Sandy & Shirley

Recycles dryer sheets

The new link on my google drive is https://drive.google.com/open?id=1d-DuA2x0D_GqdWzmp82L7qUhPT4wSpEM

If you like what I did, just follow the link (the chart will not look correct when opened in browser!), click the underscored down arrow download button, open in Excel, enable editing, and then save it to your disk.

The spreadsheet now has only 3 tabs, Marginal where you enter you data and see the results, and graph & graph2 where the now and what if charts are created for combined display on the first tab.

I use this spreadsheet during the year to avoid the now 49.95% and 40.7% marginal tax humps and I recently did a quick calculation for a surviving widow who was asking if she should pay off her mortgage before starting her Social Security.

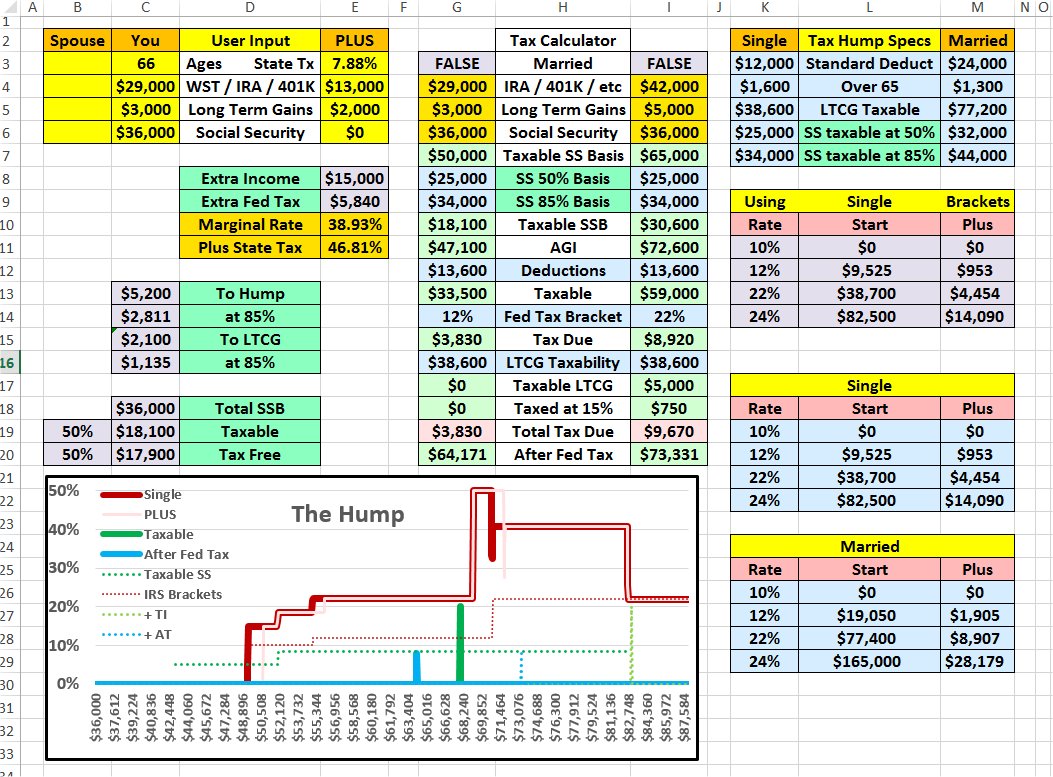

Here is the marginal page I created for her!

The only data she needed to enter (not real data here) were the yellow frames in the top left. We filled in the You column with her expected incomes, left the Spouse empty so it would use the single data from the 3rd set of tables, and then used the PLUS column to add in the amount that her house payments would drop when only making tax and insurance payments each year.

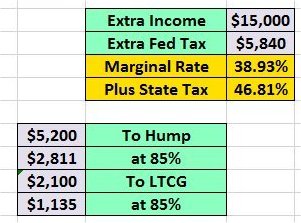

The middle “Tax Calculator” estimated her taxes due without and with the mortgage based on today’s tax brackets and the middle tables in the first set told her the results! Because her mortgage would push her into the large marginal tax humps, that extra $15,000 each year would raise her federal tax due by $5,840, a 38.93% marginal tax rate! She could afford $2,100 (To LTCG) of additional gross income before starting her 49.95% LTCG marginal rate, but since she is in the 85% SSB taxability range, the amount she could withdraw from her IRA would be limited to only $1,135.

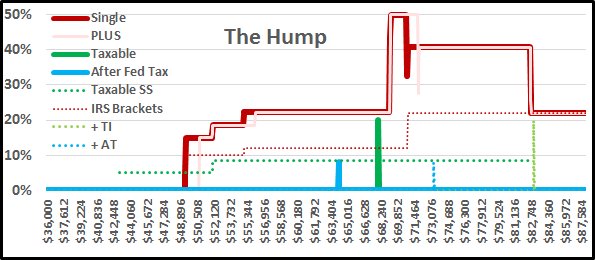

These numbers represent the combined Spouse and You input data. The other two excel tabs then build the graph that is visible at the bottom of the page. Its primary display is bold and represents only the spouse and you inputs. The lighter dotted lines illustrate how your taxes are effected using the PLUS column.

Plan A in this case, while taking her late husband’s very early relatively low survivor benefits, use the extremely smaller tax hump to withdraw extra cash from her 401K / IRA to pay off the mortgage before starting her own much higher benefits at a later age.

My personal case is different this year. We had some unexpected vet bills. The credit card will be due on Jan 1, we always auto pay 3 days early but can pay without late fees 10 days late. The extra withdraw would push us into our 2018 Marginal Tax Hump, so we will delay the card payment until Jan 8 and do our MRD on Jan 2 from our IRA in 2019 to get the extra cash to pay the bill by the before late charges!

I hope that others find this Marginal Tax Rate illustration spreadsheet as helpful as we do each year.

Any suggestions for improvements would be welcome. Feel free to share it with your friends, just let me know if you use it commercially.