You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Anyone Buying Into Today's Dip?

- Thread starter marko

- Start date

I saw on TV that the Black Friday sales today are disappointing. New Covid-19’s variant in the news, inflation talk is in the air and uncertainties in our economy are making people stay home on Black Friday and this can have a snowball effect. Stock market on monday will be telling.

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Bought some Disney and added to my favorite bond fund (deploying funds from last week's sales).

freedom2022

Recycles dryer sheets

- Joined

- Sep 24, 2021

- Messages

- 131

Bought ILMN, Illumina, gene sequencing company.

Have been waiting a while for a good entry point.

Most stocks are down today and ILMN is up.

Could not resist the temptation any longer to buy.

Have been waiting a while for a good entry point.

Most stocks are down today and ILMN is up.

Could not resist the temptation any longer to buy.

Amethyst

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Dec 21, 2008

- Messages

- 12,668

The online sales (as in reduced prices) certainly were disappointing. I did replace my lost Kindle with a new Fire 8 HD for, I think, 34% off.

Where prices weren't that bad, selection seemed limited. Of course that is only one person's experience.

Where prices weren't that bad, selection seemed limited. Of course that is only one person's experience.

I saw on TV that the Black Friday sales today are disappointing. New Covid-19’s variant in the news, inflation talk is in the air and uncertainties in our economy are making people stay home on Black Friday ....

Stormy Kromer

Thinks s/he gets paid by the post

- Joined

- Oct 1, 2017

- Messages

- 1,157

Dip? I was there for 1987's dip.....as an old Russian friend told me once. "Dis is notting"

Dip? I was there for 1987's dip.....as an old Russian friend told me once. "Dis is notting"Two or three reasons it could have dipped but probably about 5 or so that it will come back.

First is anytime news hits of airlines being effected by policy shift which happened today with 8 new countries placed on the "list" people panic sell.

Secondly, fund managers need to take their fee's before the end of the year.

Third, folks need to take RMDs out before end of the year.

But this too shall pass. It's always just temporary. If we dip 5% I'll buy but so far I am only about 2.65% off my highs.

First is anytime news hits of airlines being effected by policy shift which happened today with 8 new countries placed on the "list" people panic sell.

Secondly, fund managers need to take their fee's before the end of the year.

Third, folks need to take RMDs out before end of the year.

But this too shall pass. It's always just temporary. If we dip 5% I'll buy but so far I am only about 2.65% off my highs.

OverThinkMuch

Recycles dryer sheets

- Joined

- May 11, 2016

- Messages

- 313

Based on the where the gains are losses are happening, I view it as the newly named "omicron" Covid-19 variant. Carnival Cruises (CCL) is a very Covid sensitive stock, and dropped 11% in one day. I would assume financial stocks prefer interest rates to be higher, but XLF took a 3% drop Friday. Peloton (PTON) has been falling since summer, yet Friday it gained almost 6%. The collection of stocks making gains suggests to me this is about the new Covid-19 variant ("omicron").

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Anyone thinking of buying today's dip?

No, darn it! I was trying to donate some of my HACAX shares which had hit a new high last Friday. I did get a chunk donated on Monday at least.

I’ll be rebalancing at the beginning of next year anyway, this time of year I’m waiting for distributions to be paid out.

Last edited:

jollystomper

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Apr 16, 2012

- Messages

- 6,184

Still waiting for the "Yeah, the S&P 500 had a bad day, but is still up over 23% for the year, why are you panicking?" headlines...

- Joined

- Oct 13, 2010

- Messages

- 10,735

^That doesn't generate clicks or commissions.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

Bought $80.8K worth of stock. 2/3 are due to puts getting assigned, and 1/3 by directly pulling the trigger.

Much of the above is on semiconductor stocks which I recently sold when calls got assigned. The puts make me buy them back at lower prices than I sold, but the strike prices are still way above current market prices.

The rest is for some nat gas producers and a phosphate/potash miner to add to my existing positions.

The amount bought does not make that much of a difference to the portfolio, but so that I could pat myself on the back that I bought low. Will have to see if these stocks will not go even lower.

My holding of semiconductor shares is still a lot lower than where it was one month ago. If the market keeps dropping, should I keep on buying more back to rebuild the same position as I held? That's something I am contemplating.

Much of the above is on semiconductor stocks which I recently sold when calls got assigned. The puts make me buy them back at lower prices than I sold, but the strike prices are still way above current market prices.

The rest is for some nat gas producers and a phosphate/potash miner to add to my existing positions.

The amount bought does not make that much of a difference to the portfolio, but so that I could pat myself on the back that I bought low. Will have to see if these stocks will not go even lower.

My holding of semiconductor shares is still a lot lower than where it was one month ago. If the market keeps dropping, should I keep on buying more back to rebuild the same position as I held? That's something I am contemplating.

Last edited:

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

No. That would be market timing.

My question is what was this cash doing before today?

It surely is market timing.

About the cash, well for me it was cash coming from stock sales just a week or two ago.

Last edited:

target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

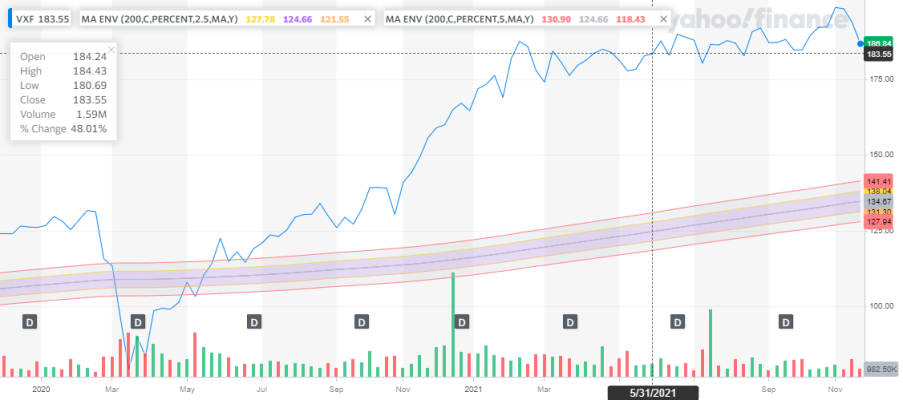

View attachment 41004

I quoted my entire response for complete understanding. Note that I did not mention recovery at all. And I started off with "My WAG." I think it's important to quote the entirety of most messages, right?

I was only talking about Monday, Nov. 29, 2021, It's a guess, and as I mentioned in the quote, I am wrong a lot.

To answer your standard, generic question, if you examine a drop and recovery as a binary, yeah everything is the same, and nothing is different. I suspect many recognize that, and develop a deeper understanding of investing. For example, I believe in the long strategy, economic cycles, and the insights of the greats (fill in the name of your books here). 85% of our investments are in passive index funds.

I looked at VXF (Extended Market ETF) to find the recoveries you mentioned. Yep, they are there. And I believe your mind's eye is on a long signal, something like the 200dMA or longer. But this thread is about a dip, and what fun we have talking about it, and trying to gain an advantage.

I believe every moment in time is different. It doesn't give me comfort to think everything's the same and will remain that way. I am hopeful that economies and markets find ways to keep progressing. Even though I have beliefs, I don't try to cut discussion short. I find usefulness in many threads that seem to get quick dismissal from others.

Since you've introduced the longer view, I will comment that I think a reasonable hypothesis about radical new variant is that the drop and duration will be between those two earlier cases on the chart. So you're talking about March and November. However, someone could just as easily refer to March thru November, meaning it took 9 months to recover. That is the great thing about charts, that we can interpret differently.

The problem we all have in buying dips is right there in the chart. We will see if the worm turns downward, won't we? Now that I've explored more, I believe it's possible we are in a much longer and slower recovery. The sideways movement of small/mid in 2021 is something to watch.

Sorry about going on about this, but even small comments deserve a thorough response.

My WAG is the latter. The bad news is not turning positive over night and when it gets digested this weekend--more pain on Monday.

However, I am wrong a lot!

Since you asked...When Covid first hit the market fell hard, and recovered fairly quickly.

When Delta first took hold, the market fell, and recovered very quickly.

Not to be diminish the ongoing impact of Covid, why is this one going to be different?

I quoted my entire response for complete understanding. Note that I did not mention recovery at all. And I started off with "My WAG." I think it's important to quote the entirety of most messages, right?

I was only talking about Monday, Nov. 29, 2021, It's a guess, and as I mentioned in the quote, I am wrong a lot.

To answer your standard, generic question, if you examine a drop and recovery as a binary, yeah everything is the same, and nothing is different. I suspect many recognize that, and develop a deeper understanding of investing. For example, I believe in the long strategy, economic cycles, and the insights of the greats (fill in the name of your books here). 85% of our investments are in passive index funds.

I looked at VXF (Extended Market ETF) to find the recoveries you mentioned. Yep, they are there. And I believe your mind's eye is on a long signal, something like the 200dMA or longer. But this thread is about a dip, and what fun we have talking about it, and trying to gain an advantage.

I believe every moment in time is different. It doesn't give me comfort to think everything's the same and will remain that way. I am hopeful that economies and markets find ways to keep progressing. Even though I have beliefs, I don't try to cut discussion short. I find usefulness in many threads that seem to get quick dismissal from others.

Since you've introduced the longer view, I will comment that I think a reasonable hypothesis about radical new variant is that the drop and duration will be between those two earlier cases on the chart. So you're talking about March and November. However, someone could just as easily refer to March thru November, meaning it took 9 months to recover. That is the great thing about charts, that we can interpret differently.

The problem we all have in buying dips is right there in the chart. We will see if the worm turns downward, won't we? Now that I've explored more, I believe it's possible we are in a much longer and slower recovery. The sideways movement of small/mid in 2021 is something to watch.

Sorry about going on about this, but even small comments deserve a thorough response.

Attachments

- Joined

- Apr 14, 2006

- Messages

- 23,059

I have been on a long term bi-weekly buying spree since the beginning of 2021. My final $70k purchase was to be in late October, but I got distracted by other things and never did it. I figure right after a 2% drop is as good a time as any. (and it is back to late October levels.)

Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I bought nothing on today's 'dip'. A 2.5% decline in one day is not a big buying opportunity, IMO.

Wake me when the market is down 20%+ and I will think about investing some spare cash I might have on hand. No way I will bet the family farm.

My 2¢. YMMV .

Wake me when the market is down 20%+ and I will think about investing some spare cash I might have on hand. No way I will bet the family farm.

My 2¢. YMMV .

Out-to-Lunch

Thinks s/he gets paid by the post

I bought nothing on today's 'dip'. A 2.5% decline in one day is not a big buying opportunity, IMO.

+1

If one sees the current market price as a buying opportunity, why weren't you buying on <checks notes...> October 27?

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

+1

If one sees the current market price as a buying opportunity, why weren't you buying on <checks notes...> October 27?

I can't speak for others, but a month ago I did not have the level of cash I do now.

I did not get the covered calls on my semiconductor stocks assigned until the last 2 weeks. Altogether, their values were up to a 7-figure total, and I felt very uneasy having a high concentration in one sector, and I decided to unload some by setting the option strike prices low enough so that they would get assigned. And they did.

Now I can buy the same shares back at lower prices, but how low should I wait for them to drop? A lot of pondering, and speculating...

Yeah I would call this a"blip" not a dip. It could turn in to a dip but we''ll find out soon enough.Dip? I was there for 1987's dip.....as an old Russian friend told me once. "Dis is notting"

PointBreeze

Recycles dryer sheets

I readjusted my asset allocation Friday morning (I was cash heavy and equities light, so bought more stock funds).

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Futures down 1100 Dow points at this hour. We are going to get some more buying opportunities.