keegs

Recycles dryer sheets

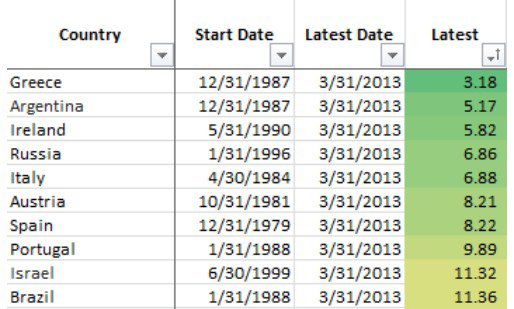

I think this is news to me.....basing withdrawl rates on CAPE (PE/10). Make sense to me ..I think...What broad index are they using I wonder?

Anyway...what say you?

Maybe Past Performance Does Predict Your Savings' Future - Bloomberg

Anyway...what say you?

Maybe Past Performance Does Predict Your Savings' Future - Bloomberg