Like many/most here, I oversee my own investments and spend time talking to and researching what the "experts" suggest (as well as many of you) in an effort to create the best "mouse trap" for me. While about 2 years out from RE, with last years run up, I have effectively "won the game", but continue to battle my logical/conservative nature with my ever present "greed glands" looking for a little more juice. While in the last few years I finally convinced myself to ratchet down to a more conservative 60/40 AA (which I suspect I will stay with thru RE), I cannot help but feel there are some better ways to turbo charge my "40". Yes, logically, I know that a big part of my bond allocation is there for stability and to counter the more volatile "60" over time, but I cant help with being discontent with a measly 2% + yield. So at the beginning of last year, after meeting with my financial executive committee (that's me), I made the decision to split my "40" as follows (and note their 2017 total returns which include reinvesting distributions and the approximate yield)...

- 25% Intermediate Bond Funds/ETFs (3.5% & 2%+) Previously, all my "40" here.

- 7% Preferred Stock Funds/ETFs (10.5% & 5.5%)

- 5% High Yield Bond Funds/ETFs (9%+ & 5%)

- 3% Foreign Bond Funds/ETFs (10% & 4%+)

While I am no expert, in simple terms, my research tells me Preferred Stocks will act more like Bonds with a little bit of stock momentum, High Yield Bond movement will generally run closer to stock performance, and Foreign Bonds will be affected more by currency changes. Again, putting it all simply.

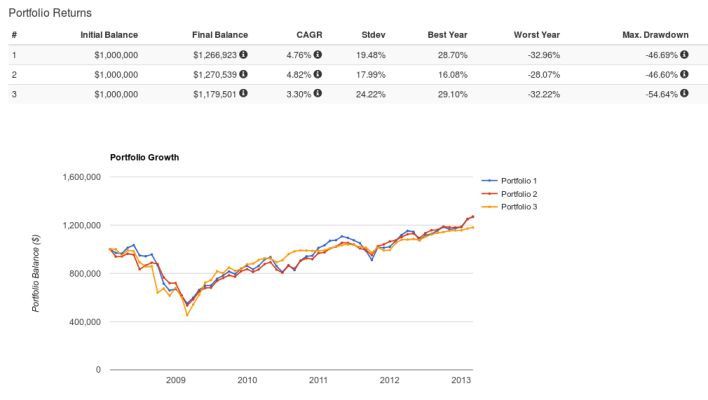

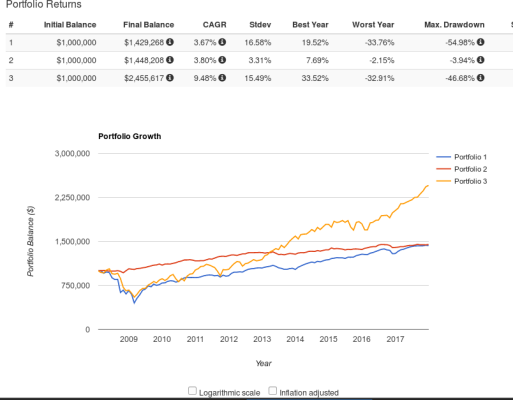

So while last years performance for this 15% alternative bond allocation looks great compared to my sleepy Intermediate Bond performance, is the risk/reward model over time really worth it? Am I kidding myself with my 5% High Yield Bonds... is this effectively as if I am really holding a 65% Stock allocation? I love the extra juice in 2017, just wondering if this is a sustainable or really needed "40" allocation model?

- 25% Intermediate Bond Funds/ETFs (3.5% & 2%+) Previously, all my "40" here.

- 7% Preferred Stock Funds/ETFs (10.5% & 5.5%)

- 5% High Yield Bond Funds/ETFs (9%+ & 5%)

- 3% Foreign Bond Funds/ETFs (10% & 4%+)

While I am no expert, in simple terms, my research tells me Preferred Stocks will act more like Bonds with a little bit of stock momentum, High Yield Bond movement will generally run closer to stock performance, and Foreign Bonds will be affected more by currency changes. Again, putting it all simply.

So while last years performance for this 15% alternative bond allocation looks great compared to my sleepy Intermediate Bond performance, is the risk/reward model over time really worth it? Am I kidding myself with my 5% High Yield Bonds... is this effectively as if I am really holding a 65% Stock allocation? I love the extra juice in 2017, just wondering if this is a sustainable or really needed "40" allocation model?