W2R

Moderator Emeritus

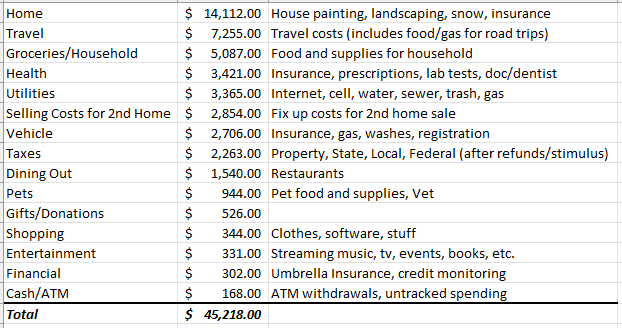

This year was odd because the first 4 months I was divorced but sharing expenses with my ex as we were still living in the house. The last 8 months I lived in the condo I bought. I spent 35k which included taxes. I didn’t travel but had significant vet expenses which were 2700. I spent a additional 12k remodeling my condo and buying appliances and some furniture which came from my savings. Luckily my son provided all the labor which was a significant savings.

Maybe the condo remodeling costs could be thought of as part of the purchase price, since these were initial costs that made the condo into the kind of place you wanted to purchase, right? Anyway that is how I thought of my humungous landscaping project that I did right after I bought my Dream Home (back in 2015). I knew I'd have to do that project even before I made my offer on the house, and I started on it ASAP. I felt better about the landscaping when I treated it like a one time expense.

Your vet expenses were rugged! Whew. Frank bought me a Teddy Bear which doesn't require any vet bills but it's not quite the same.