Prior to unemployment/retiring I used every calculator I could find to get some sense of what I needed to save. At one point using 5 of the calculators from the "brand name sources" gave me:

2 saying I would run out of money

2 saying I would die with more money than I have now

1 goldilocks that had me running out of $ just as I hit my projected life span.

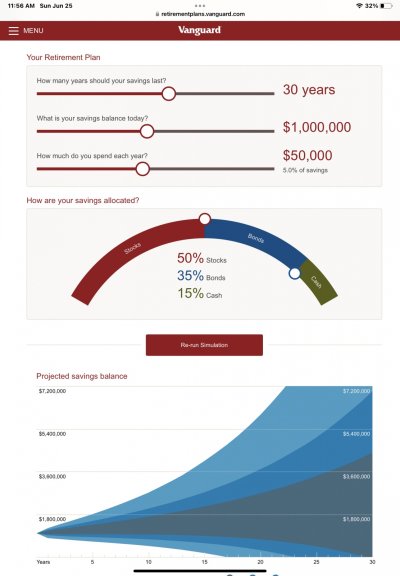

I eventually ended up with results from over a dozen calculators... I finally gave up and built a spreadsheet that simulated spending, inflation, and income for 30 years... I compared that to a rather simple PMT function and the results were the same.

Now days the big discrepancy in tools are for Social Security start dates. Financial Engines, Fidelity, OpenSocialSecurity.com, etc. all give results that do not match each other with several that don't match data from the SSA. So I'm back to building my own spreadsheets... instead of Social Security Administration is Spread Sheet Administration.