Tiger8693

Full time employment: Posting here.

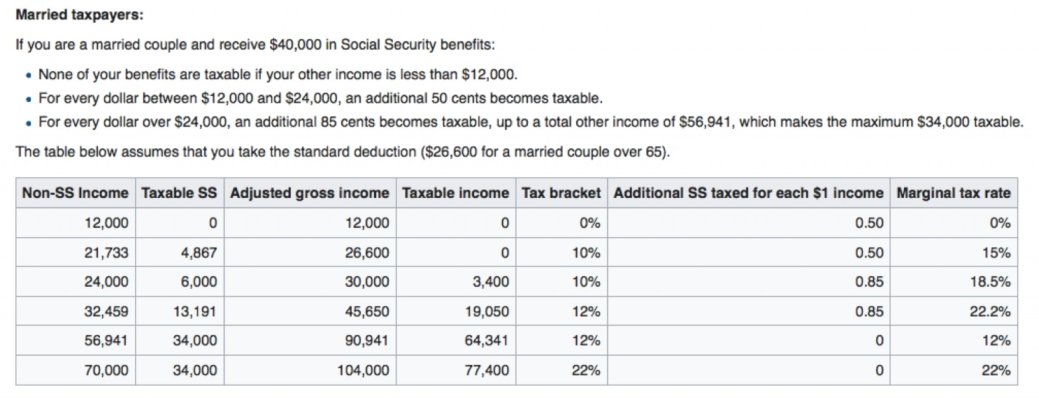

It really stinks about taxation of SS.

Have seen a couple of advertised local seminars on planning for, and minimization of this, but am always skeptical of an annuity sales pitch or something. May just go with my guard up to see if I can learn anything.

This whole retirement planning thing is tedious and time consuming. I can't imagine what people that are not as detail oriented do. See an FA and pay I guess.

Have seen a couple of advertised local seminars on planning for, and minimization of this, but am always skeptical of an annuity sales pitch or something. May just go with my guard up to see if I can learn anything.

This whole retirement planning thing is tedious and time consuming. I can't imagine what people that are not as detail oriented do. See an FA and pay I guess.

simply assume a retirement tax rate that they know is a bit higher than they will actually experience. Then when they retire and encounter a tax rate less than that, they can happily blow the excess on fun and discretionary spending.

simply assume a retirement tax rate that they know is a bit higher than they will actually experience. Then when they retire and encounter a tax rate less than that, they can happily blow the excess on fun and discretionary spending.