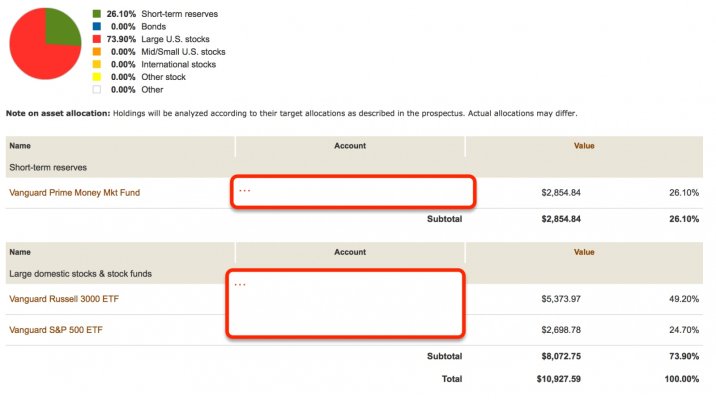

I currently have $10,927 in my Roth IRA which is invested in the Vanguard Russel 3000 and Vanguard S&P 500.

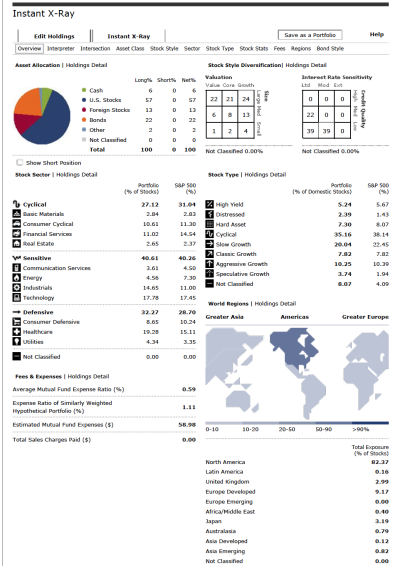

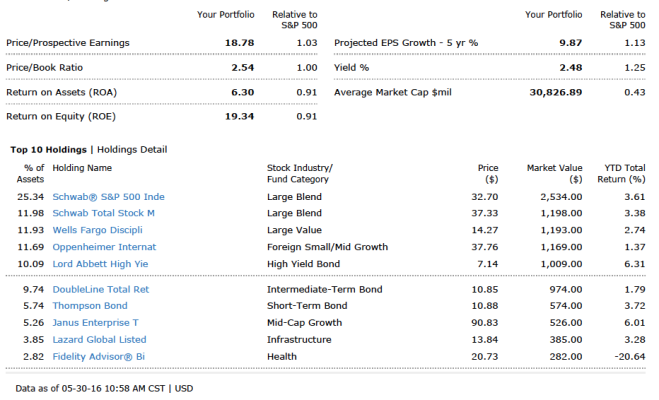

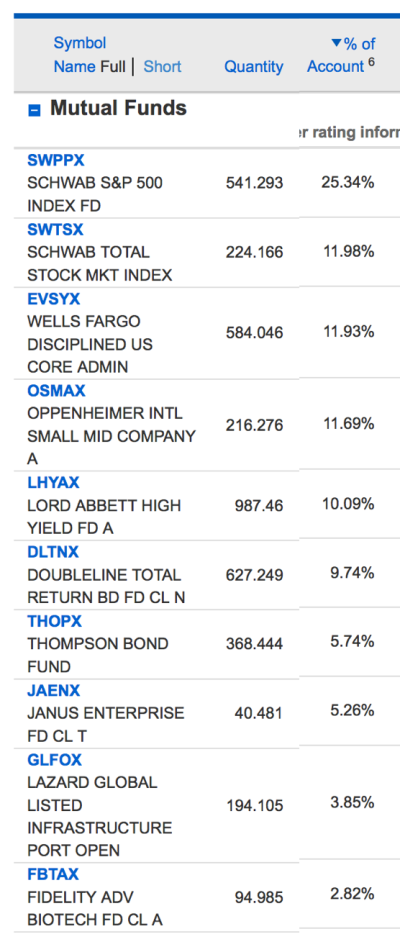

I have a firm managing my solo401k ($69,764) right now but no one helping with my Roth.

Would you guys recommend finding someone else to manage the Roth or let current 401k firm manage it? Or figure it out myself (would prefer not to do this)?

I'll be getting married this summer too, I'm 32 soon to be wife is 28. Need her to be maxing out a Roth too. Any help or advice would be greatly appreciated! Thanks

I have a firm managing my solo401k ($69,764) right now but no one helping with my Roth.

Would you guys recommend finding someone else to manage the Roth or let current 401k firm manage it? Or figure it out myself (would prefer not to do this)?

I'll be getting married this summer too, I'm 32 soon to be wife is 28. Need her to be maxing out a Roth too. Any help or advice would be greatly appreciated! Thanks

...ducking the flames coming my way after that comment....) but it really pays to be sure you understand the full scope of fees you are being charged by FA + investments you are in so you can verify the value is what you are looking for.

...ducking the flames coming my way after that comment....) but it really pays to be sure you understand the full scope of fees you are being charged by FA + investments you are in so you can verify the value is what you are looking for.