haha

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Why don't you give it a rest, Bob? People can decide for themselves what they think.Here's a timely example . . .

Ha

Last edited:

Why don't you give it a rest, Bob? People can decide for themselves what they think.Here's a timely example . . .

Okay, you go first.

I'm sure even those with smaller nest eggs could make retirement work without SS--what would be your cutoff point as to who conceivably might forego SS and who shouldn't?

We have many posters on this board who say that they have achieved FIRE, and do not actually need SS. Given the next generation will have to pay more to benefit less, some may say taking Social Security when you don't even need it presents a moral dilemma. We all have the choice not to file for benefits, but I do not hear about very many taking turning it down. (other than by dying younger than expected).

Anyone here considering not filing for benefits? I know many will reply they ""earned" the benefits, but that is not my point.

Please send it to me, and I will burn it for you. As proof, I will send photo of the pile of ash.

Your mom sounds like a wonderful, generous lady. It was good her dad was around to look after her best interest.This may not directly relate to what we are talking about here, but my dad died when I was very young. My mom could get survivors benefits, but didn't claim it. (She figured she would do fine without any help from the government.) When my grandfather found that out (my mom's dad), he basically called my mom an idiot saying "it's not like the money you hadn't collected will go to someone unfortunate." He filed the paper work for her, and my mom started getting the benefits.

I whole heartedly agree with my grandfather.

The worker-to-beneficiary ratio has fallen from 5.1 in 1960 to 3.3 in 2005. Some of the historical decline is related to the natural maturing of a pay-as-you-go social insurance program, but the projected future decline is due to the aging of the U.S. population.

It's interesting to me that the people who believe SS will run out of workers never account for productivity gains. They implicitly assume that the worker of 2040 will produce the same output as the worker of 1935. If that were true living standards for both workers and retirees would never have risen above the 1935 level.

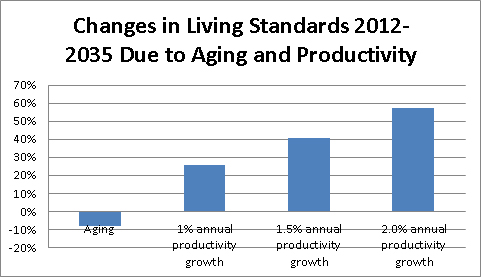

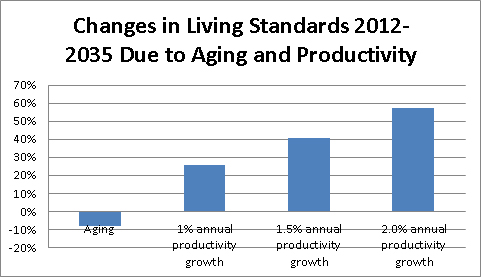

Here's a different view from Dean Baker:

One of themes that recurs endlessly in news coverage is that the United States and other countries face a disastrous threat to their living standards as a result of a falling ratio of workers to retirees. This is one that can be easily dismissed with some simple arithmetic.

A falling ratio of workers to retirees means that a larger chunk of what each worker produces must be put aside to a support the retired population. (Btw, this is true regardless of whether or not we have a Social Security or Medicare system. The only issue is whether retirees are able to maintain something resembling normal living standards.) However, that does not imply that the working population must see a drop in their living standards.

Fans of arithmetic might note that the ratio of workers to retirees fell from 5 to 1 in the early sixties to 3 to 1 in the early 90s. This sharp drop in the ratio of workers to retirees did not prevent both workers and retirees from enjoying substantial improvements in living standards over this period. The reason is that productivity growth, what each workers produces in an hour of work, swamped the impact of a falling ratio of workers to retirees.

The 1.0 percent growth bar shows the impact of productivity growth assuming that going forward it is worse than at any point in the post-war era. (Even in the period of the productivity slowdown, from 1973-1995 growth was somewhat more rapid than this.) In this case the 25.7 percent increase in living standards allowed by higher productivity growth is more than three times the 7.8 percent decline resulting from a fall in the ratio of workers to retirees.

I note that in the three years following the crisis of 2008 the productivity growth of the US economy fell to about 1% per year. It's reasonable to expect it to increase as the economy recovers, but even if it did not, rising living standards would overwhelming the declining number of workers per SS beneficiary.

It's interesting to me that the people who believe SS will run out of workers never account for productivity gains. They implicitly assume that the worker of 2040 will produce the same output as the worker of 1935. If that were true living standards for both workers and retirees would never have risen above the 1935 level.

Does it matter if there are productivity gains when very little of that is actually captured by workers? Given that median wages have been stagnant for some time, it doesn't seem like productivity increases will help funnel money into SS.

The author claims that productivity gains would account for the main reason why the system has been solvent despite the ratio of workers:retiree falling?

Perhaps those same "fans of arithmetic" Dean is addressing can look at the more likely causes of the system managing to last this long:

--In 1937, initial taxes were 2% at program start, capped at $3,000 in wages. That remained until 1950.

--In 1950, tax increased to 3%, and in 1951 cap raised to $3,600.

The "wage index" in 1951 was $2,799 (index started this year)

...

The SS wage cap in 2011 was $106,800.

The wage index in 2011 was $42,979

(I used 2011 since the wage index on SS's website only goes to 2011)

So if the wage cap on SS taxes had only matched the wage index growth, the 2011 SS wage cap would have been about $55,278.

This means that not only have SS taxes increased 520% (from 2% to 12.4%), but the maximum wages that is applicable to has gone up from $55,278 to $106,800, or 93%!

And that doesn't even add in the effect of drawing out the full retirement age from 65 to 67 for currently retiring (and those in the future).

Did productivity help increase revenue to the SS trust fund coffers? Of course it did. Was it anywhere near as large of an impact as raising the tax rates by 520% and raising the wage cap by 93%?

Hmmm......

Khufu said: "Why should Warren Buffett and I pay the same dollar amount of payroll tax each year?"

Because assuming you both paid in the max amount, you would get the same SS benefit amount that he would.

You are tipping your hand. The "income has gone to". . . reflects a particular view of things.More of the income has gone to the upper 1% . . .

Why is this considered a payment from the government?? All of the funds collected are from individuals and from companies that match their contribution. The "Govt" doesn't put in any money at all! The "Govt" just collects it and distributes it. So why is it even considered an "entitlement"?? The "Govt" is just doling out what we and our companies paid in.

You are tipping your hand. The "income has gone to". . . reflects a particular view of things.

And if Warren wants to pay more (instead of just claiming he wants to pay more) I wish he would just send in the check. He knows how to do that. He doesn't want to pay more, he thinks other people should pay more. That's the common theme, isn't it? Warren has found good uses for his money (earning more money, philanthropy, etc) that apparently don't include sending it to the US government. But he thinks "other people" aren't so inherently good as he? Arrogance--or just wanting to gain favor on the cheap. It's not an uncommon trait, but I guess I expected more of "the Oracle"

You didn't write that.Buffett's complaint is that the class of people that includes himself should be taxed more . . .

Well, call me a communist, but I think Warren should pay more. He thinks so, too, as a matter of fact.

You are tipping your hand. The "income has gone to". . . reflects a particular view of things.