copyright1997reloaded

Thinks s/he gets paid by the post

So, I saw today in the news that 10 year treasuries have hit 5%. It really intrigues me to be able to lock in 5% for 10 years. I have a couple questions ...

(1) When I log in to Vanguard it shows me 10 year treasuries as 4.933% - I think however that is a secondary market bond? When I select "Auction" it does not show any 10 year bonds? Do I need to buy from Treasury Direct. I have ibonds in Treasury Direct and hate the interface so I much prefer buying in Vanguard.

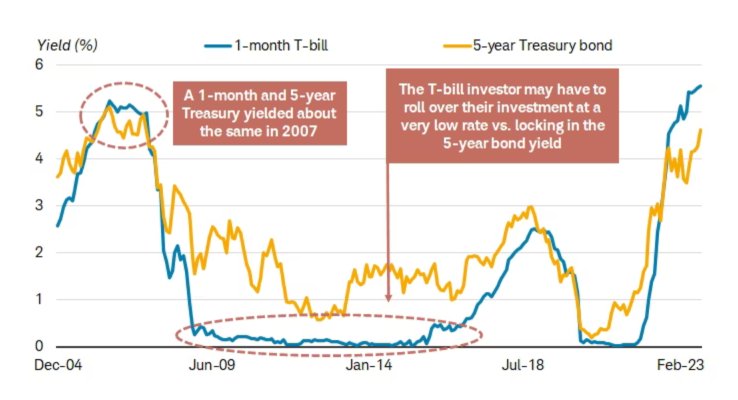

(2) I have been buying 5% CDs going out as much as 5 years - thinking I would not go above 5 years in case interest rates went sky high. But now I am thinking it would make sense to at least invest some at 10 years since interest rates could just as easily go back down. If you asked me a couple years ago if I would lock in 5% for 10 years I would have jumped at the opportunity. A guaranteed 5% is a dream but I guess the hesitation would be FOMO. Am I crazy to lock in 5% for 10 years?

Yes, this is the latest 10-year issue trading in the secondary market. It hit 5%, but then backed off. Here is a 5-day chart as of this evening courtesy of CNBC (see screenshot and a link to CNBC's quote: https://www.cnbc.com/quotes/US10Y