W2R

Moderator Emeritus

I do not track my net worth, since I have no purpose for doing so. But hey, I'd track it if I could figure out a reason to do that!

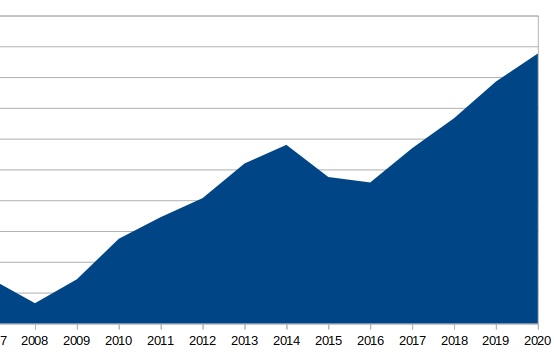

I like to keep track of my investment portfolio total. However, I keep cash both in Vanguard Money Market funds, and in my local bank. Since I might move cash from one to the other, I track my portfolio plus bank account total.

I like to keep track of my investment portfolio total. However, I keep cash both in Vanguard Money Market funds, and in my local bank. Since I might move cash from one to the other, I track my portfolio plus bank account total.