Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

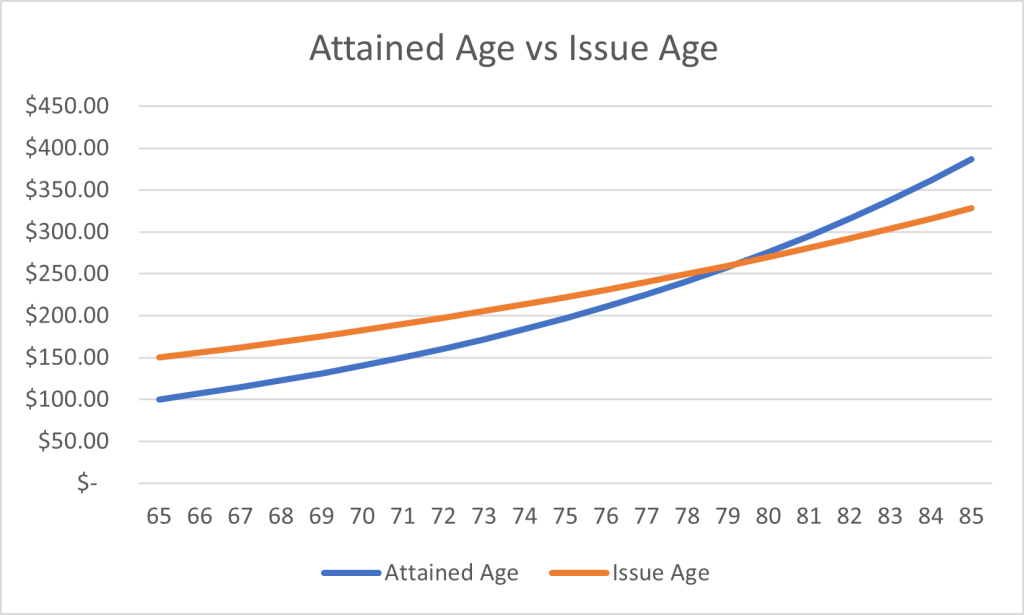

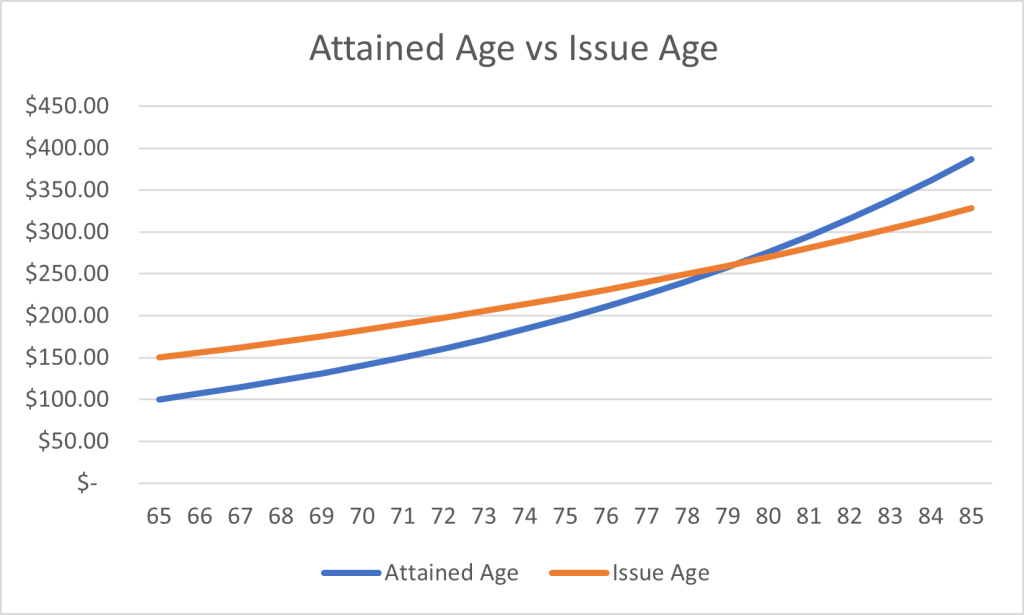

Hopefully everyone is budgeting for Medigap premium increases due to age, assuming you have an attained age policy - most do, because the premiums start out much lower (and increase faster). This source shows attained age premiums have almost quadrupled between age 65 and 85. Issue age premiums have "only" more than doubled, but they were 50% higher to begin with.

https://askmedicaremike.com/attained-age-community-issue-age/

https://askmedicaremike.com/attained-age-community-issue-age/

Attained Age

Attained Age is the most common method insurance companies use to price Medicare supplements.

The price is based on your current age.

So a 65 year old typically pays less than a 70 year old living in the same area.

If you buy an Attained Age Medicare supplement, your premium can increase for 2 reasons:

- Each year you get older

- Inflation and other factors

Community Rated

Community rated is probably the easiest to understand.

Basically it means that everyone in the same area pays the same price. So regardless of your age or gender, you will pay the same price as everyone else living in your area with that plan.

If you buy a Community rated Medicare supplement, your premium can increase because:

- Inflation and other factors

Issue Age

Issue Age is more common in certain states than others. Most areas of the country only have a few options for Issue Age Medicare supplements.

Issue Age polices are based on your age when you first buy the policy.

So if you are 70 years old, but you bought the policy when you were 65 then you pay the same premium as a 65 year old buying the same policy today.

Your premium does NOT go up because you age.

It’s important to understand that buying an Issue Age Policy does NOT mean your premium never goes up. Your premium can still go up for inflation and other reasons.

And you start off paying a higher premium for Issue Age policies compared with Attained Age. So you have to keep that specific policy long enough to be able to see any savings.

I’ve seen some estimates where that breakeven point is around 12 years. So you are going to OVERPAY for 12 years before you ever start to see any monthly savings.

12 years is a LONG time to have the same Medicare supplement policy. And then you have to have that coverage long enough beyond the 12 years to make up for how much you overpaid to start with.

Last edited: