JoeWras

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 18, 2012

- Messages

- 11,717

Interesting results.

13 wk is up 5bp from last week.

26 wk is down 6bp from last week.

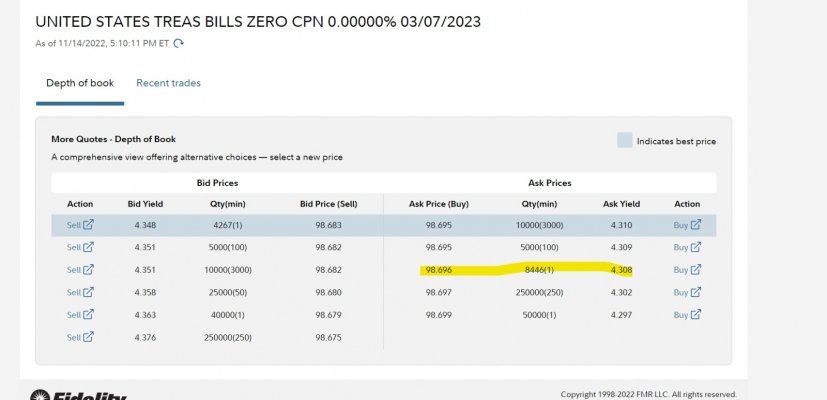

Not a surprise given what happened on secondary. I still think the market overreacted to the CPI. Should be interesting to see what happens next.

13 wk is up 5bp from last week.

26 wk is down 6bp from last week.

Not a surprise given what happened on secondary. I still think the market overreacted to the CPI. Should be interesting to see what happens next.