I wanted to re-run the projections from a year or two ago with a saved model. The numbers were lower than I remembered, so I did some investigating.

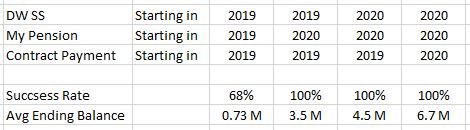

I had found that there is sensitivity as to what date you use for when social security or a pension starts. In this situation, I had start dates of 2019 for DW's SS, my pension, and for a contract payment that stretches out for many years. By modifying the 'starting in' date from 2019 to 2020, the results get better. I have attached a grid showing how much better. My pension started 7 years ago, and it makes no difference if I put starts in 2013 or starts in 2019. But the results are better when it starts in 2020.

Does anybody have any insight?

Edit to add: OK, I see there is a statement that 'Back dated entries will not be factored in. So it looks like you must use the current year for starting in dates, thus when the calender year rolls over you need to update those dates?

I had found that there is sensitivity as to what date you use for when social security or a pension starts. In this situation, I had start dates of 2019 for DW's SS, my pension, and for a contract payment that stretches out for many years. By modifying the 'starting in' date from 2019 to 2020, the results get better. I have attached a grid showing how much better. My pension started 7 years ago, and it makes no difference if I put starts in 2013 or starts in 2019. But the results are better when it starts in 2020.

Does anybody have any insight?

Edit to add: OK, I see there is a statement that 'Back dated entries will not be factored in. So it looks like you must use the current year for starting in dates, thus when the calender year rolls over you need to update those dates?

Attachments

Last edited: