...

I'm mostly thinking about how you would construct the model in FIRECalc. ...

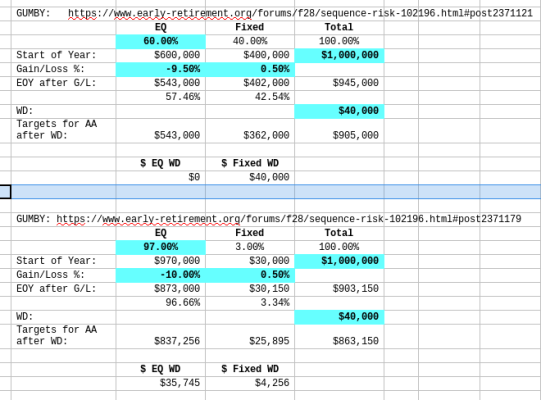

Similarly, what happens when you, for whatever reason, have chosen a 97/3 portfolio, you have a $1 million starting amount, the stock market drops 10% and you need to draw $40,000. You don't have the assets in fixed income to either re-balance or fund the yearly draw. Yes, it would be crazy to have that allocation, but from what I can see, FIRECalc will allow you to select up to 100% equities. How should the model address that?

If I were building the model and needed to accommodate such a wide range of possibilities, I would do one of 2 things:

1. Take the yearly draw from the equities/fixed in the proportion they have reached prior to re-balancing (e.g. 67%/33% for a nominal 60/40 portfolio) and then rebalance the remainder back to 60/40; or

2. Rebalance to 60/40 and then take the yearly draw 60% out of equities and 40% out of fixed. I think I showed above that the math comes out the same either way.

Otherwise, it would be way too complicated to accommodate the edge cases, only some of which I have listed above. Note that in either of my two methods the steps can be combined to only show a single net movement of money (as you note). ...

I'm only trying to figure out how the model works. If anyone can shed light on this, I welcome it.

You are way over-complicating this. There are no edge cases or decisions, it is simple arithmetic.

But I will say that my statement

"you won't sell equities in a downturn" was an over-simplification. I should have said "in an

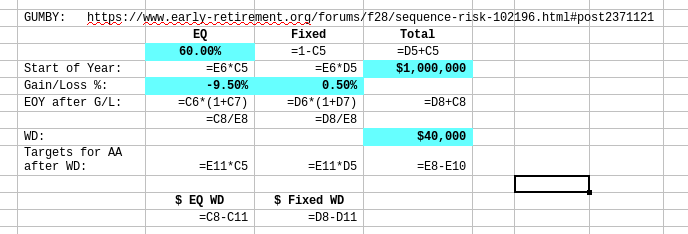

extreme downturn". With the example $40,000 withdrawal, if less than $40,000 is needed to re-balance, then yes, you'll still be selling some equities. You observed this in your "Edit to add" example at the - 9.5% point.

The simple way to look at it is:

A) Take your TOTAL EOY Balance.

B) Subtract your withdrawal $ amount from that.

C) Calculate your new $ allocations ( based on Total Balance after W/D from "B"). Done.

FIRECalc doesn't really need to deal with selling or buying, those new starting $ amounts for equity and fixed is all it needs. IRL, if we were strict re-balancers, we would make our withdrawal, plus any amounts to buy/sell to re-balance.

Even your 97/3 AA doesn't cause any issues for the simple arithmetic. (I'll try posting the spreadsheet clips next).

A couple more "IRL" points:

A) I know there are some strict re-balancers here, and that's fine. But I suspect there are many who re-balance when they get "out of whack" by enough to concern them (5%?). And they probably take a more simplistic (pragmatic?) approach and take from whichever asset class is higher than their target, and don't try to split hairs. So if your 75/25 target is now 80/20, take your W/D from equities, don't bother with the math, just get closer. And vice-versa. One transaction.

B) IRL, we are probably taking our dividends as they accrue. For an ~ 4% WR, divs probably make up about half of that, so the WD amount is half as much, so therefore less to sell from stocks in a mild downturn, and less overall effect from this W/D.

Back to FIRECalc, I' pretty sure the data sources they use include re-investment of divs, so the program really has no choice but to use the entire W/D amount in its EOY W/D & re-balance calculations.

-ERD50