Khufu, you're not getting my point (and it was a minor one). When someone says "income went to" instead of "income was earned by" it's a window into their world view.

I thought it interesting to hear people talk about their grades.

"Ms Jones gave me an "F" in English Lit"

"I got a "C" in Trig."

"I earned an "A" in Algebra"

I never heard "I earned an "F"". It's all about how we see the world, who we see as responsible for how things turn out--"them", "fate," "me" ?

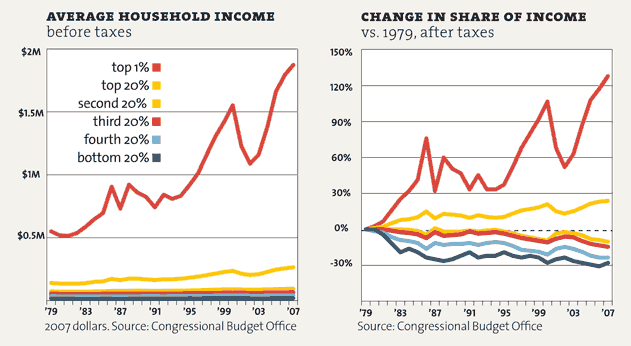

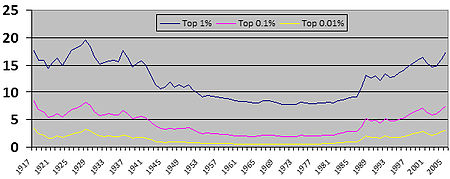

I don't dispute that the share of total income represented by the top 1% of tax returns has increased from 2009 to 2010. But I also do not grant that these are the same individuals year to year ("the 1%") and that they didn't "earn" the money (through labor or putting their capital at risk in productive ways).

I thought it interesting to hear people talk about their grades.

"Ms Jones gave me an "F" in English Lit"

"I got a "C" in Trig."

"I earned an "A" in Algebra"

I never heard "I earned an "F"". It's all about how we see the world, who we see as responsible for how things turn out--"them", "fate," "me" ?

I don't dispute that the share of total income represented by the top 1% of tax returns has increased from 2009 to 2010. But I also do not grant that these are the same individuals year to year ("the 1%") and that they didn't "earn" the money (through labor or putting their capital at risk in productive ways).

Last edited: