Ed B

Recycles dryer sheets

My Megacorp rolled out three new HDHPs that are HSA eligible for 2018 enrollment. Starting in 2018 retiree healthcare plans will be the same plans in a different risk pool consisting of pre-65 retirees, and of course, a much higher premium. They held info sessions and published charts showing the premiums for retirees, deductibles and max OOP costs. With an ER target of late 2018 this lets me plug in the numbers and see what it does to my retirement budget.

The result is that until I turn 65, assuming we hit OOP max each year, our healthcare costs will be about $27k per year. That is hard to swallow, but from what I read from this community about the high cost of premiums and deductibles and what I hear about from several friends, even among active working people, $27k total may not be so bad for a family of 3 (DW, DGS, and me). Ok, its still pretty bad, but maybe it isn't as rare as I would have presumed.

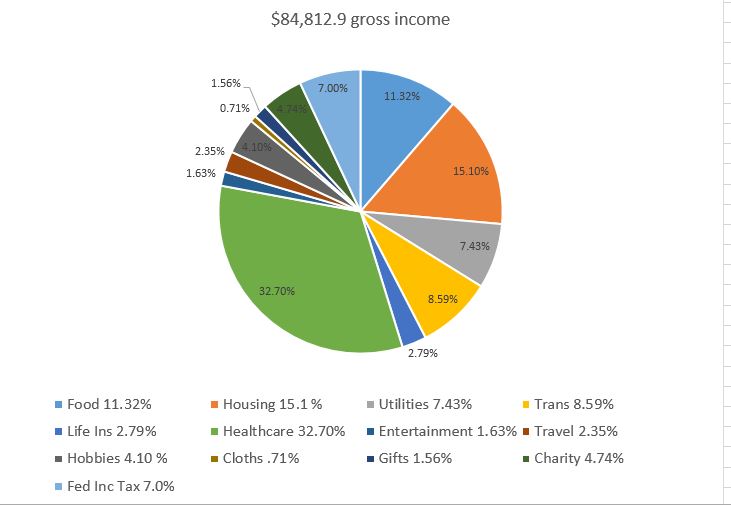

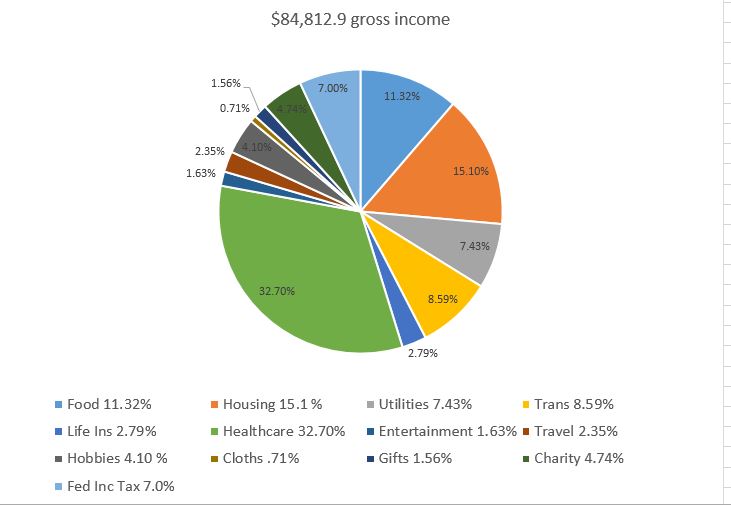

Here is the chart of expenses by percentage. I rolled up discrete expenses into categories such as transportation (gasoline, car insurance, registration, etc.)

I am curious to know how many others who are either pre-65 retired or plan to be, have this high a percentage of their budget going to healthcare costs. The green slice is total healthcare for a year -- 32.7% of budget.

The result is that until I turn 65, assuming we hit OOP max each year, our healthcare costs will be about $27k per year. That is hard to swallow, but from what I read from this community about the high cost of premiums and deductibles and what I hear about from several friends, even among active working people, $27k total may not be so bad for a family of 3 (DW, DGS, and me). Ok, its still pretty bad, but maybe it isn't as rare as I would have presumed.

Here is the chart of expenses by percentage. I rolled up discrete expenses into categories such as transportation (gasoline, car insurance, registration, etc.)

I am curious to know how many others who are either pre-65 retired or plan to be, have this high a percentage of their budget going to healthcare costs. The green slice is total healthcare for a year -- 32.7% of budget.

Last edited: