Threads merged

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Treasury Bills, Notes, and Bonds Discussion

- Thread starter jazz4cash

- Start date

- Status

- Not open for further replies.

njhowie

Thinks s/he gets paid by the post

- Joined

- Mar 11, 2012

- Messages

- 3,931

But I wonder - what if I put the money into the 13 week........and then in a few months see if rate on the 3 year has gone up.

But, what if you put your money in to 13 weeks and then in a few months you find the 3 year rate has gone down, and the 3 year rate doesn't see 4.5% again for a year or two, or 5 or 10?

A couple weeks ago folks posted the same about CDs and waiting to load the truck at 6%. From where we've been over the past 10 years, would 5% be incredibly terrible? Now the rates are clearly falling.

You need to decide what your plan is and just do it. Playing "what if" scenarios is not going to get you anywhere - analysis paralysis.

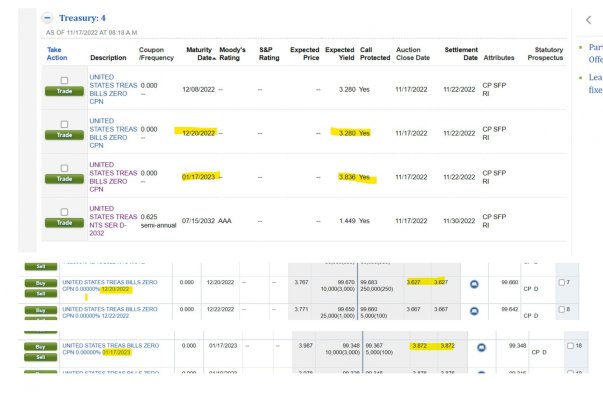

I know a lot of people prefer buying treasuries at auction rather than in the secondary market but I'm wondering if people check the secondary before placing their orders. I took a look today and there seems to be a very big discrepancy on the one month tbill and over the past week it always looks to me like you get a few bps (or more) better by purchasing in the secondary market.

I looked a little bit ago and for the one month tbill the expected yield is 3.28% vs the same maturity yielding 3.627% in the secondary (it goes down to 3.604 if you want a 1 lot minimum). The 2 month is closer at 3.872 (3.866 for 1 lot) in the secondary vs. 3.836 expected at the auction.

Do the yields come closer during the auction (the new issue yielding the current market) or will these discrepancies often continue? I guess the main issue here is the expected yield on the 1 month considering where the fed funds rate is. Any thoughts? Thanks.

I looked a little bit ago and for the one month tbill the expected yield is 3.28% vs the same maturity yielding 3.627% in the secondary (it goes down to 3.604 if you want a 1 lot minimum). The 2 month is closer at 3.872 (3.866 for 1 lot) in the secondary vs. 3.836 expected at the auction.

Do the yields come closer during the auction (the new issue yielding the current market) or will these discrepancies often continue? I guess the main issue here is the expected yield on the 1 month considering where the fed funds rate is. Any thoughts? Thanks.

Attachments

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

You can’t use the expected yield to compare. It’s often way off and much lower than what you actually get at the auction rendering it useless. I gave an example earlier in this thread.

I’m seeing 3.70% for the 1 month T-bill on my CNBC quote list (previous issue on secondary) and so I expect it to come in closer to that than the 3.28% expected yield listed in your image.

Also the US Treasury Daily Treasury Bill Rates page shows 3.70% for the 4-week and 4.01% for the 8-week near bond market close yesterday. https://home.treasury.gov/resource-..._bill_rates&field_tdr_date_value_month=202211

We’ll see the 11/17/22 auction results later this morning. Then you can compare.

I’m seeing 3.70% for the 1 month T-bill on my CNBC quote list (previous issue on secondary) and so I expect it to come in closer to that than the 3.28% expected yield listed in your image.

Also the US Treasury Daily Treasury Bill Rates page shows 3.70% for the 4-week and 4.01% for the 8-week near bond market close yesterday. https://home.treasury.gov/resource-..._bill_rates&field_tdr_date_value_month=202211

We’ll see the 11/17/22 auction results later this morning. Then you can compare.

Last edited:

JoeWras

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 18, 2012

- Messages

- 11,702

I know a lot of people prefer buying treasuries at auction rather than in the secondary market but I'm wondering if people check the secondary before placing their orders. I took a look today and there seems to be a very big discrepancy on the one month tbill and over the past week it always looks to me like you get a few bps (or more) better by purchasing in the secondary market.

I looked a little bit ago and for the one month tbill the expected yield is 3.28% vs the same maturity yielding 3.627% in the secondary (it goes down to 3.604 if you want a 1 lot minimum). The 2 month is closer at 3.872 (3.866 for 1 lot) in the secondary vs. 3.836 expected at the auction.

Do the yields come closer during the auction (the new issue yielding the current market) or will these discrepancies often continue? I guess the main issue here is the expected yield on the 1 month considering where the fed funds rate is. Any thoughts? Thanks.

Treasury auction "expected yield" on Fidelity is fantasy. We've discussed this upthread. Fidelity's algorithm for coming up with expected yield is extremely conservative and proprietary. It seems to me they make it so conservative to avoid disappointment and a flood of calls.

You'll see shifts as the auction gets closer, but it is still going to be way off.

I've said it before and I'll probably keep saying it. The secondary market drives the auction price and the auction price drives the secondary price. They don't work in vacuum. The auction typically reflects the secondary very closely. Every now and then, however, the auction has a slight surprise of a few BPs. It is an auction after all. When that happens, the secondary adjusts to the auction.

Last edited:

When comparing, remember that a secondary purchase settles the next business day (11/18). The auction settles 11/22, so the secondary is for a longer term even if the yields end up being similar.We’ll see the 11/17/22 auction results later this morning. Then you can compare.

Last edited:

That all makes complete sense and thanks for the explanation. So I guess the best way to figure is the secondary market for a particular maturity is the best indication for the expected yield for an upcoming auction.

Do you know if the Fidelity expected yield is more accurate for new issues of agencies and munis or is it just as unreliable? Those are a lot harder to use the secondary since it is so much less liquid than treasuries.

Do you know if the Fidelity expected yield is more accurate for new issues of agencies and munis or is it just as unreliable? Those are a lot harder to use the secondary since it is so much less liquid than treasuries.

Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I noticed that my order for $40,000 of the 10 year TIPS is till open at Fidelity. I guess it stays open right up until the auction today? It looks like you could still participate in the auction...at least there is a buy button still.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I guess so, non-competitive bids have to be in at 11am eastern. I sure wouldn’t try to cut it that close!

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

This week’s T-bill auction results:

| Bills | CMB | CUSIP | Issue Date | High Rate | Investment Rate | Price per $100 |

| 4-Week | No | 912796YZ6 | 11/22/2022 | 3.795% | 3.859% | $99.704833 |

| 8-Week | No | 912796ZK8 | 11/22/2022 | 4.020% | 4.101% | $99.374667 |

| 13-Week | No | 912796YA1 | 11/17/2022 | 4.155% | 4.257% | $98.949708 |

| 17-Week | No | 912796Z77 | 11/22/2022 | 4.320% | 4.443% | $98.572000 |

| 26-Week | No | 912796W47 | 11/17/2022 | 4.440% | 4.605% | $97.755333 |

Last edited:

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

As you can see from the above posted auction results, the 4-week today was 3.859% and the 8-week was 4.101%. Considerably higher than the Fidelity listed “expected yield”.I know a lot of people prefer buying treasuries at auction rather than in the secondary market but I'm wondering if people check the secondary before placing their orders. I took a look today and there seems to be a very big discrepancy on the one month tbill and over the past week it always looks to me like you get a few bps (or more) better by purchasing in the secondary market.

I looked a little bit ago and for the one month tbill the expected yield is 3.28% vs the same maturity yielding 3.627% in the secondary (it goes down to 3.604 if you want a 1 lot minimum). The 2 month is closer at 3.872 (3.866 for 1 lot) in the secondary vs. 3.836 expected at the auction.

Do the yields come closer during the auction (the new issue yielding the current market) or will these discrepancies often continue? I guess the main issue here is the expected yield on the 1 month considering where the fed funds rate is. Any thoughts? Thanks.

As you can see from the above posted auction results, the 4-week today was 3.859% and the 8-week was 4.101%. Considerably higher than the Fidelity listed “expected yield”.

Thanks for the follow-up. The rates did go up in the secondary market (all short term rates are up today) but they don't seem to be as high as the auction rate. There's so much movement in rates these days that it is tough to compare apples to apples. I think the earlier point of ignoring the expected yield clearly is holding true.

Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

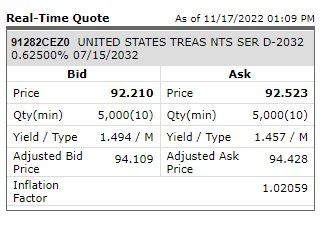

Ok, so newb question again. I see that the 10 year TIPS auction has results now (I think). I do not understand the quote now on fidelity though when I enter the cusid. It looks like the auction results were something like 94.2946 for $100 but the bid/ask on Fidelity now is 92.21/92.523

It also has an adjusted bid/ask.

This is all somewhat confusing.

It also has an adjusted bid/ask.

This is all somewhat confusing.

Attachments

One problem with buying in the secondary market just after auction is you give up the bid/ask spread (you are buying at the ask) so unless rates are rising you will do slightly worse than buying at auction because you don't give up that spread if you buy at auction. If you wait a couple of days you might do better if short-term rates have risen, but then you may do worse if rates fall (like last week).Thanks for the follow-up. The rates did go up in the secondary market (all short term rates are up today) but they don't seem to be as high as the auction rate. There's so much movement in rates these days that it is tough to compare apples to apples. I think the earlier point of ignoring the expected yield clearly is holding true.

Sunset

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Ok, so newb question again. I see that the 10 year TIPS auction has results now (I think). I do not understand the quote now on fidelity though when I enter the cusid. It looks like the auction results were something like 94.2946 for $100 but the bid/ask on Fidelity now is 92.21/92.523

It also has an adjusted bid/ask.

This is all somewhat confusing.

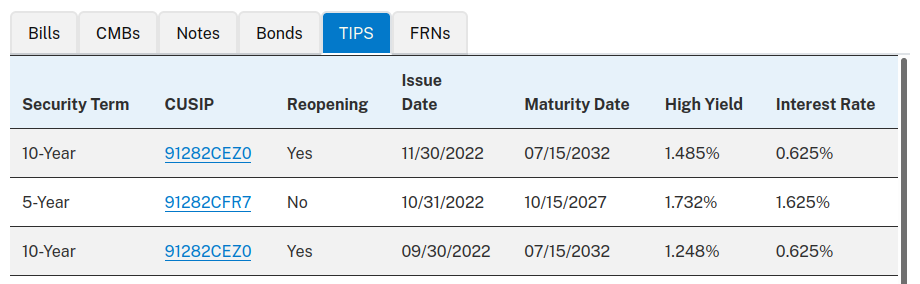

I look at the Treasury Direct site for the auction results, still a bit confusing as to what rate the 10 yr TIP is paying:

Attachments

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I look at the Treasury Direct site for the auction results, still a bit confusing as to what rate the 10 yr TIP is paying:

This is what shows on wsj.com:

MATURITY COUPON BID ASKED CHG YIELD* ACCRUED PRINCIPAL

2032 Jul 15 0.625 93.03 93.08 +16 1.374 1020

Looks like the coupon rate is 0.625% real but since it is trading at a discount that the effective yield is 1.374% real.

https://www.wsj.com/market-data/bonds/tips

copyright1997reloaded

Thinks s/he gets paid by the post

Yield curve:

The one month T-Bill is now yielding more than the 10-year treasury. (3.93% vs. 3.82%)

Also 10y-3month FRED chart: https://fred.stlouisfed.org/series/T10Y3M

The one month T-Bill is now yielding more than the 10-year treasury. (3.93% vs. 3.82%)

Also 10y-3month FRED chart: https://fred.stlouisfed.org/series/T10Y3M

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Yield curve:

The one month T-Bill is now yielding more than the 10-year treasury. (3.93% vs. 3.82%)

Also 10y-3month FRED chart: https://fred.stlouisfed.org/series/T10Y3M

Thanks. This is all very interesting to watch unfold.

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

People assume that each rate hike raises long rates, but that is not the case.Yield curve:

The one month T-Bill is now yielding more than the 10-year treasury. (3.93% vs. 3.82%)

Also 10y-3month FRED chart: https://fred.stlouisfed.org/series/T10Y3M

Hopefully folks have done a good deal of investing in longer maturities at this point.

JoeWras

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 18, 2012

- Messages

- 11,702

People assume that each rate hike raises long rates, but that is not the case.

Hopefully folks have done a good deal of investing in longer maturities at this point.

Judging by some of the posts I'm reading, there are still plenty of folks with money in the bank at sub 1% waiting for the next Fed decision. This is after they waited for the last decision. Analysis paralysis.

Diversify your maturities!

jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Judging by some of the posts I'm reading, there are still plenty of folks with money in the bank at sub 1% waiting for the next Fed decision. This is after they waited for the last decision. Analysis paralysis.

Diversify your maturities!

Yes. Many posters are avoiding longer term issues. Ladder. Ladder. Ladder.

JoeWras

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 18, 2012

- Messages

- 11,702

2 and 5 year notes auction today. It is 8:16 AM EST. If you like to play in the auction, you still have a little time to drop a bit on something longer duration. Of course, secondary trading is always available.

I've been dropping a bit in some of these longer term notes for diversity.

I've been dropping a bit in some of these longer term notes for diversity.

BooBoo

Recycles dryer sheets

- Joined

- Oct 31, 2010

- Messages

- 91

Not sure if this question belongs here. My 98 yo DM has cashed some US savings bonds that have matured. Looking for suggestions for safe and easy Vanguard ETF (like BND) or mutual fund to invest. Just want to get a better rate than local bank.

Thank you.

Thank you.

JoeWras

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 18, 2012

- Messages

- 11,702

Not sure if this question belongs here. My 98 yo DM has cashed some US savings bonds that have matured. Looking for suggestions for safe and easy Vanguard ETF (like BND) or mutual fund to invest. Just want to get a better rate than local bank.

Thank you.

BooBoo, BND has risk. User "Freedom56" has written sermons on the risk, especially in this rising rate environment.

If it were my DM, I'd simply transfer it to Vanguard and take a pause. By transferring to Vanguard's settlement fund (VMFXX), you would immediately be making 3.6% (as of today) in a very low risk investment.

You can then explore other safe options from there. One of the safer options are T-Bills and Notes, which we discuss on this thread.

- Status

- Not open for further replies.

Similar threads

- Replies

- 182

- Views

- 21K

- Replies

- 454

- Views

- 51K

- Replies

- 53

- Views

- 6K