anothercog

Recycles dryer sheets

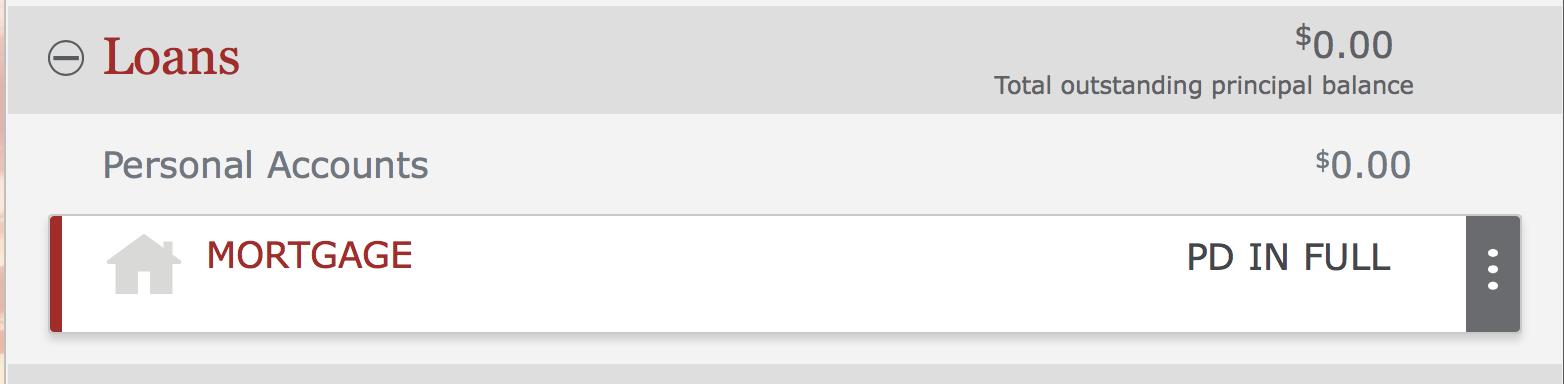

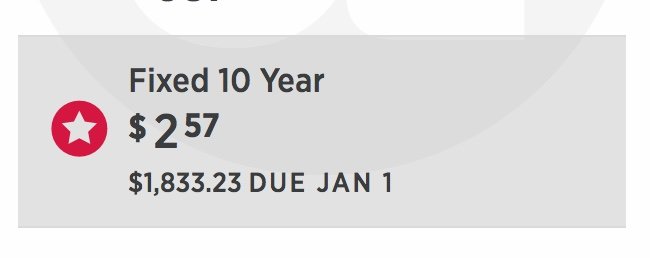

My fidelity account hit 3.5 million today, net worth is 5.6m ...feels REALLY good! Admittedly sometimes I wonder how this happened. I am just a blue collar guy who wears a tool belt for a living with no college education. I buy whatever I want whenever I want it. I feel very fortunate to have reached this level.

Congratulations to everyone else on your milestones. I like to read about other peoples successes.

That is amazing. Congrats!