Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

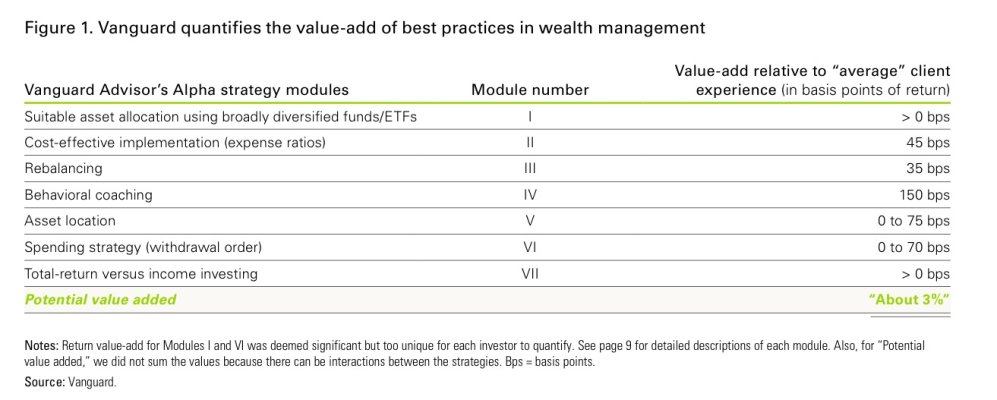

Interesting to see Vanguard themselves stating "Behavioral Coaching" is far and away the biggest value an advisor provides (est 1.5%) to an uninterested novice investor, and half the total long term value added (est 3%).

Who wants or needs behavioral coaching might only become evident at market peaks and troughs.

And they attempt to quantify the relative value of several services an FP/FA can provide (vs an I advised novice or uninterested investor). I found this an interesting read FWIW.

Who wants or needs behavioral coaching might only become evident at market peaks and troughs.

And they attempt to quantify the relative value of several services an FP/FA can provide (vs an I advised novice or uninterested investor). I found this an interesting read FWIW.

http://www.vanguard.com/pdf/ISGQVAA.pdfBecause investing evokes emotion, advisors need to help their clients maintain a long-term perspective and a disciplined approach—the amount of potential value an advisor can add here is large. Most investors are aware of these time-tested principles, but the hard part of investing is sticking to them in the best and worst of times—that is where you, as a behavioral coach to your clients, can earn your fees and then some. Abandoning a planned investment strategy can be costly, and research has shown that some of the most significant derailers are behavioral: the allure of market-timing and the temptation to chase performance.

Attachments

Last edited: