SecondCor521

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

My daughter, who filed in mid Feb for a $263 refund still does not have it. Bank info is correct. When she checks online it constantly states “in progress, should take 2-3 weeks from when we receive it”. No updates, no other way to check.

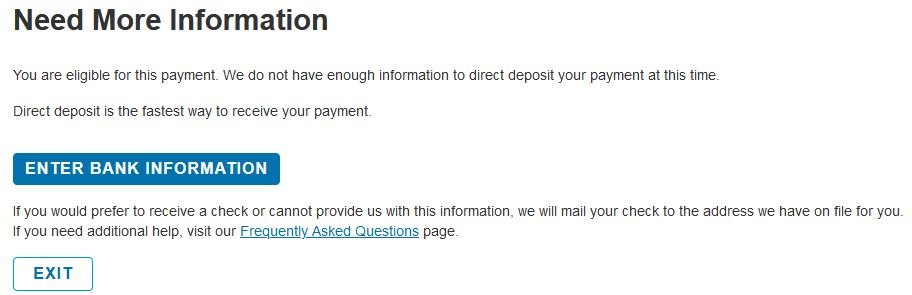

No stimulus check. Message comes on “we can’t identify you”. I even tried it today for her and got the same message

Then locked out for 24 hours

Did she file on paper? It sounds like she did given the message you're describing mentioning several weeks.

My son filed on paper in late February and has not gotten his refund, although he did receive his stimulus payment on 4/15. It has shown in progress since end of March.

My guess is that the news reports that they've shut down IRS processing centers due to the current epidemic means that paper filers' refunds (like my son's) are in limbo.

(If she filed electronically and had a typical return then she should have received her federal refund about 10 days after filing.)