I'm applying for healthcare ins. for the first time ever. I have no reported income for 2017 & I'll have none for 2018. Living off of investments but no W-2 or 1099 income of any kind. I do have assets. Any tips on the route I should take? Thanks to all!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Assistance needed, applying for HC ins. no income for 2017-18

- Thread starter z777777z

- Start date

Cut-Throat

Thinks s/he gets paid by the post

I'm applying for healthcare ins. for the first time ever. I have no reported income for 2017 & I'll have none for 2018. Living off of investments but no W-2 or 1099 income of any kind. I do have assets. Any tips on the route I should take? Thanks to all!

No interest Income ?

No Dividend Income ?

No Capital Gains Income ?

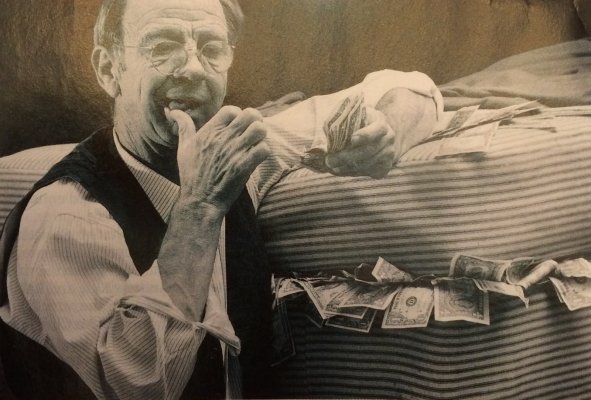

Where is your money ? ...... Under the Mattress?

Welcome to the forum. You might want to stop by and introduce yourself here Hi, I am... - Early Retirement & Financial Independence CommunityI'm applying for healthcare ins. for the first time ever. I have no reported income for 2017 & I'll have none for 2018. Living off of investments but no W-2 or 1099 income of any kind. I do have assets. Any tips on the route I should take? Thanks to all!

When you apply for insurance, do you plan on paying full rate for an ACA policy, or do you want / expect / hope for some premium assistance? For a regular rate policy, you can apply directly with the insurer. Have you identified the insurance options available where you reside?

If you want subsidy or premium assistance, you need to have some income, and you don't seem to have any. Is that by choice? Do you have any tax deferred income you could convert to ROTH?

flintnational

Thinks s/he gets paid by the post

By no income, do you also mean you do not have any dividends, interest or capital gains? These are all used to calculate premium subsidies for HC under the ACA. The exact income calculation for ACA premium subsidies is MAGI, explained here.

Option 1) The ACA provides premium subsidies for individuals/families that have a MAGI above 130% and below 400% of the poverty level. Use the KFF calculator to see potential subsidies based on income. But, with no income you may not qualify for a subsidy. See option 2 regarding expanded medicaid.

Option 2) The ACA provides for expanded medicaid for individuals/families that are at or below 130% of the Federal poverty level. With no income, you may qualify. But, some States chose not to expand medicaid and this created a gap. You will need to check if your State expanded medicaid. If so, with no income, you would likely qualify. If your State did not expand medicaid, or you do not want to be on medicaid, you may want to generate enough income to qualify for subsidies under option 1. You could do a Roth IRA conversion.

If you go the ACA route with or without subsidies, you can enroll at Healthcare.gov. You can also see plans and pricing.

Option 1) The ACA provides premium subsidies for individuals/families that have a MAGI above 130% and below 400% of the poverty level. Use the KFF calculator to see potential subsidies based on income. But, with no income you may not qualify for a subsidy. See option 2 regarding expanded medicaid.

Option 2) The ACA provides for expanded medicaid for individuals/families that are at or below 130% of the Federal poverty level. With no income, you may qualify. But, some States chose not to expand medicaid and this created a gap. You will need to check if your State expanded medicaid. If so, with no income, you would likely qualify. If your State did not expand medicaid, or you do not want to be on medicaid, you may want to generate enough income to qualify for subsidies under option 1. You could do a Roth IRA conversion.

If you go the ACA route with or without subsidies, you can enroll at Healthcare.gov. You can also see plans and pricing.

Last edited:

- Joined

- Nov 17, 2015

- Messages

- 13,953

If you are "living off investments" then aren't you selling them (creating income from gains) to live on?

Or are you living on cash that's accruing zero interest (ew...why?)

If you are selling and netting cap gains = income

If you are getting interest on your savings/cash/cd's = income

It's not so much a matter of your W2 or 1099, but your income as reported on your 1040. If that's also zero (and not expected to change in 2019), then your answers are above.

Or are you living on cash that's accruing zero interest (ew...why?)

If you are selling and netting cap gains = income

If you are getting interest on your savings/cash/cd's = income

It's not so much a matter of your W2 or 1099, but your income as reported on your 1040. If that's also zero (and not expected to change in 2019), then your answers are above.

ivinsfan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2007

- Messages

- 9,962

Find some income, really there is no world where not using your standard deductions and personal exemptions is a good thing...look at your deferred retirement accounts.

ncbill

Thinks s/he gets paid by the post

Canton, OH?

If so, since OH is a Medicaid expansion state you could estimate your 2019 MAGI at just over 130% of poverty level to qualify for maximum ACA subsidies, then settle up at tax time.

If so, since OH is a Medicaid expansion state you could estimate your 2019 MAGI at just over 130% of poverty level to qualify for maximum ACA subsidies, then settle up at tax time.

I set aside cash a few years back for living expenses so, I'll have a $200-$400 interest income. I have stock holdings, mutual funds etc. that I plan to draw on throughout retirement. I'm single, just turned 60 and have zero debt, only monthly living expenses, kids are grown & independent. Most importantly, I'm trying to qualify ACA ins. I just learned that if my gross income (any source; capital gains, interest inc. etc.) is between approx. $12K to $48.5K I can qualify for a monthly credit to assist w/ACA ins. I've run the #'s on when I'd like to begin S.S. and will probably begin at age 62. Looking to fill the ins. gap until Medicare. Hope this helps with any suggestions!No interest Income ?

No Dividend Income ?

No Capital Gains Income ?

Where is your money ? ...... Under the Mattress?

Here is a reply that I posted to someone else's response (next paragraph). Additionally, I'm well set with a traditional IRA, a smaller ROTH IRA and a brokerage acct. Other than a very small amt. of int. income, I'll have no other income for 2018. Thanks so much.

I set aside cash a few years back for living expenses so, I'll have a $200-$400 interest income. I have stock holdings, mutual funds etc. that I plan to draw on throughout retirement. I'm single, just turned 60 and have zero debt, only monthly living expenses, kids are grown & independent. Most importantly, I'm trying to qualify ACA ins. I just learned that if my gross income (any source; capital gains, interest inc. etc.) is between approx. $12K to $48.5K I can qualify for a monthly credit to assist w/ACA ins. I've run the #'s on when I'd like to begin S.S. and will probably begin at age 62. Looking to fill the ins. gap until Medicare. Hope this helps with any suggestions!

I set aside cash a few years back for living expenses so, I'll have a $200-$400 interest income. I have stock holdings, mutual funds etc. that I plan to draw on throughout retirement. I'm single, just turned 60 and have zero debt, only monthly living expenses, kids are grown & independent. Most importantly, I'm trying to qualify ACA ins. I just learned that if my gross income (any source; capital gains, interest inc. etc.) is between approx. $12K to $48.5K I can qualify for a monthly credit to assist w/ACA ins. I've run the #'s on when I'd like to begin S.S. and will probably begin at age 62. Looking to fill the ins. gap until Medicare. Hope this helps with any suggestions!

- Joined

- Nov 17, 2015

- Messages

- 13,953

So the answer is you need to create income to meet the minimum for your state to qualify for the ACA. In your case, it looks like selling a few investments each year and declaring the LTCG as income. Since you only need to do that for 2 years, it should not cause too much pain to your longer term bottom line of investments (and you can always just put the rest withdrawal back into a taxable investment, no need to actually spend it, just withdraw, claim the income, pay the tax, etc.).

You would estimate your income for 2019 to be the reasonable amount you plan to withdraw to meet the qualifying minimum, and then make sure you meet it.

You would estimate your income for 2019 to be the reasonable amount you plan to withdraw to meet the qualifying minimum, and then make sure you meet it.

gauss

Thinks s/he gets paid by the post

- Joined

- Aug 17, 2011

- Messages

- 3,615

If you live in an "expansion state" why not just take the Medicaid? It is very different than it was prior to the ACA.

You have a traditional IRA. Assuming that IRA contains mostly pre-tax contributions, you should convert enough of that to reach the minimum threshold of income that would allow you to qualify for an ACA plan.

Similar threads

- Replies

- 5

- Views

- 252

- Replies

- 16

- Views

- 1K

- Replies

- 16

- Views

- 1K