I believe I manage for total return. We have been savers all our life and its very difficult to break the habit. With that said, we are in the withdrawal stage of our retirement, and spend only a portion of our dividends because that is all we need. Behaviorally its give us comfort to see the assets grow without a larger draw down and we also don't have additional taxes to pay. We only pay tax on the dividends withdrawn or reinvested. So I believe that we are total return investors, with an asset allocation appropriate for us (Total market stock and Total Bond funds), and are living off the dividends. Am I missing something, that you can't invest for total returns and live off of dividends?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Mystery of Spending Only Dividends Behavior

- Thread starter COcheesehead

- Start date

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

No. IMO, you are doing the optimum. I think the confusion here involves a couple of things:... So I believe that we are total return investors, with an asset allocation appropriate for us (Total market stock and Total Bond funds), and are living off the dividends. Am I missing something ... ?

1) People who believe that dividends are somehow free money falling from the sky and do not have a negative effect on the future price of the underlying stocks.

2) People who optimize their portfolios for dividends and do not realize that they are then almost certainly suboptimal for total return.

People, like @marko, who understand the issues, optimize for dividends, and are satisfied with being suboptimal for total return seem to be quite rare.2) People who optimize their portfolios for dividends and do not realize that they are then almost certainly suboptimal for total return.

Probably the most difficult situation is someone who wants to spend only dividends but for whom a portfolio optimized for total return does not generate enough income. The answer, according to the academics, is that it is OK to "invade principal." Here is a good video: https://famafrench.dimensional.com/videos/homemade-dividends.aspx

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I can only speak for myself, but I don't consider, or concern myself with the idea of dividends being "quaint". I only take umbrage at some of the claims being made for dividends, that simply don't hold up to scrutiny. If people want to fool themselves to feel better about their decision, that's their business, but I do think the facts should be presented here for the benefit of fact-seekers.You are not alone. It's just that not everyone wants to discuss dividends with people who consider them quaint. Why bother?7 pages ! And I still remain in the camp of "only spend the dividends".

Ha

You can’t compare a car to a stock, because the stock will generate future earnings. All you have to do is follow several dividend stocks and you will see after a dividend some will go up when the market opens and some will go down, but not necessarily exactly by the the dividend. Prices fluctuate all day from open to close. The seller and buyer have to agree to a price. When I choose to buy a dividend stock, I don’t check when the ex-dividend date is, just that it’s at a price where I believe it will make me money in the long term.

We've already acknowledged that there is noise in the system, so you will rarely see a drop exactly in line with the dividend payout. My analogy was to provide an example that removes the noise, to better illustrate the concept. But I bet if you measured the daily ex-div change of the div payers in S&P 500, against the daily change in the market on those days, once you got enough data, you'd match to a fraction of a percent.

Yet, no one responds to the simple statement - if a stock has just distributed $4 of it's value, how can it not be worth $4 less after that?

I like the other analogy that was given - if you take $4 out of your checking account, your balance is forever $4 lower than it would have been had you not. Yes, you will have other credit/debits, and if they happen the same day, they may swamp out the $4. But it still affected your balance - forever.

Here's yet another place I get confused: Taking your example above, but extending it out for 10 years, is the non-paying dividend company's stock price going to be 45-55% higher than the dividend paying stock company?

Why is this confusing? I can't see any other answer for it. If the stock didn't pay out the cash, they still have it, and it will be reflected in the stock price. Just like that checking account.

And for those who say the company may mismanage that money going forward, it's better in your pocket, OK, just sell some when you decide. No difference, other than you gain flexibility

Take a graph of dividends and stock price. They have very low correlation. Dividends have less volatility. ...

Since money is fungible, this really doesn't matter - we should be looking at the entire picture. But even at that, I don't believe that what you say is true, it's just something the div investors seem to like to believe. Here's some actual data for you, using VHDYX as a proxy for div payers, currently @ 3.06% yield - (Fund Summary - The investment seeks to track the performance of a benchmark index that measures the investment return of common stocks of companies that are characterized by high dividend yield. The fund employs an indexing investment approach designed to track the performance of the FTSE High Dividend Yield Index, which consists of common stocks of companies that pay dividends that generally are higher than average.)

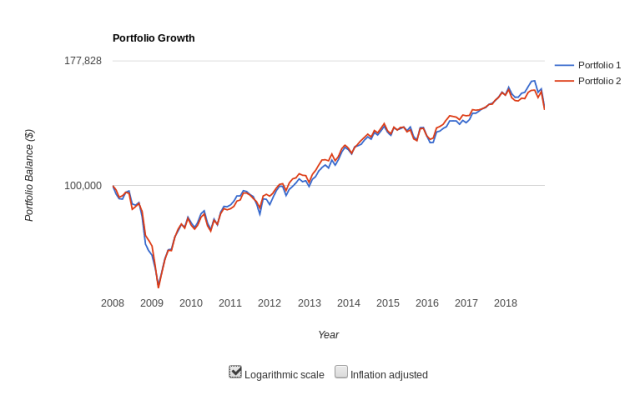

This shows:

https://finance.yahoo.com/quote/VHD...00&interval=div|split&filter=div&frequency=1d

dividends went from a high of $0.17 to $0.085, a 50% drop.

And this shows that the total value (the only thing that really matters), doesn't show any significant difference in volatility (select ALL on the slider), though it does show the broad market to outperform a bit:

https://stockcharts.com/freecharts/perf.php?spy,VHDYX

... If one can afford living on dividends it is way better than having to stay your whole retirement worrying about SWR, bear marketing, risk of sequence of loss and so on. The latest SWR i have been reading lately (millenial revolution, ern) lies on about 3% in order to have 90+% success rate. So, it is not even that more expensive to live on dividends, specially if you consider investing outside US.

How so? If I'm taking 3%~3.5%, I don't worry about anything either. I can't help but get most of that from divs anyway (SPY pays ~ 2%, plus some from bond allocation). A typical investor is going to have an allocation of 80/20 to 40/60. So during a bear, you maintain your AA by selling a small % of bonds, you don't sell stocks at a low.

Here's another chart - drawing 3% inflation adjusted from a dividend fund versus SPY, even at 100% stock allocation, SPY slightly outperforms the dividend fund, and in 2009, the div fund dipped lower than SPY. This idea that div payers are less volatile, or hold up better in a drop is not supported by facts.

http://bit.ly/2P14564

-ERD50

UnrealizedPotential

Thinks s/he gets paid by the post

- Joined

- May 21, 2014

- Messages

- 1,390

I won't try to answer if dividends or selling stocks is better for income. I don't know. What I think I do know is that the dividends I receive each month and some which are every quarter, are not free. There is a cost involved with it. The price of the security goes down as the dividend is paid. It is for this reason I have always when I could, reinvested the dividends to help offset the cost of the dividends itself and to help against inflation.

Last edited:

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Supporting your point, if I substitute VTSMX as the reference the difference is even greater. I would also argue that using VTSMX is probably a better optimization for total return than just an D&P 500 fund.... Here's another chart - drawing 3% inflation adjusted from a dividend fund versus SPY, even at 100% stock allocation, SPY slightly outperforms the dividend fund, and in 2009, the div fund dipped lower than SPY. This idea that div payers are less volatile, or hold up better in a drop is not supported by facts.

http://bit.ly/2P14564

-ERD50

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

... As one who lives on dividends, I just want my portfolio to 1) deliver enough dividends to live on and 2) make enough return for the balance* to stay ahead of inflation; something I've managed to do for almost two decades now. ...

Ok, when you put it that way, you've already made your decision, there is no other answer if you want a higher dividend that an AA of stocks/bonds can provide!

+1

Maybe this is the key.

Different people expect different things from their portfolio. Some people must have the greatest total return. Others who may not need the money just want to be risk free in CDs. ....

If my total return is 1%-2% below what I could potentially get if fully optimized, that is fine as long as the first two conditions are met. YMMV

*Success for me is enough dividends to pay the bills and a portfolio balance at the end of the year that is greater than the start of the year.

Interesting - "a portfolio balance at the end of the year that is greater than the start of the year" infers that you are looking at total return. And you won't meet your goals many years - clearly the market of div payers drops in some years, and your balance will be lower.

The funny thing to me is, when I look at the data, it seems these goals are best met by avoiding the div payers. The broad market does better than the high div payer sector, even when making these withdrawals - look at the charts in my previous post.

Want to reduce volatility? Increase your allocation to bonds.

Don't get me wrong, if you are happy with your system, fine. I'm just trying to point out that your reasons for being happy with it don't seem to hold up.

-ERD50

Last edited:

poppydog

Recycles dryer sheets

UK poster here. Half of our retirement income comes from dividends from our retirement investments, in our case a diversified portfolio of Investment Trusts, which I believe you guys call closed-end funds. We have funds which invest in UK, International and Private Equities, commercial property, Infrastructure and Fixed Income.

We readily achieve a yield of about 5.5% from this portfolio, and I have no intention of spending any of the capital, but to leave it as a permanent income stream for my kids/grandkids.

UK markets are much more set up for dividends than the US is, I believe.

We readily achieve a yield of about 5.5% from this portfolio, and I have no intention of spending any of the capital, but to leave it as a permanent income stream for my kids/grandkids.

UK markets are much more set up for dividends than the US is, I believe.

marko

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 16, 2011

- Messages

- 8,427

Ok, when you put it that way, you've already made your decision, there is no other answer if you want a higher dividend that an AA of stocks/bonds can provide!

Interesting - "a portfolio balance at the end of the year that is greater than the start of the year" infers that you are looking at total return. And you won't meet your goals many years - clearly the market of div payers drops in some years, and your balance will be lower.

-ERD50

True, but despite withdrawing dividends, the only two years where my balance was lower were 2008 and 2018

retiredgeek

Dryer sheet wannabe

Supporting your point, if I substitute VTSMX as the reference the difference is even greater. I would also argue that using VTSMX is probably a better optimization for total return than just an D&P 500 fund.

I fully agree optimizing for dividends is different from optimizing for total return. But using etfs is optimized just for peace of mind and management easyness.

Another issue to discuss: Most, if not all studies I have read, comparing diferent asset management methodologies, or withdraw metodologies uses etfs and total return. None model cashflow preciselly (well, they are limited by their spreadsheet capabilities). People willing to compare living on dividends vs dipping into principal use a high dy etf vs a total stock etf. Then compare total returns. This is not a good approach.

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

True, but despite withdrawing dividends, the only two years where my balance was lower were 2008 and 2018

Which you also would have had being invested in the total market, rather then a high-div focus.

http://bit.ly/2P3tY5d

No advantage that I can see. I don't understand the attraction.

-ERD50

Attachments

poppydog

Recycles dryer sheets

Which you also would have had being invested in the total market, rather then a high-div focus.

http://bit.ly/2P3tY5d

No advantage that I can see. I don't understand the attraction.

-ERD50

Would this hold true if 4% was being withdrawn each year I wonder?

I'd suggest that the near-optimum strategy is to optimize the portfolio for total return, then take and spend only the dividends if that's your preference. The optimum total return portfolio is probably a total world market portfolio with whatever home country bias you prefer.

That should leave you with less current dividend income but richer overall.

I get that except “richer overall” is a less important goal to me than “sleep well.” Nearly half my money is in hard money lending fixed income yielding ~8% on average. It’s horribly tax inefficient and the odds of earning more that my interest rate are low. But having those steady, reliable monthly payments do the trick for a good night’s sleep. I have a similar feeling toward dividends where I prefer the stability over the upside. That said, Vanguard put my ten year personal rate of return at over 16% annually for past decade so I don’t believe I’ve left all that much on the table. (And for most of those ten years I was mostly in index funds. It’s much more recently that I switched to a current income strategy.)

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I'm not clear on your points. An ETF is just a mutual fund. It can be based on a broad index, it can be based on a sector or specialized index, it can be optimized for dividend yield, or it can be a stock-picker. The historical data says that picking a broad-index mutual fund is likely to be optimum for total return. We hold both conventional mutual fund VTWSX and its etf brother, VT. IMO these are likely to be near optimum for total return. We also hold VTSMX but not its ETF brother.I fully agree optimizing for dividends is different from optimizing for total return. But using etfs is optimized just for peace of mind and management easyness.

Another issue to discuss: Most, if not all studies I have read, comparing diferent asset management methodologies, or withdraw metodologies uses etfs and total return. None model cashflow preciselly (well, they are limited by their spreadsheet capabilities). People willing to compare living on dividends vs dipping into principal use a high dy etf vs a total stock etf. Then compare total returns. This is not a good approach.

Re comparing, a properly done total return calculation does account for dividends and timing. The general problem is that total return information is a little harder to calculate and can be hard to find; most charts only look at fund prices and index values and omit consideration of dividends thrown off. Comparing these incomplete pictures can be very misleading.

Last edited:

UK markets are much more set up for dividends than the US is, I believe.

As are Canadian markets. We also receive a pretty nice tax credit for dividends received from Canadian corporations which has encouraged dividend based investing and dividend growth based investing here to a large degree.

Our main market (TSX) is heavily weighted to oligopolies in a few industries and they are pretty heavy dividend payers.

I myself have far to much fixed income to ever survive solely on dividends. However, by the time I fully hang up my hat in 3 years time I will be very close to living off of dividends & interest (on a pre-tax basis).

I do not intend to preserve my capital though.

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Would this hold true if 4% was being withdrawn each year I wonder?

I gave you the link. Try it and see. And report back.

'teach a person to fish, and...."

-ERD50

poppydog

Recycles dryer sheets

I gave you the link. Try it and see. And report back.

'teach a person to fish, and...."

-ERD50

A quick look shows PF1 going down in 2011 and 2015, as well as the aforementioned 2008, 2018. Not by a lot though....

Which you also would have had being invested in the total market, rather then a high-div focus.

http://bit.ly/2P3tY5d

No advantage that I can see. I don't understand the attraction.

-ERD50

Guess it all depends on the time frame you use. I would use Total Market instead of S&P500. Why not use portfolio visualizer with all the data it provides for these funds, Dec 2006 to Mar 2009?

Last edited:

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Guess it all depends on the time frame you use. Why not use portfolio visualizer with all the data it provides for these funds, Dec 2006 to Mar 2009?

Because I was answering marko, who mentioned 2008 being a down year. So I wanted to give the highest resolution to 2008. Starting earlier makes it harder to see what happened in 2008.

Go back to DEC2006, no real difference. Hi-div fund still under-performed.

I'm sure you can find time-frames where the two exchange the lead, that is to be expected with just about any sector versus the total market.

-ERD50

marko

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 16, 2011

- Messages

- 8,427

Which you also would have had being invested in the total market, rather then a high-div focus.

No advantage that I can see. I don't understand the attraction.

-ERD50

So if it's six of one/half dozen of another, the argument either way is sort of moot.

As noted earlier, the personal attraction is not gain/return but more of convenience and some psychological aspect.

I like just having the dividends deposited each month/quarter automatically.

I like the idea of not having to sell shares, which sometimes out of need could be at the worst possible moment.

I like the idea of having the same number of shares I started out with and having them grow in value, despite having 'sold' extra shares via dividend distributions.

I do appreciate your inputs here and over time however; we may now be beating a dead horse I fear.

RunningBum

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 18, 2007

- Messages

- 13,236

This is true. Although using ETF is far from optimized for total return. Its optimized for easy management, but not total return, not dividends.

“vs the rest” isnt “vs the optimized for total return”. But as a data scientist myself, I totally agree you can beat and present numbers to “prove” any statement you want.

Since you seem to know what isn't a portfolio optimized for total return, how about you enlighten us as to what is. Preferably with something to back it up with.I fully agree optimizing for dividends is different from optimizing for total return. But using etfs is optimized just for peace of mind and management easyness.

Another issue to discuss: Most, if not all studies I have read, comparing diferent asset management methodologies, or withdraw metodologies uses etfs and total return. None model cashflow preciselly (well, they are limited by their spreadsheet capabilities). People willing to compare living on dividends vs dipping into principal use a high dy etf vs a total stock etf. Then compare total returns. This is not a good approach.

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

So if it's six of one/half dozen of another, the argument either way is sort of moot. ...

Yes, it is pretty much (with small caveat to follow) a moot point, and that is my point.

Some people keep trying to convince others that dividend paying stocks have advantages and characteristics that just don't stand up to scrutiny.

...

As noted earlier, the personal attraction is not gain/return but more of convenience and some psychological aspect.

I like just having the dividends deposited each month/quarter automatically.

I like the idea of not having to sell shares, which sometimes out of need could be at the worst possible moment.

I like the idea of having the same number of shares I started out with and having them grow in value, despite having 'sold' extra shares via dividend distributions.

I do appreciate your inputs here and over time however; we may now be beating a dead horse I fear.

Well, if you like it, you like it! I hardly see any convenience factor. A balanced AA will provide most of a conservative WR with its somewhat lower dividends. I just have the divs deposited to that account, and I have an auto withdraw set up for $X,xxxx each month (an exact number, the same month after month unless I change it, known ahead of time, that I can plan on). If the balance is running low, I sell some of either/both Equity or Bond fund and rebalance at the same time. That's about once a year, I should be looking at least that often anyhow, so no real work.

And again (yes, this is beating a dead horse, but he keeps whimpering!) you will NOT be selling stocks at the worst possible moment! As I said, if stocks are down, you'll be selling from fixed. On average stocks are up, so on average it all works out anyhow.

...

I like the idea of having the same number of shares I started out with and having them grow in value, despite having 'sold' extra shares via dividend distributions.

I do appreciate your inputs here and over time however; we may now be beating a dead horse I fear.

Well, mine have grown in value, though I may have fewer shares. That's been shown in the graphs I linked. I'm having a little trouble assigning any importance to that. It's like saying ten $1 bills have more value than one $10 bill or vice versa? I don't pay my bills with 'shares', I pay with $.

Almost forgot the small caveat that others have mentioned - focusing on any subset of the market means you are less diversified. I'd bet that the higher-than-average div payers are concentrated in a few sectors. That may not be a big thing, but some day it might. I just can't see taking even that small risk, against the perceived advantages that just seem to be based on "I like", rather than anything tangible.

-ERD50

retiredgeek

Dryer sheet wannabe

I'm not clear on your points. An ETF is just a mutual fund. It can be based on a broad index, it can be based on a sector or specialized index, it can be optimized for dividend yield, or it can be a stock-picker. The historical data says that picking a broad-index mutual fund is likely to be optimum for total return. We hold both conventional mutual fund VTWSX and its etf brother, VT. IMO these are likely to be near optimum for total return. We also hold VTSMX but not its ETF brother.

Re comparing, a properly done total return calculation does account for dividends and timing. The general problem is that total return information is a little harder to calculate and can be hard to find; most charts only look at fund prices and index values and omit consideration of dividends thrown off. Comparing these incomplete pictures can be very misleading.

My english makes expressing myself harder. I was agreeing with you on total return vs dividend optimization being very different, and that some people are not aware of this.

I do my portfolio the following way:

- I get as much as dividend oriented stocks, reits, and treasure bonds to fund my estimated expenses.

- All the remaining, I put in growth oriented assets (including stocks and non-dividend-paying bonds);

I have been doing this for 7 years.

For the ETF vs Stock Picking discussion, I know this is a heated subject. My country has about 300 stocks and 150 reits. So, it is not that hard to be a stock picker and have returns way above the local market. Actually, we barely have ETFs. Maybe less than 5.

Now I am a US resident, I might have to change my mindset.

youbet

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Perhaps, but the data is pretty clear to me.

But, but, but "the data" says nuttin' about what the next 20 years will be in terms of value vs. growth stocks! That's what we really need to know.......

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

.... But I remember reading somewhere that dividend paying stocks tend to outperform non payers. Then I found this: https://www.thebalance.com/why-dividend-stocks-outperform-non-dividend-stocks-357353

So...I may be out in the weeds here or, more likely miss your point, but thought I'd pass it on, FWIW.

^^^^ The differences are pretty small in the long run.

Since Jan 1993.... Vanguard Value Index Inv (higher dividend payers)...9.35%... Vanguard Growth Index Inv (lower/no dividend payers)... 9.59%... Vanguard Total Stock... 9.46%.

Higher dividend payers tend to give one a more stable ride. For shorter periods one can be quite a bit better than the other... growth has shined for the last 10 years, but value has shined for the last 20 years.

https://www.portfoliovisualizer.com...cation2_2=100&symbol3=VTSMX&allocation3_3=100

Could this subject be headed into the "it depends" category along with SS, paying off the mortgage and others?

Perhaps, but the data is pretty clear to me.

But, but, but "the data" says nuttin' about what the next 20 years will be in terms of value vs. growth stocks! That's what we really need to know.......

No crystal ball... but my view that is it most likely to be the same as the past.... similar over long periods of time... rather than different. I certainly see no reasonable basis for claiming that dividend payers will outperform since they have failed to outperform in the past.

Similar threads

- Replies

- 7

- Views

- 727