copyright1997reloaded

Thinks s/he gets paid by the post

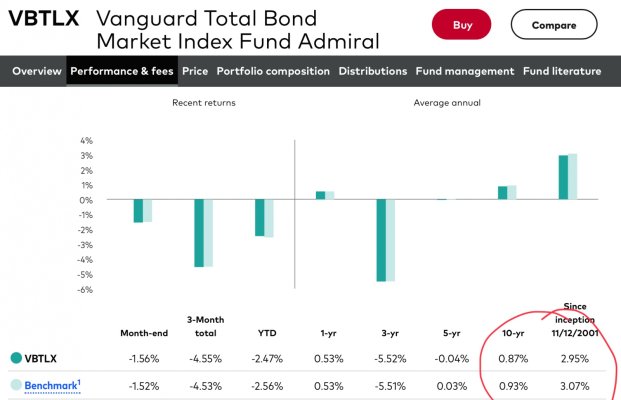

The market appears to be seeing a top in rates. Hopefully people have been extending duration for quite some time now.

If this is or was the top bonds may continue this rally which at least will help those bonds already in your portfolio.

Respectfully, there have been calls that we are at the peak repeatedly.

Ironically, part of the reason for the two day bond market rally is that there is less long term treasury issuance than expected (which means more on the short end). Perhaps I'm dense, but further shortening borrowing term when we are running out-of-control deficits doesn't seem like a good long term strategy.

OTOH, I bought some 18-month 5.5% CD's today (thus extending my weighted time to maturity), so I speak out of both sides of my mouth on this one.