retire2020

Recycles dryer sheets

- Joined

- Sep 22, 2012

- Messages

- 459

Posted on BH and posting here for more clarity..

My daughter is graduating from medical school this May and will soon start her residency in June. So far, for last nine years she was dependent on my tax return but will be filing her taxes as independent for the first time next year for the year 2024. I(Dad) am the account owner of 529 plan and she is the beneficiary so for the last nine years I had 529 withdrawal distributed to me. Then I received 1099-Q on my name which I filed along with her 1098-T on my tax return to show that withdrawal was used to pay her tuition and living expenses. I already paid her last semester tuition about a month ago(30K) and planning to withdraw same amount from 529 sometimes this year. What are my options?

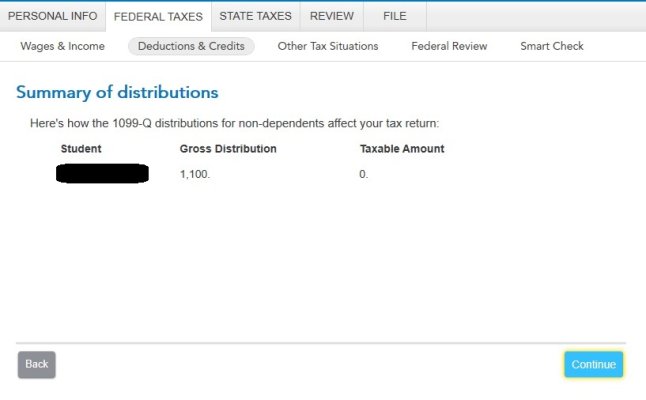

- I tried mimicking the scenario in TT if I withdraw and have a check send out to me. If I do not have my daughter listed as dependent then TT will not allow me to enter 1098-T/1099-Q. How do I notify IRS that 1099-Q was indeed used to pay for her college education? I think not reporting 1099-Q will create a red flag to IRS, wouldn't it?

- Withdraw from 529 and have a check send out to my daughter. She'll then receive 1099-Q on her name and shall be able to file on her tax return along with her 1098-T. Also when she receives the check and she then writes check to me, would it trigger any gift tax issues? I have already paid her tuition from my account so can she just write a single check to me or split into two(me and my wife) to avoid gift tax issue if IRS looks at it this way?

- Which option from above you would choose or better in my case? I do not want to trigger any un-necessary audit problem from IRS

My daughter is graduating from medical school this May and will soon start her residency in June. So far, for last nine years she was dependent on my tax return but will be filing her taxes as independent for the first time next year for the year 2024. I(Dad) am the account owner of 529 plan and she is the beneficiary so for the last nine years I had 529 withdrawal distributed to me. Then I received 1099-Q on my name which I filed along with her 1098-T on my tax return to show that withdrawal was used to pay her tuition and living expenses. I already paid her last semester tuition about a month ago(30K) and planning to withdraw same amount from 529 sometimes this year. What are my options?

- I tried mimicking the scenario in TT if I withdraw and have a check send out to me. If I do not have my daughter listed as dependent then TT will not allow me to enter 1098-T/1099-Q. How do I notify IRS that 1099-Q was indeed used to pay for her college education? I think not reporting 1099-Q will create a red flag to IRS, wouldn't it?

- Withdraw from 529 and have a check send out to my daughter. She'll then receive 1099-Q on her name and shall be able to file on her tax return along with her 1098-T. Also when she receives the check and she then writes check to me, would it trigger any gift tax issues? I have already paid her tuition from my account so can she just write a single check to me or split into two(me and my wife) to avoid gift tax issue if IRS looks at it this way?

- Which option from above you would choose or better in my case? I do not want to trigger any un-necessary audit problem from IRS