Thanks to the OP and to all who've posted here for this excellent thread.

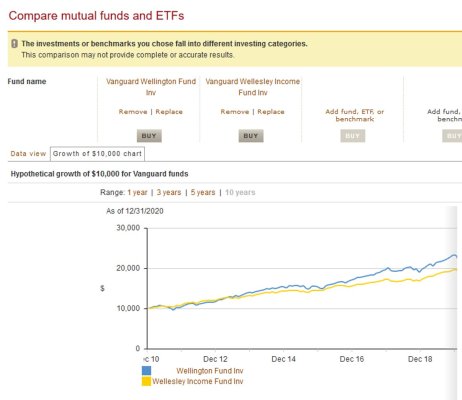

Like many others here I have great respect for the two W's (Wellesley and Wellington) and Wellington Management's many decades of great management of these and other funds.

Wellesley is designed to be a set-it-and-forget-it complete conservative portfolio - but that doesn't mean one has to use it that way. It is important to bear in mind that it is Wellesley INCOME Fund meaning tax efficiency isn't a goal, so it's certainly best to hold it in a tax-deferred account if possible (though not the end of the world if not, for most folks) AND (more important, IMHO) to buy Admiral shares (VWIAX) directly at Vanguard, which saves you .05% in ER over the Investor shares available from other brokers.

If you're risk-averse enough to go all-in on Wellesley you might be interested in looking at what adding a slice of gold does to the historical returns and SWR (scroll down to the charts provided by Tyler of "Portfolio Charts"):

https://www.gyroscopicinvesting.com/forum/viewtopic.php?f=10&t=11196

Personally I've chosen to diversify across both asset classes and investment strategies. As a dyed-in-the-wool index fund fan at heart I have about 40% of our portfolio in a plain vanilla Total U.S./Total International Stock mix balanced with short-term Treasuries and iBonds, which is then "bookended" by having nearly 45% of our total nest egg in Wellesley which is actively-managed, highly-concentrated and (on the bond side) intermediate-duration and credit quality. 15% gold hedges against sequence-of-returns risk and continued currency debasement by the Fed.

We all know the old saw about past performance being no guarantee of future results and have valid concerns about paying a premium for actively-managed funds but I think this recent interview with the folks who manage Wellesley makes a pretty compelling argument for continuity of management at Wellington. The way look at is is for the .16% ER I pay for VWIAX I have a whole team of great FA's looking out for my best interests and following macroeconomic trends, with the ability to respond quickly to events like the pandemic.

https://www.morningstar.com/podcasts/the-long-view/75

That said, I can't imagine any actively-managed funds other than the two W's that would make me deviate from a pure index fund strategy. And there are plenty of happy retirees out there who own only Wellesley or one of the Vanguard LifeStrategy or Target Retirement Income funds-of-funds who do perfectly well without the need to rebalance, while also preventing themselves from tweaking allocations or second-guessing themselves in the event of market panics or age-related cognitive decline. K.I.S.S. is rarely a bad idea.