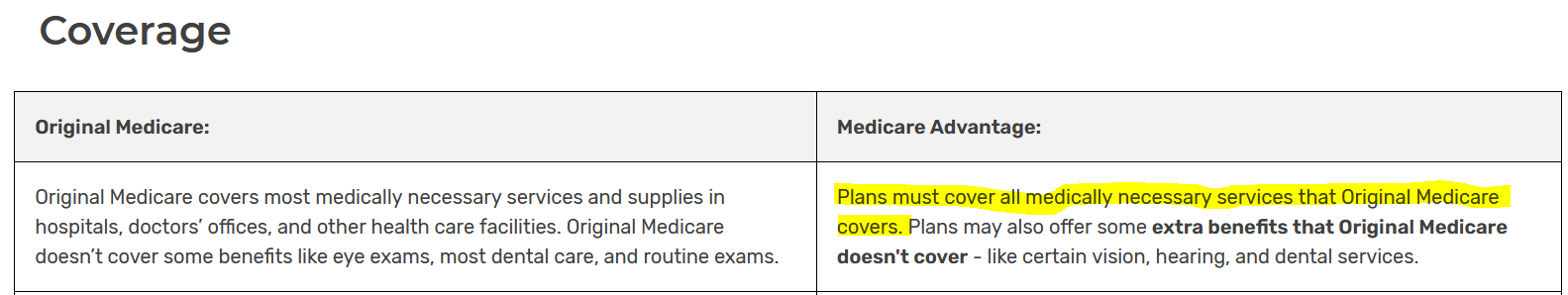

Ummm, yes, Medicare Advantage subscribers do have Medicare. That's why it's called Medicare Part C. It's just the claims processor that is different but they have to run under the same rules for what conditions to cover. As the link from the federal Medicare web site and pic I posted shows.

And the diagnostic coding is what determines what the case is. And why there are appeals processes. The private insurance carrier providing Medicare Part C coverage is never the final arbiter but too many people do not know their rights. If I or my family member had the condition you mentioned I would have seeked legal counsel.

And why the IG released the results of a study a year or two ago saying that Medicare Advantage providers were found to be requiring conditions and extra tests that they were not allowed to do. And that they inappropriately denied treatment between, I think it was,12% and 20% of the reviewed cases.

Because they do have to cover what Original Medicare does but often refuse illegally. It would be interesting to read the letter denying coverage because it sounds like you got the information secondhand. And yes, they did get such a letter.

Ray

no , advantage plans are administering their version of medicare ,it is not the same as having not for profit govt medicare in the drivers seat

the for profit insurer determines your course of treatment. you can try to fight it but many times you lose

in the case i mentioned it went thru the appeals process and was denied repeatedly because it was not able to be determined what govt medicare would have done in this specific case because she didn’t have govt medicare.

so it doesn’t matter what the general terms are as far as covering what medicare would .

the ruling sided with the insurer.

there are specific treatment paths that would likely have had a different outcome with govt medicare like this one.

there are similar stories like this on all forums that discuss differences between the two.

hospitals have been dropping advantage plans left and right all over the country . if not totally then with individual ones they have trouble with while govt medicare is no problem

one hospital listed below found a 22% denial on advantage plans vs 1% on govt medicare and so they are dropping all advantage plans . other hospitals have done the same

Stillwater (Okla.) Medical Center has ended all in-network contracts with Medicare Advantage plans amid financial challenges at the 117-bed hospital. The hospital said it made the decision after facing rising operating costs and a 22% prior authorization denial rate for Medicare Advantage plans, compared to a 1% denial rate for traditional Medicare.

according to a study by kaiser

in the case of Medicare Advantage plans, physicians submitted more than 35 million requests for prior authorization to insurers in 2021, and more than 2 million of them – or about 6 percent – were fully or partially denied, according to the Kaiser Family Foundation’s new report on more than 500 Advantage plans.

Only about 11 percent of the denials were appealed, but the vast majority of those appeals succeeded in getting a full or partial reversal of the original denial but still hundreds of thousands of advantage plan subscribers were left denied

Here are 13 more recent instances of hospitals dropping Medicare Advantage contracts:

In October, the Nebraska Hospital Association issued a report detailing how Medicare Advantage is "failing patients and jeopardizing Nebraska hospitals," 33% of which do not accept MA patients. The report cited negative patient experiences, post-acute placement delays, and administrative and financial burdens on hospitals that accept MA patients.

York, Pa.-based WellSpan Health will no longer accept Humana Medicare Advantage and UnitedHealthcare-AARP Medicare Advantage plans starting Jan. 1. UnitedHealthcare group MA PPO and Humana employer PPO MA plans will still be accepted.

Greenville, N.C.-based ECU Health said it anticipates it will no longer be in network with Humana's Medicare Advantage plans starting Jan. 1.

Raleigh, N.C.-based WakeMed went out of network with Humana Medicare Advantage plans in October. According to CBS affiliate WNCN, the plan provides coverage to about 175,000 retired state employees. WakeMed cited a claims denial rate that is "3 to 4 times higher" with Humana compared to its other contracted MA plans.

Zanesville, Ohio-based Genesis Healthcare System is dropping Anthem BCBS and Humana Medicare Advantage plans in 2024.

Brunswick-based Southeast Georgia Health System will terminate its contract with Centene's WellCare Medicare Advantage plan on Dec. 8. The system said it started negotiations with the carrier after years of "inappropriate payment claims and unreasonable denials."

Nashville, Tenn.-based Vanderbilt Health went out of network with Humana's HMO Medicare Advantage plan in April.

Fayetteville, N.C.-based Cape Fear Valley Health dropped UnitedHealthcare Medicare Advantage plans in July.

Corvallis, Ore.-based Samaritan Health Services ended its commercial and Medicare Advantage contracts with UnitedHealthcare. The five-hospital, nonprofit health system cited slow "processing of requests and claims" that have made it difficult to provide appropriate care to UnitedHealth's members, which will be out of network with Samaritan's hospitals on Jan. 9. Samaritan's physicians and provider services will be out of network on Nov. 1, 2024.

Cameron (Mo.) Regional Medical Center stopped accepting Cigna's MA plans in 2023 and plans to drop Aetna and Humana in 2024. It plans to continue Medicare Advantage contracts with UnitedHealthcare and BCBS, the St. Joseph News-Press reported. Cameron Regional CEO Joe Abrutz previously told the newspaper the decision stemmed from delayed reimbursements.

Stillwater (Okla.) Medical Center has ended all in-network contracts with Medicare Advantage plans amid financial challenges at the 117-bed hospital. The hospital said it made the decision after facing rising operating costs and a 22% prior authorization denial rate for Medicare Advantage plans, compared to a 1% denial rate for traditional Medicare.

Brookings (S.D.) Health System will no longer be in network with nearly all Medicare Advantage plans in 2024, with the exception of Medica. The 49-bed, municipally owned hospital said the decision was made to protect the financial sustainability of the organization.

Louisville, Ky.-based Baptist Health Medical Group went out of network with Humana's Medicare Advantage plans in September, Fox affiliate WDRB reported. The system will also go out of network with UnitedHealthcare and Centene's WellCare on Jan. 1 without a new agreement in place.

DOES THAT SOUND THE SAME TO YOU AS GOVT MEDICARE ?