- Joined

- Oct 13, 2010

- Messages

- 10,763

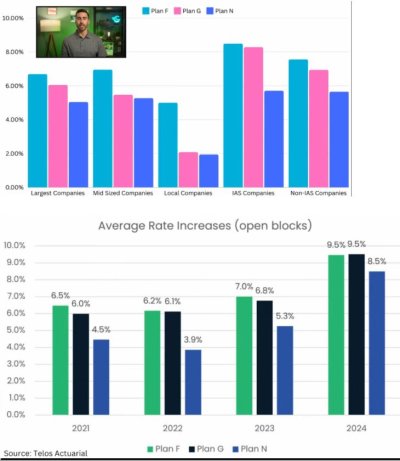

Average Rate Increases of Plans F, G and N

There's a site called where the very dedicated person can learn a lot about historic rate increases, closed books of business, and much more:

https://www.serff.com/serff_filing_access.htm

I did NOT try to dig out specifics from this site, but if I had know about it before I bought my medigap policy, I would have used it.

The way I learned about it was from a video from this channel:

https://www.youtube.com/@GiardiniMedicare

A specific video (The Hidden Truth to Finding the Best Medicare Supplement Company) was very informative, especially about rate increases between open and closed books of business as well as between different plan letters.

For the purposes of this thread (G vs N), that specific video had a few graphics. The one I found most informative is below showing plan N increases have been smaller than G.

So irrespective of whether guaranteed issue business includes a higher proportion of sicker people, it's clear that you can expect higher increases with a Plan-G vs a Plan-N. In the Telos Actuarial graphic, I multiplied it out. If you bought in 2020, the Plan-G person had a 32% increase over 4 years, and the Plan-N person had a 24% increase over the same 4 years.

There's a site called where the very dedicated person can learn a lot about historic rate increases, closed books of business, and much more:

https://www.serff.com/serff_filing_access.htm

I did NOT try to dig out specifics from this site, but if I had know about it before I bought my medigap policy, I would have used it.

The way I learned about it was from a video from this channel:

https://www.youtube.com/@GiardiniMedicare

A specific video (The Hidden Truth to Finding the Best Medicare Supplement Company) was very informative, especially about rate increases between open and closed books of business as well as between different plan letters.

For the purposes of this thread (G vs N), that specific video had a few graphics. The one I found most informative is below showing plan N increases have been smaller than G.

So irrespective of whether guaranteed issue business includes a higher proportion of sicker people, it's clear that you can expect higher increases with a Plan-G vs a Plan-N. In the Telos Actuarial graphic, I multiplied it out. If you bought in 2020, the Plan-G person had a 32% increase over 4 years, and the Plan-N person had a 24% increase over the same 4 years.