ShokWaveRider

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Quality of Healthcare should be top of the list for retirement.

Not trying to make the case that ME taxes are better than NH's, but the difference between ME and NH, when adding in Real Estate taxes, is less than the example you set. The money has to come from somewhere, if not income and sales taxes, then real estate taxes.Yes and in NH the total would only be the $16334. No state income tax.

Also no state sales tax. 6% in VT and 5.5% in Maine.

When your income is double that you double the savings (obviously).

Of course in retirement the advantage could be less as you most likely would have much lower taxable income and may have income sources that receive favorable treatment.

Quality of Healthcare should be top of the list for retirement.

Not trying to make the case that ME taxes are better than NH's, but the difference between ME and NH, when adding in Real Estate taxes, is less than the example you set. The money has to come from somewhere, if not income and sales taxes, then real estate taxes.

+1 Two teaching hospitals serve northern Vermont, UVM Medical Center to the west and Dartmouth-Hitchcock just over the border in NH to the east.

Vermont health insurance is priced similar to employer group health insurance coverage... not age rated... same price for everyone (other than catastrophic coverage)... also, no medical underwriting (even before ACA)... and costs is moderate... a bronze level policy is about $550/month.

Yes that is the knock on Nh but I believe we still have one of the lower over all tax burdens. As I mentioned in post #11 we have been very lucky in my particular town because there are several lakes and ponds containing many summer homes which are assessed higher because of water frontage and thus reducing my tax burden and our town tax rate is very low by NH standards.

Interestingly Vermont came out very high(#3) as well as Maine(#4), both being higher than Massachusetts(#22).

NH was way down at number 45 but #1 in property tax as you said. The property tax varies wildly here. In retirement that could be an issue since the income tax could be way down and of course sales tax can be mostly controlled by consumption habits.

https://wallethub.com/edu/states-with-highest-lowest-tax-burden/20494/

New Hampshire is a wonderful state. I've spent a lot of time there. It is beautiful and the mountains can't be beat. I do love Maine though, but not because of its taxes.

We have some friends who moved from Vermont to Maine and they say that Maine taxes are brutal.

Yes. We love Maine as well. Spend most of our "vacations" there in the down east sections. Love the northern coastal areas Blue Hill, Deer Isle , Bar Harbor, Winter Harbor etc.

Wow! Wintah Habah. Not too many people have heard of it. Every time I mention it people ask if it's anywhere near Bar Harbor but don't know where WH is.

I was stationed at the (now defunct) Navy Base there from 1989-1992. Beautiful spot inside the Schoodic Section of Acadia National Park. Wicked long winters, though. I returned for the formal ceremony in 2002 when the base was turned over to the Park Service.

My daughter, who is a novelist, wrote a book set in a fictional Down East fishing village that was based on her experience as a high schooler in that area.

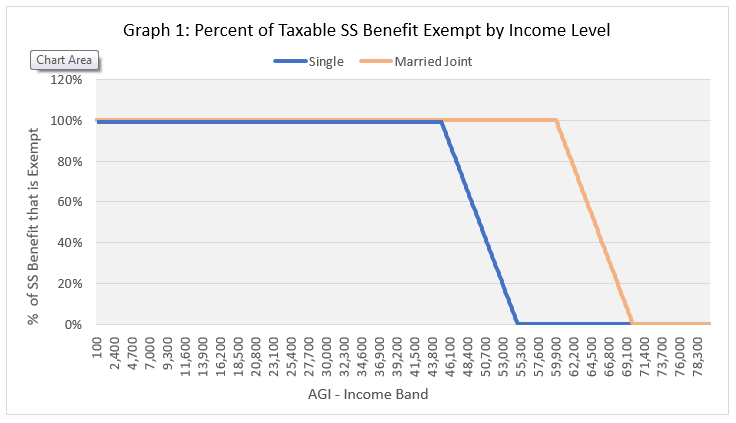

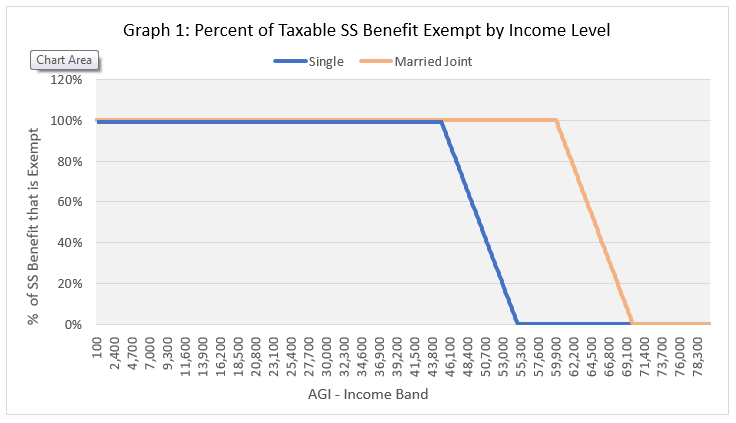

Actually, Vermont exempts SS from state income taxes for lower income taxpayers. The exemption phases out between $45-55k for a single and $60-70k for MFJ. The exemption is probably of little worth for most people here but is valuable to Vermont's lower income taxpayers.

We summer in VT at a remote cabin, and spend the winter in Asheville. It's a great way to live. Amazing summer weather and great community in VT, then a delicate taste of mild winter and lovely flowering spring in Asheville.

It's like having two different lives, the back and forth is a little tiring driving and leaving friends is hard, but worth it. Property taxes are steep in VT compared to Asheville.

Winter in VT would be too harsh for us.

Doesn’t t your retirement income get taxed? Either state taxes it. Which one is your official residence?

Doesn’t t your retirement income get taxed? Either state taxes it. Which one is your official residence?

Everyone’s financial aspect is varied. So you must take a detailed look at your individual situation

My Aunt moved from VT to NH, thinking she would pay less. Welp it’s not a reality. Yes no state income tax, but the property tax, car insurance and State fees (car reg, ....) all eat up the income tax savings.

Myself - comparing moving Permanent residence from VT to FL, a very slight savings. Vermont car and home owner insurance rates are extremely low compared to other States. These two items alone eat up the income tax saved.

Because I’m able control what my income is with Roth rollovers. We receive Aca subsidy’s and vermont property tax rebate. If my income increases over those limits, it will probably be wise to switch my residency.

But the taxes on SS and all other retirement income in VT and estate taxes down the line. Then NH does not have a sales tax.

I am also on an ACA plan in NH just until next June when I turn 65. I get full subsidies on a silver plan. My husband Medicare supplement much less expensive than in NY. And car and home insurance very inexpensive here.