They say common rule is to withdraw from taxable accounts first, followed by tax deferred, then tax free or roth. But isn't there sometimes a reason to withdraw from tax deferred accounts first? My tax deferred accounts are 3 times larger than my taxable. In my situation I believe it is better to withdraw from the tax deferred first since I believe I will be in a higher bracket because of rmd's.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

withdraw sequence

- Thread starter ripper1

- Start date

Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Well, you will face mandatory minimum withdrawals at the age of 70. These may affect your taxable SS as well as other benefits. So, withdrawing from them earlier may make sense, or at least converting some of the tax differed money to Roths.

Meadbh

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 22, 2006

- Messages

- 11,401

Yup. It all depends on your personal circumstances. The conventional wisdom addresses the needs of "most people" whose taxable income will decrease in retirement. But we are not "most people".

I live in Canada, where the details differ but the principle is the same. There is much debate about this question on Canadian financial forums and there is a Canadian software program called RRIFMetric that can compare the effects of different withdrawal strategies on after tax income and portfolio longevity. I'm sure somebody in the US must have come up with similar software.

If I defer withdrawing from my tax sheltered accounts until I reach the age of RMDs, my income tax payable will radically increase at age 71, and in addition, my Old Age Security payments will be completely clawed back. That's equivalent to paying an extra 15% in taxes. OTOH, deferring withdrawals from tax sheltered accounts allows them to grow faster in the meantime, so I would reach 71 with a higher NW. But, since my fixed income is in those accounts, they still won't be the growth portion of my portfolio. It all depends on many factors including yields, tax policy and cash flow needs. Scenario building suggests that it may be a wash. But I am planning to draw down on some of my tax sheltered funds earlier than required.

I live in Canada, where the details differ but the principle is the same. There is much debate about this question on Canadian financial forums and there is a Canadian software program called RRIFMetric that can compare the effects of different withdrawal strategies on after tax income and portfolio longevity. I'm sure somebody in the US must have come up with similar software.

If I defer withdrawing from my tax sheltered accounts until I reach the age of RMDs, my income tax payable will radically increase at age 71, and in addition, my Old Age Security payments will be completely clawed back. That's equivalent to paying an extra 15% in taxes. OTOH, deferring withdrawals from tax sheltered accounts allows them to grow faster in the meantime, so I would reach 71 with a higher NW. But, since my fixed income is in those accounts, they still won't be the growth portion of my portfolio. It all depends on many factors including yields, tax policy and cash flow needs. Scenario building suggests that it may be a wash. But I am planning to draw down on some of my tax sheltered funds earlier than required.

ripper1

Thinks s/he gets paid by the post

Also if I withdraw from these tax shelter accounts first I can keep my income down and stay in the 15% bracket and therefore maintain the 0% taxation on qualified dividends and capital gains in taxable as well as possibly leaving a legacy to my kids at the stepped up basis.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

They say common rule is to withdraw from taxable accounts first, followed by tax deferred, then tax free or roth. But isn't there sometimes a reason to withdraw from tax deferred accounts first? My tax deferred accounts are 3 times larger than my taxable. In my situation I believe it is better to withdraw from the tax deferred first since I believe I will be in a higher bracket because of rmd's.

One thing to remember is that withdrawal sequence is commonly accompanied from ER to SS or pensions by Roth conversions so you need to look at them in combination. Each Roth conversion reduces your tax-deferred amounts by the amount of the conversion with a corresponding increase in tax-free funds (the Roth) and also reduces taxable accounts by the amount of the tax. These reductions in tax-deferred funds has the effect of reducing future RMDs.

What I am now doing is living on taxable accounts and doing Roth conversions to the top of the 15% bracket. Prior to Roth conversions my taxes are nil because most of our income is qualified dividends and LTCG (and foreign tax credits too) but once I do my Roth conversions I pay about 7% on the conversion amount, which I think of as a deal considering my marginal tax rate was 25% when I deferred that income.

ripper1

Thinks s/he gets paid by the post

Most of my income is pension along with my wife's ss to begin in 2 years. So my income will be quite high. I'm just not a fan of roth. Do most people anticipate withdrawing from this type of account or is it a legacy play.

Yes, to both of your options for the Roth.Most of my income is pension along with my wife's ss to begin in 2 years. So my income will be quite high. I'm just not a fan of roth. Do most people anticipate withdrawing from this type of account or is it a legacy play.

You may be at what you think will be a high tax rate now but look at where one of you will be when the other one dies. You'll no longer be able to do a joint return. The 25% marginal bracket starts at $36,900 for a single versus $73,800 for a joint return. That provides an incentive to increase withdrawls into the 25% bracket to reduce the impact of possible 28% or 33% rates in the future.

A Roth allows interest, dividends and capital gains to grow tax free. How can you not be a fan of that?

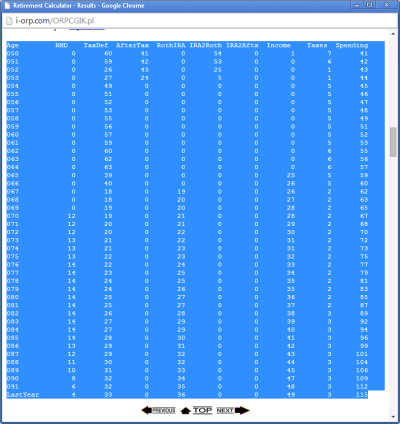

For the US, there is the i-orp site, which is supposed to help perform some of this optimization of withdrawals. I've played with it a little bit, but there wasn't enough transparency for me to gain confidence that it was truly doing what I hoped it was doing. I need to check it out some more.I live in Canada, where the details differ but the principle is the same. There is much debate about this question on Canadian financial forums and there is a Canadian software program called RRIFMetric that can compare the effects of different withdrawal strategies on after tax income and portfolio longevity. I'm sure somebody in the US must have come up with similar software.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Most of my income is pension along with my wife's ss to begin in 2 years. So my income will be quite high. I'm just not a fan of roth. Do most people anticipate withdrawing from this type of account or is it a legacy play.

Both. If we make it to our 90s our projections show we would be drawing from it as our taxable and tax-deferred accounts would be exhausted. If we don't make it to our 90s then our children will get the tax free benefit.

I'm not sure what there is not to be a fan about - it is as close to a free lunch as you can get.

GTFan

Thinks s/he gets paid by the post

Minus the loss of ACA subsidies in exchange for maxing out Roth conversions, but you've already factored that in. I'm still on the max subsidy track because I'm not that concerned about having to donate a lot of income to avoid the tax man after 70 (if I'm lucky enough to live and have that RMD income).

Badger

Thinks s/he gets paid by the post

- Joined

- Nov 2, 2008

- Messages

- 3,411

Yes, to both of your options for the Roth.

You may be at what you think will be a high tax rate now but look at where one of you will be when the other one dies. You'll no longer be able to do a joint return. The 25% marginal bracket starts at $36,900 for a single versus $73,800 for a joint return. That provides an incentive to increase withdrawls into the 25% bracket to reduce the impact of possible 28% or 33% rates in the future.

A Roth allows interest, dividends and capital gains to grow tax free. How can you not be a fan of that?

I thought I had covered all my bases but failed to take this into consideration. Thank you for bringing this up. It looks like I have some numbers to crunch to figure a higher Roth conversion. I only have 3 more years before my wife starts RMD.

Cheers!

FANOFJESUS

Thinks s/he gets paid by the post

You can file as widower for 2 years after a spouse death to maintain the tax bracket. But yes, after that, your on you own in the irs's eyes.

Sent from my iPhone using Early Retirement Forum

So the year they die and the next one?

Qualifying Widower has several conditions....

From 2013 IRS 1040 Instructions

Line 5

Qualifying Widow(er) With

Dependent Child

You can check the box on line 5 and use

joint return tax rates for 2013 if all of

the following apply.

Your spouse died in 2011 or 2012

and you did not remarry before the end

of 2013.

You have a child or stepchild you

can claim as a dependent. This does not

include a foster child.

This child lived in your home for

all of 2013. If the child did not live with

you for the required time, see Exception

to time lived with you, later.

You paid over half the cost of

keeping up your home.

You could have filed a joint return

with your spouse the year he or she died,

even if you did not actually do so.

From 2013 IRS 1040 Instructions

Line 5

Qualifying Widow(er) With

Dependent Child

You can check the box on line 5 and use

joint return tax rates for 2013 if all of

the following apply.

Your spouse died in 2011 or 2012

and you did not remarry before the end

of 2013.

You have a child or stepchild you

can claim as a dependent. This does not

include a foster child.

This child lived in your home for

all of 2013. If the child did not live with

you for the required time, see Exception

to time lived with you, later.

You paid over half the cost of

keeping up your home.

You could have filed a joint return

with your spouse the year he or she died,

even if you did not actually do so.

I'll be doing Roth conversions as long as the taxable accounts last. After that, we'll withdraw from an IRA up to a lower tax bracket and cover the rest of expenses from the Roth. If we live a really long time we'll be withdrawing completely from Roths. That's what looks like the optimum for us, maximizing yearly spending.

Which Roger

Thinks s/he gets paid by the post

- Joined

- Jun 5, 2013

- Messages

- 1,019

Minus the loss of ACA subsidies in exchange for maxing out Roth conversions, but you've already factored that in. I'm still on the max subsidy track because I'm not that concerned about having to donate a lot of income to avoid the tax man after 70 (if I'm lucky enough to live and have that RMD income).

For those who might take advantage of them, the ACA subsidies change the equation quite a bit. Prior to ACA, the common wisdom was to do Roth conversions up to the top of your current tax bracket. When the bracket is 15%, this allows for tax-free capital gains and qualified dividends.

But the subsidy cliff kicks in at 62K MAGI (for a family of 2). This is significantly lower than the top of the 15% bracket, and it seems to me that the cost of losing the subsidies would far outweigh the advantages of Roth conversions that would take one over the cliff while still staying in the 15% bracket.

Yes, to both of your options for the Roth.

The 25% marginal bracket starts at $36,900 for a single versus $73,800 for a joint return. That provides an incentive to increase withdrawls into the 25% bracket to reduce the impact of possible 28% or 33% rates in the future.

The 15% tax brackets for 2014 are $39,150 single / $82,250 married

Tax bracket is applied on income after deducting personal $3,950 each and standard $6,200/$12,400 (or itemized) deductions.

A single can earn $45,745 and remain in the 15% bracket

Married couples can earn $102,550 and remain in the 15% bracket

For those who might take advantage of them, the ACA subsidies change the equation quite a bit. Prior to ACA, the common wisdom was to do Roth conversions up to the top of your current tax bracket. When the bracket is 15%, this allows for tax-free capital gains and qualified dividends.

But the subsidy cliff kicks in at 62K MAGI (for a family of 2). This is significantly lower than the top of the 15% bracket, and it seems to me that the cost of losing the subsidies would far outweigh the advantages of Roth conversions that would take one over the cliff while still staying in the 15% bracket.

+1 same problem here. Everyone's retirement scenario is pretty much as unique as their fingerprints. We have no pensions, and no govt./megacorp supplemental healthcare until Medicare. We rely on the ACA for healthcare (BCBS canceled our individual plans when the ACA started up). We have sufficient retirement and taxable accounts to live off for the rest of our lives. Currently withdraw only dividends off taxable accounts and Roths, along with SS to manipulate our income for ACA subsidy. It's not just Federal, but state taxes that come into play for us. Imagine things will continue to get complicated as time goes by (like the ACA subsidy being modified to take into consideration all of ones SS, and not just what was Federally taxed).

I don't know where you got your tax bracket figures but this is where mine came from.The 15% tax brackets for 2014 are $39,150 single / $82,250 married

Tax bracket is applied on income after deducting personal $3,950 each and standard $6,200/$12,400 (or itemized) deductions.

A single can earn $45,745 and remain in the 15% bracket

Married couples can earn $102,550 and remain in the 15% bracket

http://www.taxpolicycenter.org/taxfacts/content/pdf/individual_rates.pdf

I agree with your personal exemption and standard deductions. If I limit myself to $94,100 of taxable income, I won't make a serious dent in my IRAs before I take my first RMD. Using your numbers won't make a meaningful difference in my situation.

Last edited:

FIRE'd@51

Thinks s/he gets paid by the post

- Joined

- Aug 28, 2006

- Messages

- 2,433

You may be at what you think will be a high tax rate now but look at where one of you will be when the other one dies. You'll no longer be able to do a joint return. The 25% marginal bracket starts at $36,900 for a single versus $73,800 for a joint return.

Plus the increased Medicare parts B and D premium threshold falls from $170K to 85K.

Great question as it got me to try i-orp which I hadn't until now (thanks samclem). It didn't estimate my contributions correctly from now until 50 but the actual amounts aren't important just the withdrawl strategy. I input 50 as my ER date with approx $1MM balance at that time. Of the $1MM approx 80% in IRA, 20% in after-tax savings. SS starting at 65.

I see it's suggesting moving money from IRA to ROTH for the first 4 years of retirement and using the after-tax money for spending early on. From age 54 to 66 though it looks like it wants me to withdraw from IRA (taxdef) (and pay taxes early on). At 65 SS starts, at 70 RMDs start.

I see it's suggesting moving money from IRA to ROTH for the first 4 years of retirement and using the after-tax money for spending early on. From age 54 to 66 though it looks like it wants me to withdraw from IRA (taxdef) (and pay taxes early on). At 65 SS starts, at 70 RMDs start.

Attachments

From the horse's mouth:

http://www.irs.gov/pub/irs-drop/rp-13-35.pdf

The Tax Is:

Not over $18,150

10% of the taxable income

Over $18,150 but not over $73,800

$1,815 plus 15% of the excess over $18,150

Over $73,800 but not over $148,850

$10,162.50 plus 25% of the excess over $73,800 "

"

$5,081.25 plus 25% of the excess over $36,900 "

http://www.irs.gov/pub/irs-drop/rp-13-35.pdf

"SECTION 3. 2014 ADJUSTED ITEMS

.01 Tax Rate Tables. For taxable years beginning in 2014, the tax rate tables under § 1 are as follows:

TABLE 1 - Section 1(a) - Married Individuals Filing Joint Returns and Surviving

Spouses

If Taxable Income Is: The Tax Is:

Not over $18,150

10% of the taxable income

Over $18,150 but not over $73,800

$1,815 plus 15% of the excess over $18,150

Over $73,800 but not over $148,850

$10,162.50 plus 25% of the excess over $73,800 "

"

TABLE 3 - Section 1(c) – Unmarried Individuals (other than Surviving Spouses and

Heads of Households)

If Taxable Income Is

: The Tax Is:

Not over $9,075 1

0% of the taxable income

Over $9,075 but not over $36,900 $907.50 plus 15% of the excess over $9,075

Over $36,900 but not over $89,350 $5,081.25 plus 25% of the excess over $36,900 "

IIRC, it suggested the same general pattern when I put in my numbers. Suggestions:I see it's suggesting moving money from IRA to ROTH for the first 4 years of retirement and using the after-tax money for spending early on. From age 54 to 66 though it looks like it wants me to withdraw from IRA (taxdef) (and pay taxes early on). At 65 SS starts, at 70 RMDs start.

1) Play around with a few different levels of expected investment returns to get an idea of how sensitive your "optimum" strategy is to that. I found it to be especially important to understand the "best" strategy if my returns are lower than I presently expect: That's when it will be especially important to get every dime we can safely withdraw. If my investments do very well then I know I'll have to pay more taxes, but that's a "good problem to have."

2) If you are married, maybe see how the optimum withdrawal strategy changes if you/spouse are alone in the future. The tax situation can change a lot with the lower bracket levels and lower standard deduction.

I don't think i-orp is "smart enough" to take into account the impact of the zero% dividend and CapGains tax rate for those in the 15% bracket--I can see that it might pay to go a bit slower on the Roth conversions in order to have room in the 15% bracket to harvest some of those gains. And I know it doesn't take into account the ACA subsidies, which can be a major factor in causing some people to minimize O-MAGI income.

Good thoughts samclem. I'll be honest, up until now I haven't given much thought to taxes and the withdrawl strategies, I'm saving that for a few years before I retire. However, I do see value in getting most taxes out of the way early on. Who knows where the taxes will go in the following 2 or 3 decades, even from the ACA perspective you could be on a high deductible plan early on when you're relatively healthy compared to later on. Who knew retirement planning could be a part-time job lol

I don't think i-orp is "smart enough" to take into account the impact of the zero% dividend and CapGains tax rate for those in the 15% bracket--I can see that it might pay to go a bit slower on the Roth conversions in order to have room in the 15% bracket to harvest some of those gains.

It's far worse than you are assuming.

Look here to see what the i-orp developer says about its model for a taxable account. It ignores income from a taxable account. It just reduces growth of that account by your tax bracket.

IMHO, this is a dangerous tool. It gives tax advise but doesn't really take tax law into consideration. And, it calls itself optimal.

Last edited:

Similar threads

- Replies

- 23

- Views

- 2K

- Replies

- 15

- Views

- 595