Alex The Great

Recycles dryer sheets

I have a question to those who has 100% success with FireCalc: do you include retirement income, such as Social Security, etc?

I have a question to those who has 100% success with FireCalc: do you include retirement income, such as Social Security, etc?

Not OP! I'm similar. I planned for Summer 2020 and a year ago from today was super excited. 2020 took the wind out of my sails... my LWN now is 22% higher now but my optimism has been shattered. I used to mostly read the threads about life after FIRE and now I'm back to overthinking do I have enough (bouncing around a 2.5% WRD overall but also accessibility issues with a majority in deferred accounts).

I'm not pessimistic but just don't know what to expect (easy come easy go). I index invest (and discount cashflow when I choose individual securities) but still know that I am ultimately buying equity in individual companies as an owner and just feel things are "frothy" now... if we keep printing money and the vaccine reopens shuttered sectors of the economy maybe I'm ok.. or maybe not. I just don't know and piled on top of that is many of the things I want to do when free from the chains of employment are impacted by COVID. So, I take it one day at a time trying (not that successfully) to maintain my sanity... then I feel so lonely to be in such a "good" position but to be feeling constant anxiety when there are so many more that are suffering (some good friends and several I know who have lost almost everything) when I am wishy-washy on quitting my job with much more money than I had a year ago. Wordy I know, a bit of stream of consciousness.

There needs to be an ER therapist that understands our unique population but all the qualified ones are retired!!!

FLSunFire (Grateful to have such "problems" to deal with)

Well, I'll play the role of the "little guy". But as of close yesterday, my investments are now over $500k.

It truly is a snowball. The first $100k was the hardest!

I'm not a C-Suite Exec or high income earner. Just LBYM and save 35% to 50% of my income. Ready for the next $500k.

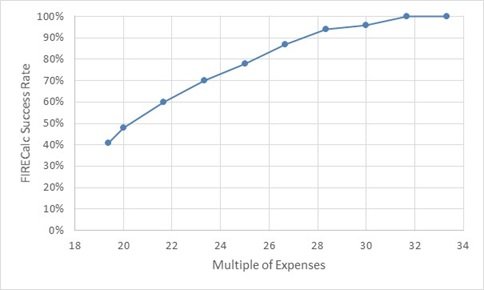

Thank you. Currently, I'm around 28X of projected expense and I do have 100% success from Firecalc when social security is included. However, I've never been able to get 100% success from Personal Capital retirement planner: it always say 99% even if I put some random large number like $20M there.I do. We’re four years away from DH collecting at 62, so that seems close enough. I’m farther away from collecting, hopefully at an older age, but I assume any change would be a haircut, not a complete elimination.

It’s a risk, but we have buffer in our spend.

If you were ready last year and now are in even better shape, why wait?

Well, I'll play the role of the "little guy". But as of close yesterday, my investments are now over $500k.

It truly is a snowball. The first $100k was the hardest!

I'm not a C-Suite Exec or high income earner. Just LBYM and save 35% to 50% of my income. Ready for the next $500k.

I walked out the retirement door at 58 on 12/31/2015 with 2.43M in our portfolio. Husband retired at 56 in 12/31/2016. In Dec., the portfolio was at 5.2M. I never expected it.

Maybe could have gone sooner but no one can predict the future.

This is all market appreciation with no new funds since I'm retired. I'm an aggressive investor, with no bond exposure. I have one index fund (S&P fund) and a significant share of AAPL. I own both of these for the long term and do not trade them. I was up 29% in 2020.Just curious. Is this all from market appreciation or was there a windfall/contribution?