COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

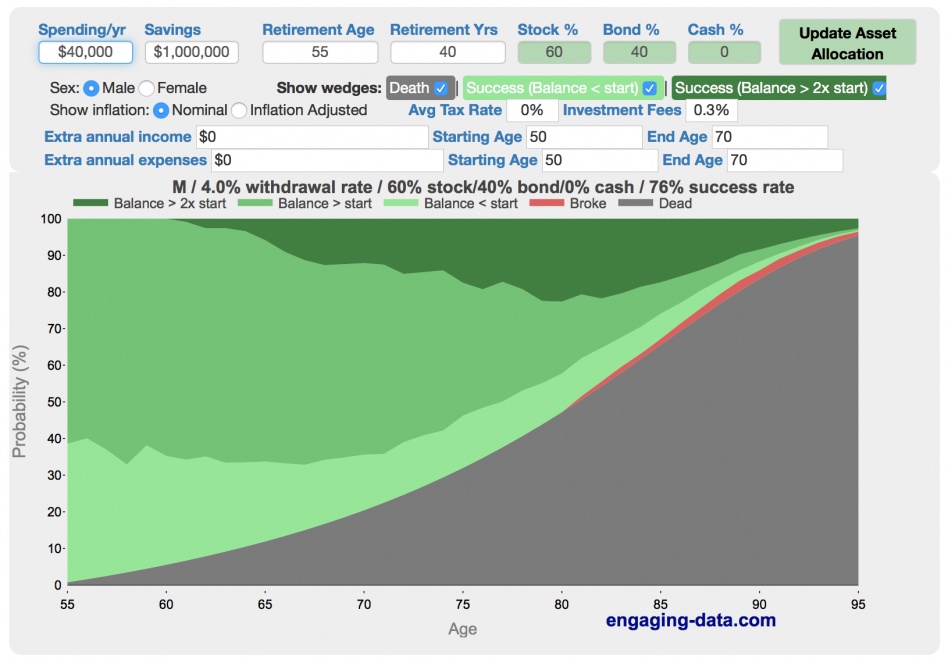

I think I'd be comfortable if the lowest balance was zero, or even a failure before the end of the time span. I'm only shooting for 95%, myself. However, my opinion is that, these failure cycles are like a slow motion train wreck. If you pay attention to them, you should see the calamity coming years down the road, and should be able to make changes, such as cutting back on spending, downsizing, working a bit longer, etc, to help kick the can further down the road.

Most of these failure cycles don't just sneak up on you late in life. Usually it seems to be a bad sequence of returns early on, with too much money pulled out during those bad years, and whatever is left, just never gets the chance to recover, so it slowly erodes over time.

+1