Like many, while my greed gland loves the continued run up in the market, I can’t help but feel we are close to another correction. How much/how long/when it happens, who knows? Being 2 years out from launching, I can’t help but “fear” I be “that guy” who retires right before the big drop, statistically putting me at a disadvantage of a successfully RE. While I am underwriting to a very generous spend budget with significant discretionary spending, I would like to think my SHTF budget is my fallback.

If you're going to bring up the question then you should consider that your asset allocation may be more aggressive than you'll really be comfortable with. Sleeping comfortably at night is much harder than using math & logic to arrive at an asset allocation. You may also be more vulnerable to sequence-of-returns risk than you may wish, although that's straightforward to handle with variable spending.

If you had a pension that covers most of your expenses, this question is probably not for you. I am curious to hear more from those of you who rely 100% on your assets to fund your retirement. Your experiences will help many of us getting ready to launch plan accordingly. Look forward to your wisdom!

I ER'd in June 2002, just in time for the bottom of the Internet recession. Despite all of our 2002 practice at intense discussions about asset allocation & spending, we were still not emotionally ready for 2008-09. We were financially ready, though, and we held on despite a 58% drop from peak to trough.

Our 2008-09 pension (at the time) covered our mortgage (at the time), but not "most of our expenses". An annuity is a very comforting part of an asset allocation.

We also did a lot of tax-loss harvesting. I don't think we used up those capital losses until well into this decade.

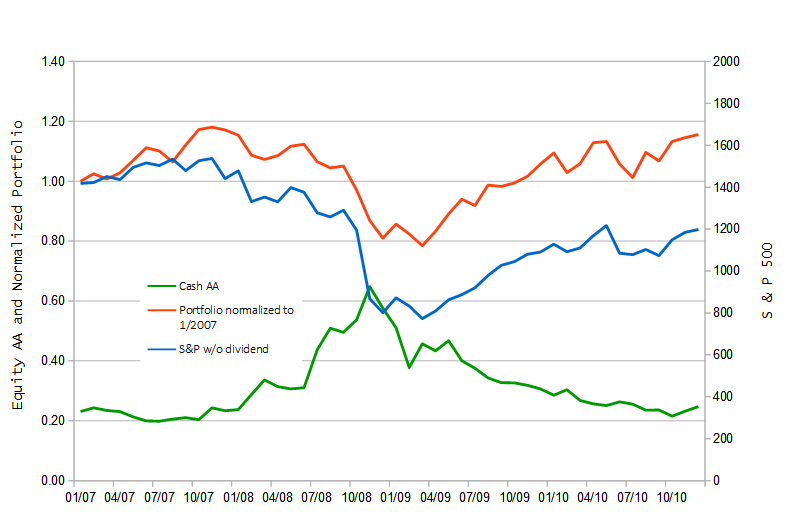

During our first decade of FI, we handled the sequence-of-returns risk by keeping our asset allocation at over 90% equities with two years' expenses in cash. We chewed through the first year of cash by the end of 2008 and chewed through the second year of cash by the end of 2009. We replenished the stash for 2010 and sold some shares for lower capital gains than we'd hoped, but (other than deliberate tax-loss harvesting) we never had to sell shares at a loss.

Our daughter was in high school and driver's ed, so we didn't take any fantasy cruises. However we did buy a used Prius (when Hawaii gas prices were over $4.50/gallon) and we had some home-improvement contractor work done at a huge discount for cash. At the market bottom, though, we were technically no longer FI for a few months.

Another member of the forum kept loading up on Bank Of America stock for the dividend as it kept dropping in share price... and then BofA cut the dividend to a penny. That member may still post here so I'll let them share that story, but I think they're back to FIRE.

I retired on Jan,19,2008 . I did have a survivor pension and SS survivor annuity both of these were not huge amounts. I was aggressively invested and lost 1/3 of my portfolio.I was ready to panic and sell but one of the long term members (Nords ) talked me off the ledge and told me to stay the course .I did except for a small amount I sold before the bottom.My portfolio returned within five years .Like Rewahoo I did claim my SS early . It was a lot more than the survivor benefit . I took a budget cut but We still travelled a lot . There were some incredible deals at the time . Looking back at some of the terrible things that happened to me this is not even on the radar .If you want an insight search for the old threads during that time especially "Who is a member of lost a million club ".

I guess it was group therapy by shared misery!

In early 2008 our daughter was 15 years old, and (according to our predetermined plan for her 15th birthday) we liquidated her college fund into CDs. Berkshire Hathaway B shares (bought in 2001) were a big chunk of that fund. It took the next five years for Berkshire Hathaway stock to recover its 2008 share price, and by that point our daughter was a college junior.