pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

This drop was far, far faster than the other periods which took many months if not years to reach the down 30% from peak, so I get the running scared part.

Many ER folks here retired after 2008 as that is already 12 years ago!

Yes, this drop was much faster... and that is what has rattled people, along with the uncertainty as to what will happen.

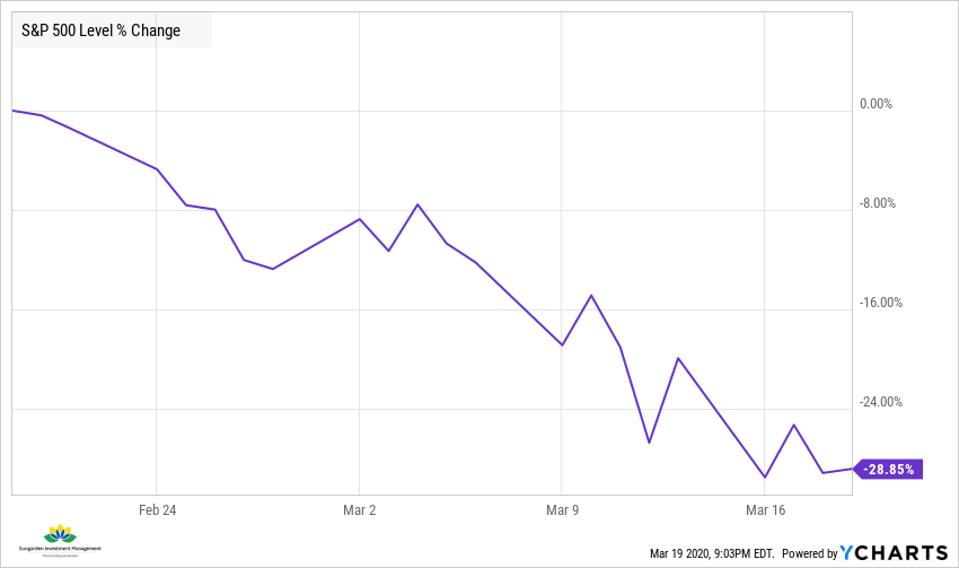

Here is the S&P 500 since it peaked back on February 19 of this year. This is through Thursday’s close. It is down about 29% in 4 weeks.

Now, here is the S&P 500 from back in the Global Financial Crisis. This was the last time the world’s economy was in total panic mode. The headline reasons were different. There was not a global health crisis. It was the reckoning of years of leverage in the financial system, and the bubble popped. This is just about the same point in the down-cycle for stocks. It just took a month this time, versus about a year last time.

https://www.forbes.com/sites/robisb...vs-2020-a-warning-to-the-greedy/#68eabe794b62