ShokWaveRider

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

We are at the point that we need to withdraw money from our IRAs or we will never draw it down in the foreseeable future. Up till now (70y and 65y olds), we have not needed to touch them. We still do not but should take the money out at some point. We have no heirs other than charities to leave anything to. Our home is worth a significant sum and this is my DW's LTC insurance for after I cark it. I have recently done some simple basic sums of the difference between a MYGA with DIY systematic withdrawals and having a SPIA for the same period doing it automatically for you. I do not want to manage a ladder of bonds or CDs.

The 2 scenarios I tested were:

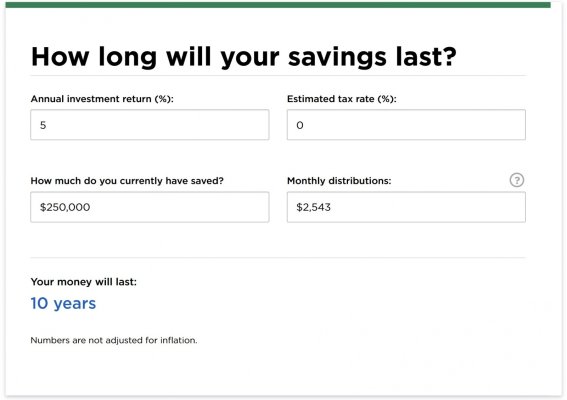

1) A 10 year MYGA with an interest rate of 5%

2) A SPIA 10 Year Period Certain with a monthly payout of $2,543

I did not take taxes into consideration as taxes would need to be paid on both using qualified funds.

Without getting to granular, they both lasted the same amount of time ..... 10 years. I do not see a good reason for managing the funds and withdrawals oneself when with a SPIA the objective seems to be achieved. I.E. Withdrawing money for 10 years till depleted from a $250k cash bucket.

I was wondering what folks thought.

The 2 scenarios I tested were:

1) A 10 year MYGA with an interest rate of 5%

2) A SPIA 10 Year Period Certain with a monthly payout of $2,543

I did not take taxes into consideration as taxes would need to be paid on both using qualified funds.

Without getting to granular, they both lasted the same amount of time ..... 10 years. I do not see a good reason for managing the funds and withdrawals oneself when with a SPIA the objective seems to be achieved. I.E. Withdrawing money for 10 years till depleted from a $250k cash bucket.

I was wondering what folks thought.

Last edited: