UnrealizedPotential

Thinks s/he gets paid by the post

- Joined

- May 21, 2014

- Messages

- 1,390

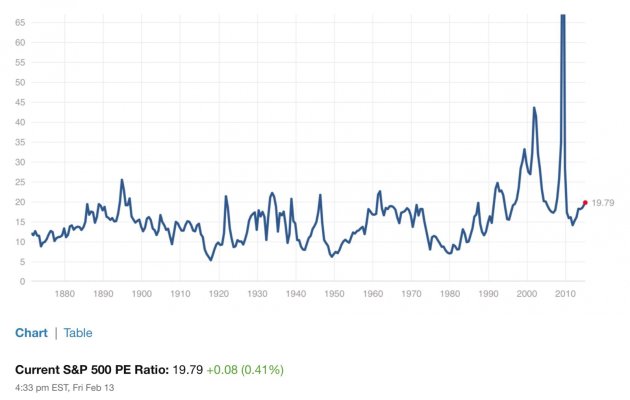

With the Sp500 reaching all time highs again, I am amazed how it just keeps going up. It has not been a smooth ride. There have been been bumps in the road. Yet, not that I am asking for a correction or even worse, I can't help but wonder, where are we? I am not a market timer, but I do feel a sense of responsibility to myself if I can ,to understand if the markets are overvalued, fully valued , or if earnings are good, undervalued? Now I know there will be those who say it does not matter. To those who say that, you are correct, to a point. But to get more knowledge we have to ask why things are the way they are. So I am asking.