You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Updated: Delayed to 2023 - PayPal, Venmo issuing 1099-Ks

- Thread starter The Cosmic Avenger

- Start date

misanman

Thinks s/he gets paid by the post

- Joined

- Apr 28, 2008

- Messages

- 1,252

Ouch! We have expenses related to common property that we share with DS and DD. Twice a year they Venmo their portion to me and I deposit it in the checking account that we use to pay the expenses. These amounts exceed the $600 by a wide margin. Am I going to get a 1099 for these?

If so, then I might have to have them make the deposits themselves as I don't see how a 1099 can result from a deposit to a common account.

If so, then I might have to have them make the deposits themselves as I don't see how a 1099 can result from a deposit to a common account.

SecondCor521

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Ouch! We have expenses related to common property that we share with DS and DD. Twice a year they Venmo their portion to me and I deposit it in the checking account that we use to pay the expenses. These amounts exceed the $600 by a wide margin. Am I going to get a 1099 for these?

If so, then I might have to have them make the deposits themselves as I don't see how a 1099 can result from a deposit to a common account.

You probably will. Doesn't mean that the amount reported is taxable, though. There'll be explanations for how to report it; personally I like @cathy63's methods mentioned earlier on this thread.

donheff

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Qwerty. The circle is that if banks had to do this with checks it wouldn't be your bank that would report the earnings to the plumber (your bank would not even have the recipient's SSN). It would be the plumber's bank that would have to report it. But, of course, this requirement does not extend to such transactions.We’re talking in circles.

I read a report about this in the Washington Post. It mentioned that Paypal contacted a user and asked for their SSN so it could issue a 1099K. If I got some gifts through Paypal, I would inform them that I had never received income payments thru Paypal and would refuse to give them my SSN. If you do accept payments for goods and services thru Paypal or Venmo, I assume they will cancel your account if you don't provide a tax ID.

donheff

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I was curious to see how Paypal was handling this so I looked it up for my account. I have no transactions that are logged for IRS reporting. The Paypal help screen says this:

"Both PayPal and Venmo offer a way for customers to tag their peer-to-peer (P2P) transactions as either personal/friends and family or goods and services by choosing the appropriate category for each transaction. Users should select Goods and Services whenever they are sending money to another user to purchase an item, like a couch from a local ad listing or concert tickets, or paying for a service."

So, as long as you and your peers check the right boxes, your gifts won't get flagged. If you never use Paypal to receive taxable income, don't give them your SSN. If you do, my guess is you need to pay close attention to make sure only the real income is flagged > PITA.

"Both PayPal and Venmo offer a way for customers to tag their peer-to-peer (P2P) transactions as either personal/friends and family or goods and services by choosing the appropriate category for each transaction. Users should select Goods and Services whenever they are sending money to another user to purchase an item, like a couch from a local ad listing or concert tickets, or paying for a service."

So, as long as you and your peers check the right boxes, your gifts won't get flagged. If you never use Paypal to receive taxable income, don't give them your SSN. If you do, my guess is you need to pay close attention to make sure only the real income is flagged > PITA.

misanman

Thinks s/he gets paid by the post

- Joined

- Apr 28, 2008

- Messages

- 1,252

A few weeks ago we arranged for a local contractor to add a small porch to the back of our lake house. I suggested that I pay him using Venmo but he refused. I thought he was being old fashioned but I'm thinking now that he was the one that was more "in the know".

There are probably people on ER that downsized or decluttered stuff and sold it on Ebay. They know all of their items sold for less than what they originally paid for them, so no taxes are owed. Now, assuming the total exceeds $600, they'll receive a 1099 from Paypal for their total sales. I'm unclear as to what level of detail will be required on the tax forms for them to net out the non-profitable transactions to prove that no tax is owed. Just another hoop to jump through at tax time.

Last edited:

There are probably people on ER that downsized or decluttered stuff and sold it on Ebay. They know all of their items sold for less than what they originally paid for them, so no taxes are owed. Now, assuming the total exceeds $600, they'll receive a 1099 from Paypal for their total sales. I'm unclear as to what level of detail will be required on the tax forms for them to net out the non-profitable transactions to prove that no tax is owed. Just another hoop to jump through at tax time.

Assuming they owned all the items more than one year, they should add one line to Part II of their 8949 with description "Household goods, see 1099-K". If they had some items less than a year, then those go in Part I of the 8949, same description.

Estimate the purchase price (cost basis), they don't need original receipts. Use code L for non-deductible loss and $0 for the adjustment amount. Technically, they probably should also use code M to indicate that they are summarizing multiple transactions.

For documentation, just in case they get audited, they should also keep a copy of the eBay report that shows what they sold so they can demonstrate that it was normal thrift-store type stuff that sold at normal thrift-store type prices, which are obviously less than the original price; thus there is no taxable income.

easysurfer

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 11, 2008

- Messages

- 13,152

Fingers crossed that Turbotax is aware of this  .

.

CRLLS

Thinks s/he gets paid by the post

If I sell on eBay, Craigslist and Facebook Marketplace and accept PayPal, Venmo, Zelle and also accept cash in person, then who will be the issuer of the 1099? Will there be double reporting? i.e. sold thru eBay and paid via Paypal. Will it be gross or net (after fees) and will it include shipping costs?

I get the need to do this. This will just drive the underground economy further underground. "Cash only" transactions will become more prevalent.

I get the need to do this. This will just drive the underground economy further underground. "Cash only" transactions will become more prevalent.

mpeirce

Thinks s/he gets paid by the post

This will just drive the underground economy further underground. "Cash only" transactions will become more prevalent.

This is one reason the government is exploring a digital currency (a CBDC). All transactions would be visible to them.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

You just saved me some money. Thank you.Assuming they owned all the items more than one year, they should add one line to Part II of their 8949 with description "Household goods, see 1099-K". If they had some items less than a year, then those go in Part I of the 8949, same description.

Estimate the purchase price (cost basis), they don't need original receipts. Use code L for non-deductible loss and $0 for the adjustment amount. Technically, they probably should also use code M to indicate that they are summarizing multiple transactions.

For documentation, just in case they get audited, they should also keep a copy of the eBay report that shows what they sold so they can demonstrate that it was normal thrift-store type stuff that sold at normal thrift-store type prices, which are obviously less than the original price; thus there is no taxable income.

SecondCor521

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Estimate the purchase price (cost basis), they don't need original receipts. Use code L for non-deductible loss and $0 for the adjustment amount.

Normally I think you're 100% right on tax stuff. And I know what I think you mean above, but the wording could confuse.

I think the taxpayer should use an adjustment amount to make the resultant gain/loss in column (h) to be $0.

So for example if I sold my kid's Razor scooter for $25 on Facebook Marketplace and had originally paid $100, I think we both agree that I would have a $75 nondeductible personal capital loss. Your above description seems to me that columns (d) through (h) would end up reading:

Code:

Proceeds Basis Code Amount Gain/loss

$25 $100 L $0 ($75)but I think it should be:

Code:

Proceeds Basis Code Amount Gain/loss

$25 $100 L $75 $0

Last edited:

Fingers crossed that Turbotax is aware of this.

TurboTax already handles income reported on 1099-Ks. This is not a new form and none of the problems discussed in this thread are new problems. It's just that more people will receive this form from now on than have received it in the past.

Normally I think you're 100% right on tax stuff. And I know what I think you mean above, but the wording could confuse.

I think the taxpayer should use an adjustment amount to make the resultant gain/loss in column (h) to be $0.

So for example if I sold my kid's Razor scooter for $25 on Facebook Marketplace and had originally paid $100, I think we both agree that I would have a $75 nondeductible personal capital loss. Your above description seems to me that columns (d) through (h) would end up reading:

Code:Proceeds Basis Code Amount Gain/loss $25 $100 L $0 ($75)

but I think it should be:

Code:Proceeds Basis Code Amount Gain/loss $25 $100 L $75 $0

Well, that's what I get for doing this from memory instead of by looking at the form instructions! You are right. The gain/loss needs to end up at $0 so when the totals are carried to Sched D, this transaction has no effect on the LTCG totals.

CRLLS

Thinks s/he gets paid by the post

This is one reason the government is exploring a digital currency (a CBDC). All transactions would be visible to them.

Then they will be back to trading chickens and pigs for services. The ingenuity of the underground is boundless.

I don't think you can use capital gains/losses approach for personal property transactions.

I am still trying to figure out how to report this on my 1040.

I have a lot of hobby transaction over the year with Paypal ... buying various hobby gear and often selling it later to try something else. Much over the $600 limit so, I expect to see a 1099k. It was mostly at a small loss, certainly no gain for me.

Most PP transactions have been "goods/services" because internet buyers want the protection that gives them.

Anyway, I am very interested in finding out how best to report all this on my 1040.

I have been very good about keeping records of my purchases and sales.

I am still trying to figure out how to report this on my 1040.

I have a lot of hobby transaction over the year with Paypal ... buying various hobby gear and often selling it later to try something else. Much over the $600 limit so, I expect to see a 1099k. It was mostly at a small loss, certainly no gain for me.

Most PP transactions have been "goods/services" because internet buyers want the protection that gives them.

Anyway, I am very interested in finding out how best to report all this on my 1040.

I have been very good about keeping records of my purchases and sales.

- Joined

- Nov 17, 2015

- Messages

- 13,950

TurboTax already handles income reported on 1099-Ks. This is not a new form and none of the problems discussed in this thread are new problems. It's just that more people will receive this form from now on than have received it in the past.

Exactly. More people will now feel they have to report the income, when, in reality, they already had that obligation.

And some people will now have a bit more work to do to excuse themselves from the obligation.

foxcreek9

Recycles dryer sheets

- Joined

- Sep 19, 2015

- Messages

- 319

This is one reason the government is exploring a digital currency (a CBDC). All transactions would be visible to them.

"All transactions they want to see would be visible" would be a better description.

gauss

Thinks s/he gets paid by the post

- Joined

- Aug 17, 2011

- Messages

- 3,615

I don't think you can use capital gains/losses approach for personal property transactions.

I am still trying to figure out how to report this on my 1040.

I have a lot of hobby transaction over the year with Paypal ... buying various hobby gear and often selling it later to try something else. Much over the $600 limit so, I expect to see a 1099k. It was mostly at a small loss, certainly no gain for me.

Most PP transactions have been "goods/services" because internet buyers want the protection that gives them.

Anyway, I am very interested in finding out how best to report all this on my 1040.

I have been very good about keeping records of my purchases and sales.

I thought that Cathy's example, above, was designed specifically to address personal capital transactions .

-gauss

Since I use Paypal a lot, and I buy/sell a bunch of hobby gear, I was very curious about what Paypal will actually report on the 1099k.

Does the amount I get after the Paypal fee get reported?? Apparently not. It is the gross amount that I am paid which is reported to the IRS, before PP takes their fee.

For example, if I sold a used motorbike for $1000 to someone who used Paypal to pay me using goods/services, the net amount I receive is less due to the Paypal fee. Let's say I get $970 net. The amount Paypal will report in the 1099k will be $1000. So, the IRS thinks I made $1000 on the sale. I contacted Paypal and asked them about this and they confirmed that yes, this is how it will work.

Beware!

Does the amount I get after the Paypal fee get reported?? Apparently not. It is the gross amount that I am paid which is reported to the IRS, before PP takes their fee.

For example, if I sold a used motorbike for $1000 to someone who used Paypal to pay me using goods/services, the net amount I receive is less due to the Paypal fee. Let's say I get $970 net. The amount Paypal will report in the 1099k will be $1000. So, the IRS thinks I made $1000 on the sale. I contacted Paypal and asked them about this and they confirmed that yes, this is how it will work.

Beware!

38Chevy454

Thinks s/he gets paid by the post

Since I use Paypal a lot, and I buy/sell a bunch of hobby gear, I was very curious about what Paypal will actually report on the 1099k.

Does the amount I get after the Paypal fee get reported?? Apparently not. It is the gross amount that I am paid which is reported to the IRS, before PP takes their fee.

For example, if I sold a used motorbike for $1000 to someone who used Paypal to pay me using goods/services, the net amount I receive is less due to the Paypal fee. Let's say I get $970 net. The amount Paypal will report in the 1099k will be $1000. So, the IRS thinks I made $1000 on the sale. I contacted Paypal and asked them about this and they confirmed that yes, this is how it will work.

Beware!

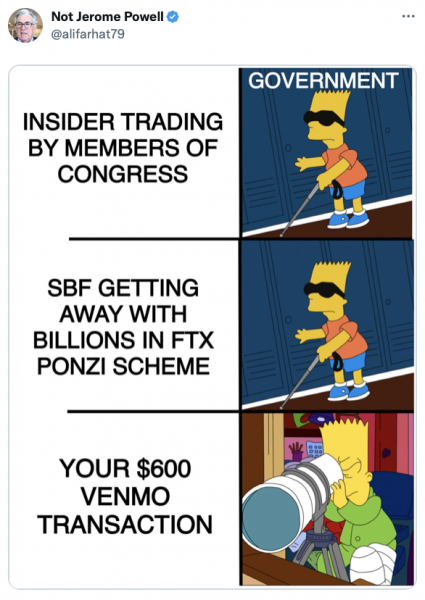

Why should the IRS/govt care, it is more potential tax money for Uncle Sam. This whole $600 idea is just a backdoor way for govt to collect more tax money. Yes, some of this money should have been included on tax returns in the past. But the difficulty will be to prove that it is *not* actually income, but rather a reimbursement or partial recovery of money already paid. It is not the same as investing.

I do agree with your comment. Fees should not be included in the 1099 amount. Net proceeds, since Paypal or Venmo or whoever is already paying tax on the fees as corporate income.

Now to throw a wrench into the discussion, just wait until states want to not only get their portion of the income tax, but look out for sales tax in addition. Never doubt the govt tax monster tentacles ability to come up with ways to get more tax collection out of you.

Last edited:

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I’m not outright disagreeing, but is there an easier way to report legitimate income to the IRS? Sadly but not surprisingly the honor system hasn’t worked, why should honest people pay more than dishonest…This topic was mentioned on a podcast. A little confusing. But if correct. This would be a "nightmare" for a lot of us.

Sounds like, if someone receives, more than $600 a year. One may receive a 1099.

Income on a 1099 is taxable. IRS also receive a "matching" 1099.

If you look into the details, this is really bad. Big Brother coming after us.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Plug your income into Dinkytown and see the reality of what the 1099 really means. I sold $2000 worth of household stuff on eBay this year. I ran the numbers, we itemize and with the 1099 income we’ll still not owe any additional tax - thanks to a big muni bond ladder in our taxable account.

SecondCor521

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Since I use Paypal a lot, and I buy/sell a bunch of hobby gear, I was very curious about what Paypal will actually report on the 1099k.

Does the amount I get after the Paypal fee get reported?? Apparently not. It is the gross amount that I am paid which is reported to the IRS, before PP takes their fee.

For example, if I sold a used motorbike for $1000 to someone who used Paypal to pay me using goods/services, the net amount I receive is less due to the Paypal fee. Let's say I get $970 net. The amount Paypal will report in the 1099k will be $1000. So, the IRS thinks I made $1000 on the sale. I contacted Paypal and asked them about this and they confirmed that yes, this is how it will work.

Beware!

If the used motorbike was something you bought for $2000, then you have a nondeductible personal capital loss and the fee is just too bad.

But if you're running a business and report the $1000 on a Schedule C, you can probably deduct the $30 fee as a business expense. You'll only pay self-employment and income taxes on the $970 net.

Similar threads

- Replies

- 16

- Views

- 555

- Replies

- 11

- Views

- 683

- Replies

- 5

- Views

- 251

Latest posts

-

-

-

-

-

-

What new series are you watching? *No Spoilers, Please*

- Latest: ShokWaveRider

-

-