Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

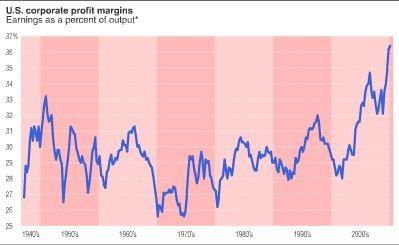

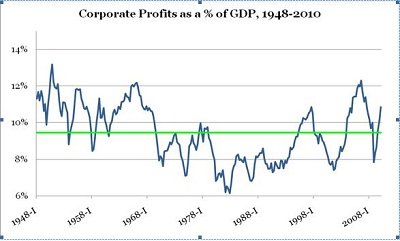

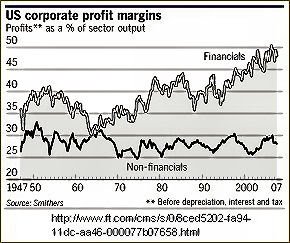

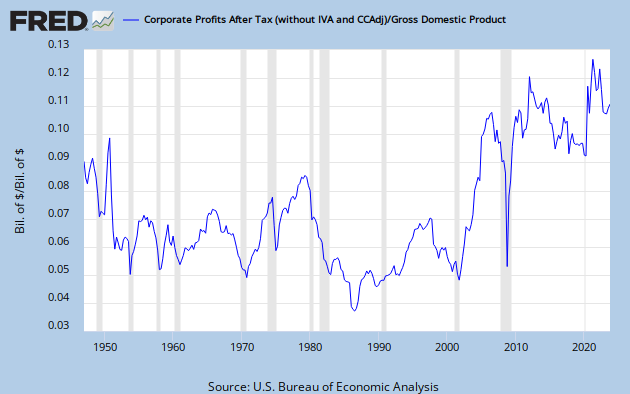

What we're seeing (and experiencing) is a several decade long shift in power away from labor and toward capital. And that is happening for many of the reasons mentioned above. But the assumption that this is absolutely necessary to maintain competitiveness is belied by record corporate profit margins that trend ever higher. Surely if competitiveness were an issue, companies would be using increases in worker productivity to cut prices. Instead it looks like it is all flowing to the bottom line.