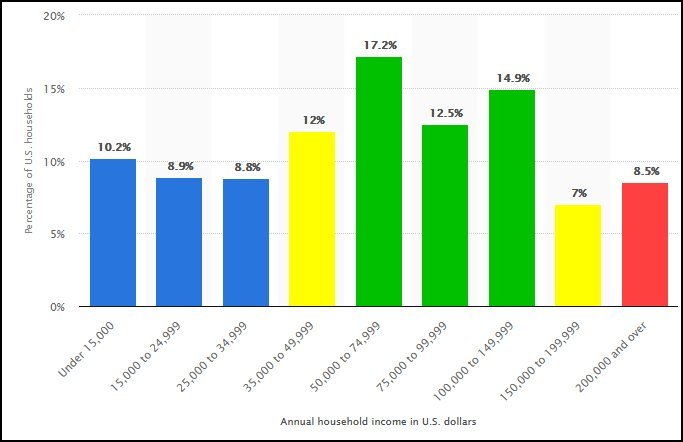

A special note to married couples; this end of year tax check is a good time to do Roth Conversions. Your surviving spouse will be forced to pay taxes at the single tax bracket rates so the amount of extra taxable income before reaching their 40.7% Marginal Tax Rate will be greatly reduced.

Let’s look at some numbers to see how larger Social Security benefit levels can create larger pre 40.7% retirement income levels with lower IRA withdrawals. Note: read the last column like it is a paragraph that explains the other columns.

| Social Security | $54,000 | $60,000 | $70,000 | Larger SSB levels |

| IRA / Pen / etc | $61,838 | $60,460 | $58,163 | require less other income |

| Gross Income | $115,838 | $120,460 | $128,163 | resulting in more gross income. |

| Taxable SS Basis | $88,838 | $90,459 | $93,162 | This increases your "Basis" for |

| Taxable SSB | $44,112 | $45,490 | $47,787 | the amount of your taxable SSB. |

| Taxable % | 81.69% | 75.82% | 68.27% | Lower % taxed |

| Tax Free % | 18.31% | 24.18% | 31.73% | Higher % tax free |

| AGI | $105,950 | $105,950 | $105,950 | The target for all of this is the |

| Deductions | $27,000 | $27,000 | $27,000 | after standard age 65 deductions |

| Taxable | $78,950 | $78,950 | $78,950 | maximum taxable income at |

| Fed Tax Bracket | 12% | 12% | 12% | the 12% federal tax bracket. |

| Federal Tax Due | $9,086 | $9,086 | $9,086 | Everyone pay the same taxes |

| After Fed Tax | $106,752 | $111,374 | $119,077 | but after tax income is higher, |

| Overal Tax Rate | 7.84% | 7.54% | 7.09% | and your overall tax rate is lower. |

| Hump Width | $2,104 | $6,482 | $13,780 | BUT the 40.7% tax hump is larger |

| At 40.7% | $856 | $2,638 | $5,608 | costing more if you didn't plan for it. |

| | | | |

I call the graph line of the 22.2% to 40.7% back to 22% Marginal Tax Rates the Tax Hump, I think that this is what you call the Tax Torpedo on this forum.

A special note here: if you have LTCGs the top end of the 12% standard tax bracket causes those gains to also become taxable at 15% for a total Marginal Tax Rate of 27% without the taxation of your Social Security. This 27% rate becomes 49.95% when each extra dollar of income increases your taxable income to $1.85.

The Tax Hump, Torpedo, becomes 22.2% to 49.95% to 40.7% back to 22%! Even more reason to plan ahead and start your tax returns in January of the CURRENT year, not next year!