I agree although based on the CPI-U numbers announced in Jan 2013 the long term average since WWII was 3.96%, and of course that includes the high inflation 1970s and 1980s. So 5% seems like a reasonable hedge to me.

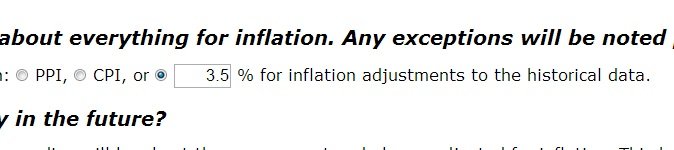

I still think it would be better to use CPI in FIRECALC, and if you want to add a hedge, add X% to the investment fees (expense ratios) on the "Your Portfolio" tab. That way you are not underestimating inflation during critical times like the 80's, which make up some of the failures in many runs.

The 80's would have been a picnic with a 5% inflation average.

Remember, with FIRECALC, averages aren't driving the failure scenarios - the worst case conditions drive the failures. I think you are may be giving yourself a false sense of security by using averages. At a minimum, IMO you are undermining the strength of FIRECALC, which is reporting all these historical interactions.

Heck, easy enough to prove for yourself; 5% minus your 3.96% average is 1.04%. Add that to expenses and use CPI and see what you get versus average 5% inflation and default expenses.

edit/add - sorry, on my first cup of coffe, missed the importance of this:

Another approach I have used is to rely on the CPI preset, which produces a 100% success rate for me, and then run it a few more times while gradually increasing the inflation number to see where the tipping point is. I have found a 6% plug to be the point where my failure rate begins to shoot up.

OK, so doesn't that tell you your 5% underestimated things, and 6% gets you to par with CPI? So your 5% isn't a hedge, it is an underestimate?

-ERD50