12 years into ER, this is an interesting question for me.

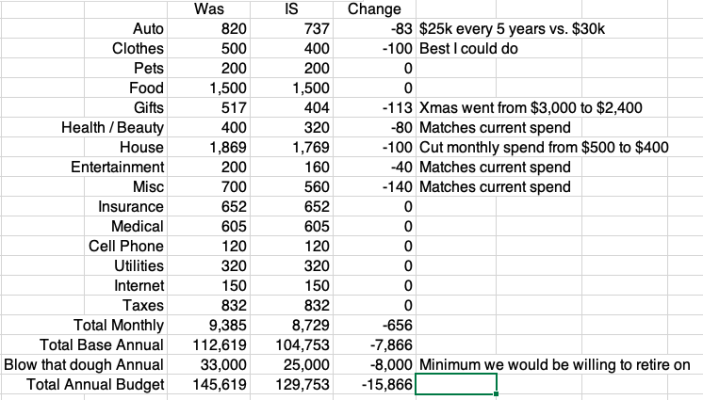

1) How did you arrive at your annual budget? We used our historical spend and then added a comfortable headroom over it. I think this is the best thing we did in our planning because it allowed us to be flexible when markets crashed (in our case, within 6 months of ER).

2) What method are you using to determine success? Constant SWR or variable. We settled on Bob Clyatt's 4/95 method which is variable & based on portfolio value. A requirement of course, is the ability to live on a smaller budget when things aren't going well. VPW on the bogleheads board is very interesting since it takes life expectancy into account too.

3) Are you taking other sources of income/wealth into account? We did not take SS into account though it will be sufficient for our basic needs when we take it at 70. We also did not include the value of our home. An inheritance may be in your future. We think of these as contingency plans.

4) Are you willing to work again? This was part of our plan and we got to put it into action in 2010 (we ER'd in May 2008). We worked for part of that year. In hindsight, we didn't need to go back to work, but it gave us great comfort to add to our savings instead of withdrawing from them. It also gave us greater confidence in being able to pull off ER successfully. Now, our labor capital is much lower, but if we needed to, we'd do that sooner than later.

5) Are you taking into account possible future reductions in spending? For us, our health insurance premiums will reduce when we go on Medicare, but we didn't account for it in our initial plans. ACA wasn't even on the horizon when we ER'd, so possible subsidies weren't considered either. The flip side is increased spending - we like to travel a little more luxuriously now than we did 10 years ago. Medical expenses & nursing care are so unpredictable that I just used SS payments as a contingency and decided that we would adjust our lifestyle to accommodate it.

I am sure there are other considerations which merit a great deal of thought. On the other hand, if you're flexible you can choose to just wing it. Life is short & unpredictable. Either way, good luck to you.