Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

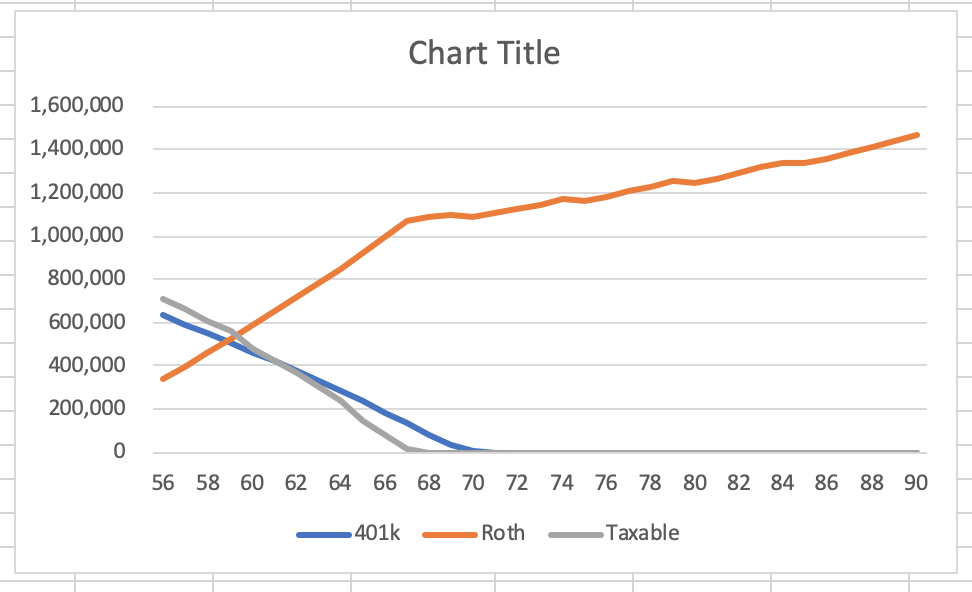

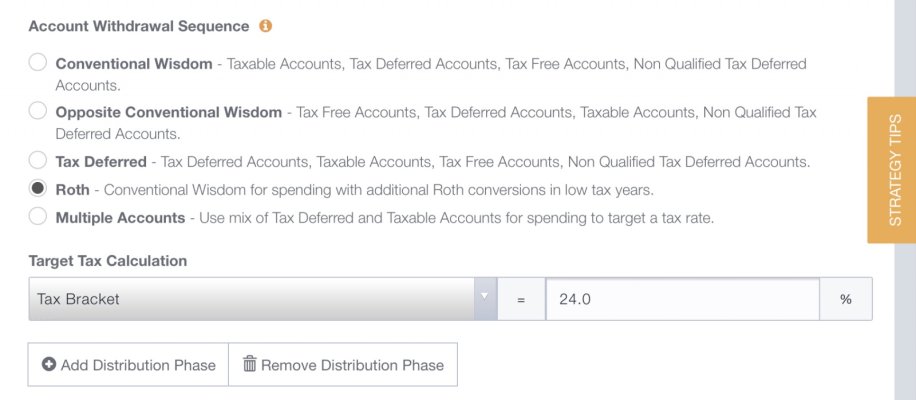

Indeed I am sitting on a large chunk of LTCGs, but I also have a sizeable cash allocation. So I’m paying taxes from taxable cash to maximize what remains in IRAs. If you have to sell assets from taxable and generate capital gains to pay estimated taxes, you’ll have to see how the math works out versus paying taxes from your IRA.I understand your reasoning for converting up to the 22% bracket. My question is what account will you pay for the conversion with. Will it be taxable account or the IRA account itself? I seem to remember in the thread that you had a significant quantity of LTCG's. How are you paying for these conversions?

Fido & many others said:It's usually considered a good idea to avoid using the funds that are being converted from within your Roth to pay the tax on a conversion. By doing so, you will have less left in the account to potentially grow tax-free and, if you are under 59½, you'll also incur the 10% penalty on the amount you don't convert to the Roth IRA.

Last edited: