ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Regardless what the other side of the trade *expects,* the raw numbers show that the vast majority of options expire worthless, and this benefits the sellers.

Do Option Sellers Have a Trading Edge?

While I agree with the premise that option sellers have the edge, the data within is meaningless. And when I see meaningless data presented as if it is supposed to mean something, I ask - hmmm, whas'up wid'at?

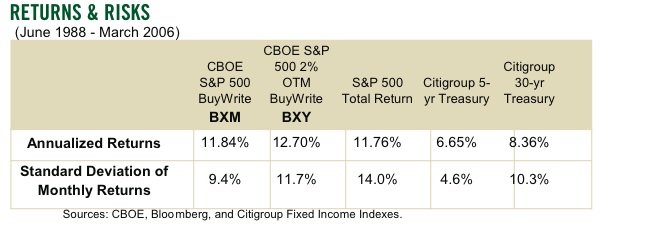

Notice that they never mention the value of the options that expire worthless, minus the losses incurred when they didn't, divided by the entire amount of money at risk over a given time period, compared to the behavior of the underlying over that same time period? Now *that* would give you some indication of how *much* of an advantage the sellers have over B&H. The % that expire worthless means nothing, absolutely nothing.

I'll re-visit the Roulette Wheel. You are the house, and you are "selling options" in effect. You don't care if the bettor steps up and bets either:

Bettor A) On a SINGLE NUMBER - he will only win 1 of 38 times, over 97% of his bets "expire worthless".

or...

Bettor B) On RED - he wins almost half the time (18/38), 52.6% of his bets "expire worthless" - much better performance than bettor A.

Yet, the house will, on average, collect the exact same 5.263% of the money bet from each of them. No matter what bet is placed and what the odds of it "expiring worthless" are. Because simply, the payout matches the chance of the bet. I'm pretty sure "the market" has known this for as long as gamblers have.

Now the only thing that keeps people coming to the table and betting on a single number is that, every once in a while, there is a big payout (but the house still, on average keeps 5.236%). So those people giving you money month after month are going to expect a big payout once in awhile (you take the full loss), or they get bored and don't play (supply/demand says the price they are willing to pay drops). So yes, I think option sellers can skim a bit off because people on the other side are willing to pay to play (either "gamble" by buying a call, or "buy insurance" with a put), but I don't think they will pay anything near 5% a month, on average. If it did, there would be a thread titled - "The easy way to retire early with a nest-egg approaching the size of the GDP", with this approach explained

-ERD50